People use an ATM at Wells Fargo Bank in San Francisco, California on July 14, 2021.

- Americans have already used up a third of their savings, according to the latest data.

- That’s nearly three times more than previously thought, suggesting consumption will soon slow down.

- Retailers are responding to the slowdown in consumption. But the data suggests a recession is more likely.

Savings, the economic headroom that protects Americans from skyrocketing inflation, is less than previously thought. As American savings dwindle, the likelihood of a deep recession increases.

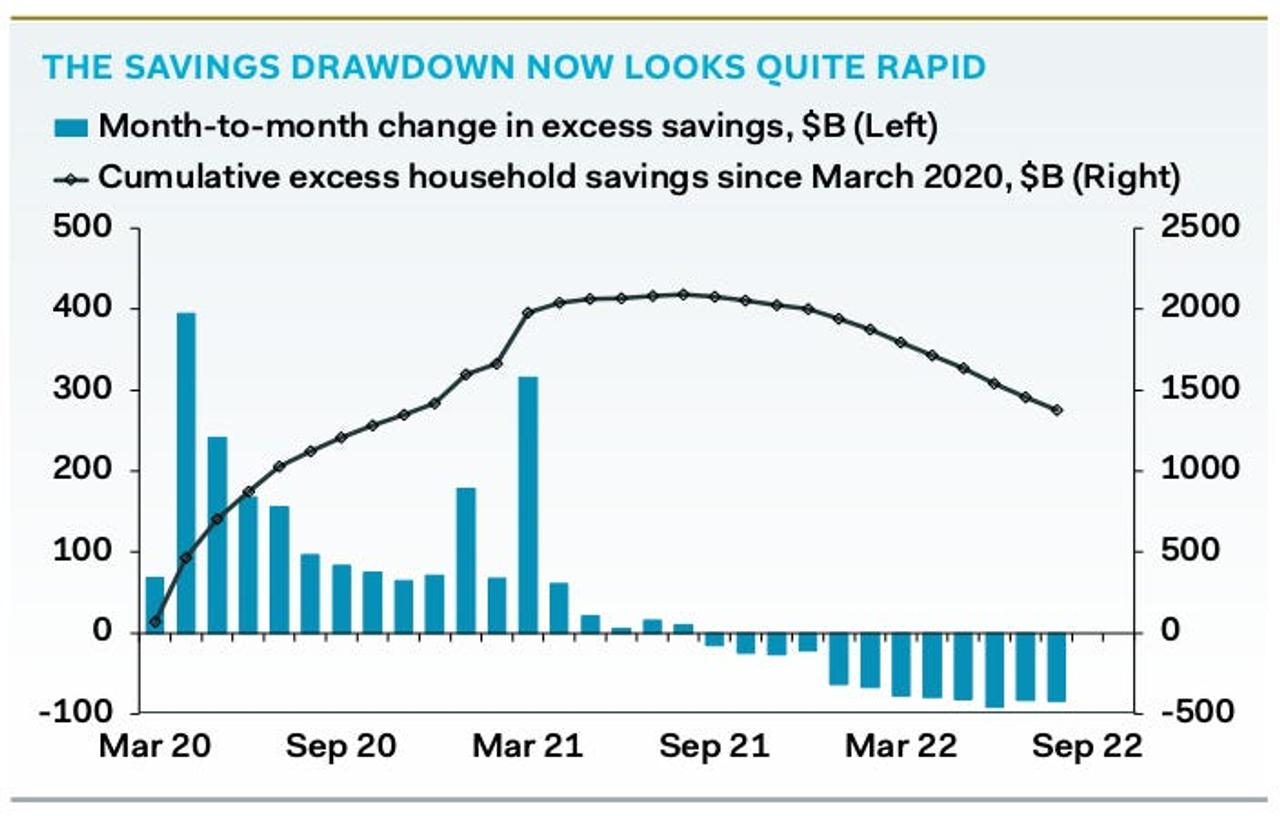

American households are in alarming decline. In the early days of the coronavirus pandemic, unprecedented economic stimulus and weak consumer spending led to a surge in American savings. The trend peaked in mid-2021, with consumption picking up as the economy started to turn around again. Inflation has forced many people to cut down on their savings to buy the necessities of life. As prices continue to rise, people’s savings are declining.

It looks like the situation is even worse than previously thought. According to the Bureau of Economic Analysis, the Commerce Department’s Bureau of Economic Analysis, data for August 2022 show that American households saved about $2.4 trillion in February 2021. It shows that 270 billion dollars (about 39 trillion yen) was used. About 11% of that has been spent since the savings balance began to dwindle in 2021.

And recent reports show an even more grim picture. According to the newly updated statistics on September 30, 2022, savings were $2.1 trillion (about ¥303 trillion) in August 2021, but 31%, or about $630 billion (about 91 trillion yen) has already been used.

Source: Pantheon Macroeconomics

“The risk of a recession is higher than we previously thought,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics, in an Oct. 5, 2022 note. Says.

As households start to spend less and make up for their dwindling savings, the engine of economic growth could be lost, he said.

“People will not be able to cut down on their savings enough to continue to increase consumption.”

Some big retailers are already betting that the economic slowdown will become a reality. Walmart and Target announced in September 2022 that the holiday season sales season would begin in early October 2022 to attract shoppers who are hesitant to spend due to soaring prices. Meanwhile, Amazon has announced that it will launch its own sale for Amazon Prime members in October 2022 to compete with bricks-and-mortar competitors.

By running the sale early, inflation-aware consumers can break up their holiday shopping spree and put less strain on their budgets.

“Price is a top priority for Walmart customers, and we understand that it will continue to be a key factor as the holidays approach,” Walmart spokesman Nick DeMoss said in 2022. told The Washington Post in September 2019.

“Customers start shopping early and their number one priority is finding the lowest prices.”

Despite the early sales, holiday spending is likely to fall as Americans dwindle in their savings. According to a September 2022 report by Deloitte, holiday retail sales are expected to grow by only 4% to 6% between November 2022 and January 2023. This is below the 15.1% increase in the same period last year.

There are still ominous signs. Inflation-adjusted spending at retail and restaurants has been declining since April 2022, with the exception of an unexpected rise in August 2022. In other words, higher prices are causing households to spend less while paying more for the same necessities.

A drop in savings alone does not guarantee a recession. If inflation eases, Americans may save more, and if the stock market recovers, households may have more flexibility to spend more.

But shepherdson said he doesn’t know “where the drain on savings will stop” because households “have never been in a situation like this.” If current trends continue, a slump in consumption will drag America into a dark recession, eroding household savings that have been set aside to weather the storm.

“Sustained strength in consumption is absolutely necessary to prevent a recession, but we are less confident about the strength of U.S. consumption than we were before the release of this new savings data. We are,” added Shepherdson.

[Original: Americans are running out of money and big companies like Target and Walmart are noticing. It makes a recession more likely.]

(Translation: Mayuko Oba Editing: Toshihiko Inoue)

Advertisements

Source: BusinessInsider

David Ortiz is an opinionated and well-versed author, known for his thought-provoking and persuasive writing on various matters. He currently works as a writer at 24 news breaker, where he shares his insight and perspective on today’s most pressing issues. David’s unique voice and writing style make his articles a must-read for those seeking a different point of view.