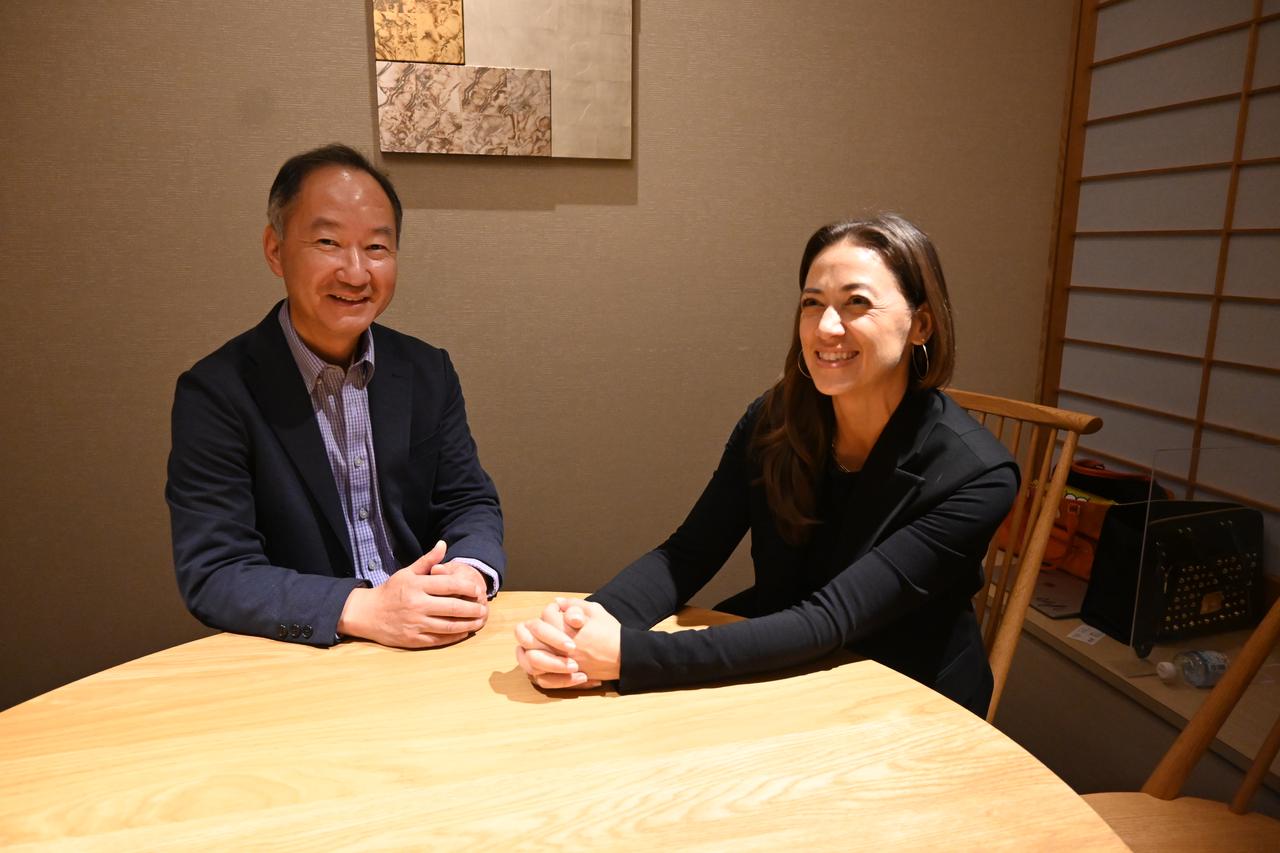

In Japan, domestic and foreign reskilling services are competing to acquire customers. The left is Udemy, the right is the person in charge of General Assembly.

“Reskilling” to acquire new digital skills is attracting attention, and service competition is intensifying.

In Japan in particular, corporate services are expected to drive the reskilling market, with some service providers answering that the Japanese market is expanding at a pace that exceeds the global average growth rate.

“Japan is a very important market.”

Mr. Rich Chu (left), who is in charge of new business development at Udemy, and Mr. Stacey Zold Hara, who is in charge of corporate communications, came to Japan.

Udemy, a reskilling platform from the United States, is on the offensive with the aim of expanding service awareness, such as by broadcasting TV commercials.

“Japan is a very important market. We started our service in Japan seven years ago, and we read that cutting-edge knowledge would be required from that time, and we were right.”

Mr. Rich Qiu, chief executive of new business development, who came to Japan in the winter of 2022, said so.

Udemy was founded in 2010 and will be listed on the Nasdaq in 2021. Its current market capitalization is around $1.5 billion. In Japan, since 2015, we have formed a partnership with Benesse for sales, etc., and in 2020, Benesse will invest $50 million. It is said that more than 1 million people use it in Japan (as of September 2022).

Corporate use is currently being strengthened alongside personal use at Udemy.Udemy does not disclose the number of detailed contracts, but the number of contracts for business services is “more than 1000 companies”It says.

In particular, it is appealing that it has been used by large companies, and it is announced that more than 50% of the 225 companies used to calculate the Nikkei Stock Average have introduced it.

“Corporate contract growth in Japan is trending at a pace that exceeds the global average growth rate.”It says.

At Udemy, we will appeal the introduction results especially in major companies.

Advertisements

The selling point is speed, which other companies do not have.

Regarding expectations for the Japanese market, he said, “There is room for reskilling to fit in because Japan has a deep-rooted lifetime employment system.”(Mr. Rich Chu).

“Japanese companies have a strong culture of teamwork and passion. Recruiting the necessary human resources from outside takes time to get used to the corporate culture.There is a need to reskill internal human resources and develop necessary human resourcesI think

Regarding the strength compared to other companies’ services, he emphasizes the “speediness” of being able to deliver online courses to ordinary people.

“Many of our competitors take a long time to create a single course, especially in fast-changing technology, even months after an announcement is slow.

On the other hand, on Udemy, people who are currently active in the field have created courses that teach real-life content immediately.The advantage is that you can learn from the timing as soon as technology is updated, such as OS updates(Mr. Rich Chu)

Number of members doubled after Corona

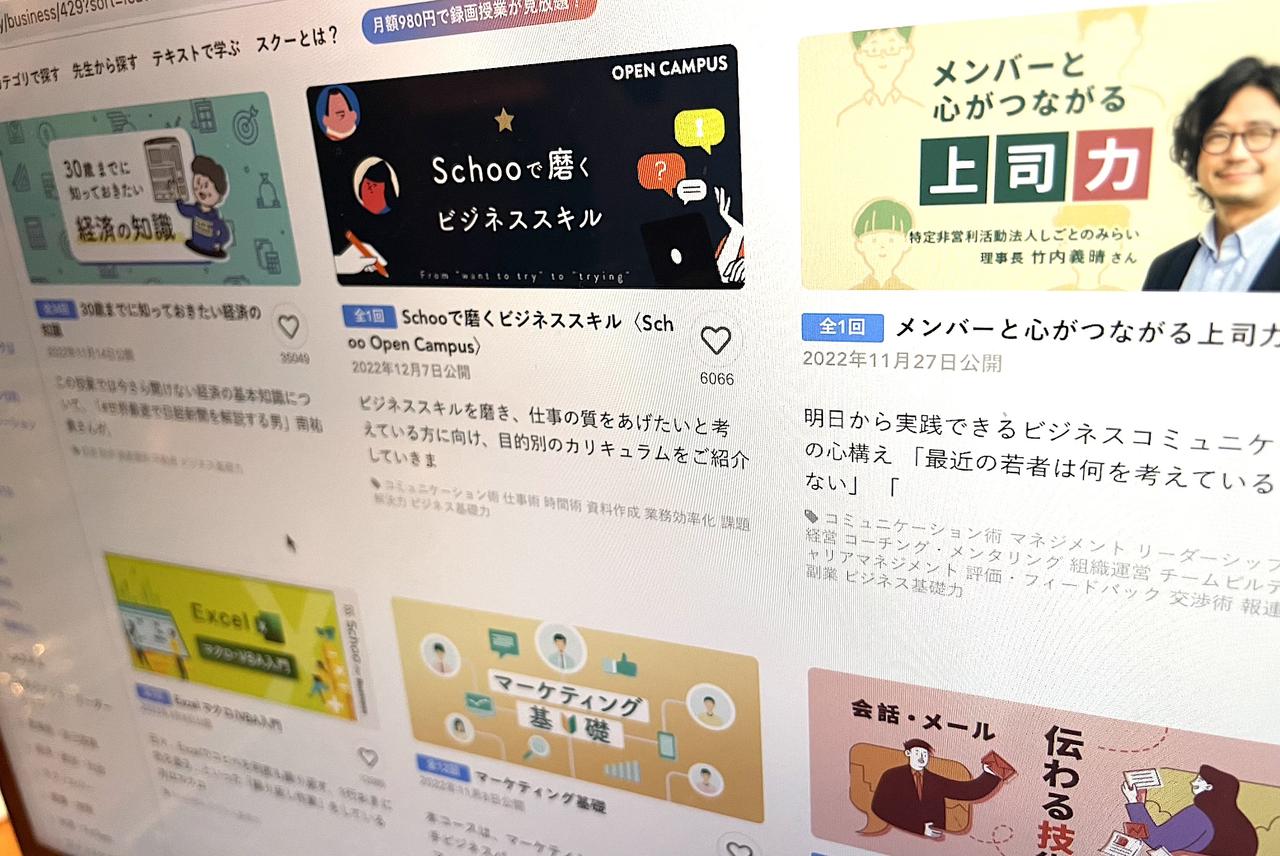

The service screen of the school’s online course. It is a model that Suku is responsible for from planning to recording.

Japan’s first reskilling service, Schoo, is also trying to leverage corporate contracts.

There are about 2,700 corporate contracts with Suku (as of November 2022). Although the number of individual contracts is not disclosed, the number of members, including individuals and corporations, isAt the end of 2019 before COVID-19, the number was about 430,000, but as of January 2022, it doubled to about 830,000.are doing.

“While the short-term negative impact of the economic recession is expected in the future, companies have had the bitter experience of stagnation in growth across the board after halting investment in education during the Lehman shock.

We expect that educational investments that are valuable and that match the trends of the times will survive, and we aim to be the “No. 1 in online learning services for corporations.”(Mr. Yohei Inukai, Head of School Corporate Business)

Exploring expansion of cooperation with local governments

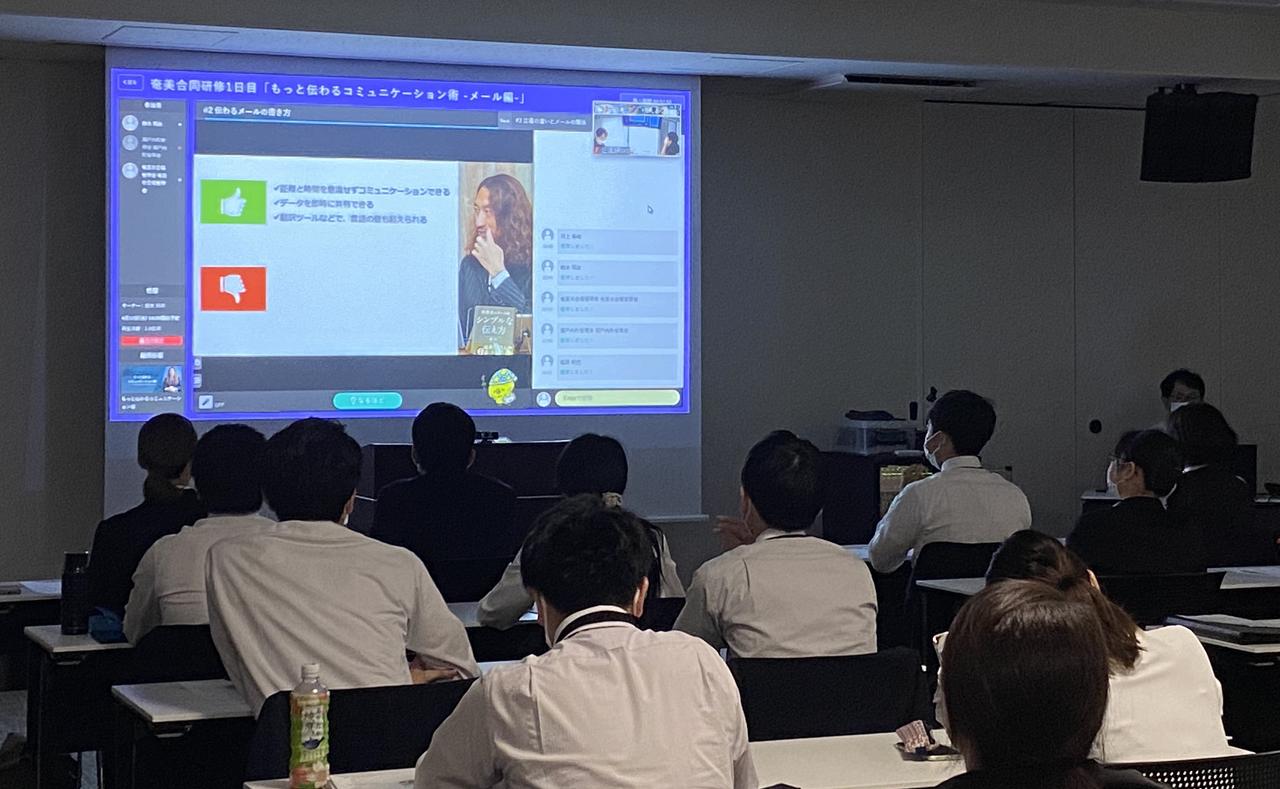

On Amami Oshima, schools were used for training government officials.

In addition to corporate contracts, schoolwith local governments nationwidealliancealso proceed.

Shiojiri City, Nagano Prefecture signed a corporate contract for city hall officials, and five municipalities on Amami Oshima, the first in the island, used it for online training for new employees. It has been introduced to 27 local governments, and we are aiming for further expansion.

AlsoNew business to increase name recognitionalso launch.

In December 2021, announced a capital and business alliance with Sansan, a cloud business card management service. Suku’s video content can now be viewed on the “Eight” service for individual users.

However, only free content can be viewed on Eight, and it is not directly linked to Suku’s revenue.

Suku’s CCO Takigawa Maiko explained at a press conference as follows.

“First of all, we are aiming to get people to think of reskilling as the first thing that comes to mind when they think of reskilling. We want to raise awareness and have people actually use it, which will lead to corporate contracts and paid contracts for individuals.”

New “overseas players” established in 2011 also enter

Ms. Amy Jones, who is in charge of general assembly market development, interviewed me when I came to Japan.

General Assembly (GA), which operates in the United States and other parts of the world, will start operations in Japan in the spring of 2023. Aiming for differentiation as a face-to-face and high-priced service.

Amy Jones, who is in charge of market development mainly in APAC at GA, said,“We see Asia as a big reskilling market, let alone Japan.”talk to.

GA was founded in 2011. It has campuses for face-to-face reskilling courses in 15 countries around the world, and in Asia, Singapore, Sydney, Bangkok, Malaysia, etc., with more than 140,000 students.

GA’s strength is short-term intensive face-to-face reskilling.

“In Japan, the development of the reskilling market is expected partly due to the policy of the Kishida administration.Each country has its own strategy, but I think Japan is led by organizations rather than by individuals.Although lifelong employment has taken root, the current situation is that what was learned 20 years ago is no longer valid as the population ages, and I see a high need for ToB.” (Mr. Amy)

Differentiation with high-priced face-to-face

GA also has many face-to-face programs.

At GA, in addition to online, there are many in-person courses. Especially in Japan, we are paying attention to interpersonal courses.

Courses range from short-term courses, such as one day, to long-term courses, such as a 40-hour course in 10 weeks.

Lecturers in other countries’ classrooms are often hired as side jobs from major tech companies such as Google and Uber.

“All instructors employ people who are active on the front lines as side jobs,We prefer a hands-on approach rather than academia.I believe that the practical educational content that has been reskilling in the shortest distance over the past 10 years will be accepted in Japan.” (Mr. Amy)

about the competition”It’s in every country’s market.”However, we will emphasize interpersonal rather than online, and aim to differentiate ourselves as a reskilling service in the high price range.

In the present circumstances”I can’t talk about the details and costs of the Japanese business.”However, it is aimed at corporate contract needs and is expected to be attended during working hours.

Potential for further intensification of competition in Japan

Mr. Muneaki Goto of the Japan Reskilling Initiative.

“In Japan, the market for reskilling services has just started.

Muneaki Goto, who launched Japan’s first reskilling enlightenment organization, “Japan Reskilling Initiative,” says so.

Since around 2016, Mr. Goto has been analyzing reskilling services and related markets in the United States.

“In American employment practices, there is a sense of value that it is the responsibility of the individual to improve their skills and dismiss them.

Especially in the consulting industry, where people update their skills by themselves, companies such as Accenture now spend a lot of money on employee training.It is said.” (Mr. Goto)

Japanese companies tend to invest less in employee development than in other developed countries.

From 2010 to 2014, the ratio of corporate skills development to GDP was 2.08% in the United States and 1.78% in France, but only 0.10% in Japan.

However, in the future, as more attention is paid to reskilling, there is a possibility that corporate investment will increase, and we expect that the number of service entries will also increase.

“I feel that there are not enough players compared to the expansion of the market.Just as Udemy has been successful in the Japanese market, overseas online services such as Coursera and OpenClassrooms may increase their presence if more content is available in Japanese. There is also a nature.” (Mr. Goto)

On the other hand, in reskilling developed countries, reorganization of players is already progressing. In 2018, the aforementioned GA was also acquired by the major human resources company Adecco Group for $412.5 million.

Skill visualization service

In addition to learning, there are also services that visualize the acquired skills (the photo is an image).

In emerging reskilling countries such as the United States, not only the provision of educational content itself, but also peripheral services such as “Skills Tech” are currently attracting attention.

Mr. Goto of the Japan Reskilling Initiative also serves as the Japan representative for SkyHive, a Canadian skills tech company.

Skyhive is a reskilling platform that allows you to visualize the skills you have acquired in addition to learning management by reskilling.

“Which human resources have received which program and what skills they have acquired. That is the key to human resource development. Rather than contracting with a reskilling service, the company or individual can visualize the skills. Services are considered as a set with content, and we expect the need to grow in Japan as well.”

Reskilling, which has attracted a lot of attention in 2022. Whether or not a culture in which each and every worker acquires new skills and raises market value will take root in Japan.

2023 is likely to be a year in which the truth will be questioned.

Source: BusinessInsider

Emma Warren is a well-known author and market analyst who writes for 24 news breaker. She is an expert in her field and her articles provide readers with insightful and informative analysis on the latest market trends and developments. With a keen understanding of the economy and a talent for explaining complex issues in an easy-to-understand manner, Emma’s writing is a must-read for anyone interested in staying up-to-date on the latest market news.