Last time, we analyzed the business model of Timee Co., Ltd. (hereafter, Timee), which provides the skimmer byte app “Timee”.

Workers will be paid on the same day, and companies will be matched with part-time jobs while minimizing recruitment costs and paperwork. There is no doubt that the growth of the company lies in the fact that they have built a system of “picking the best” for both of them.

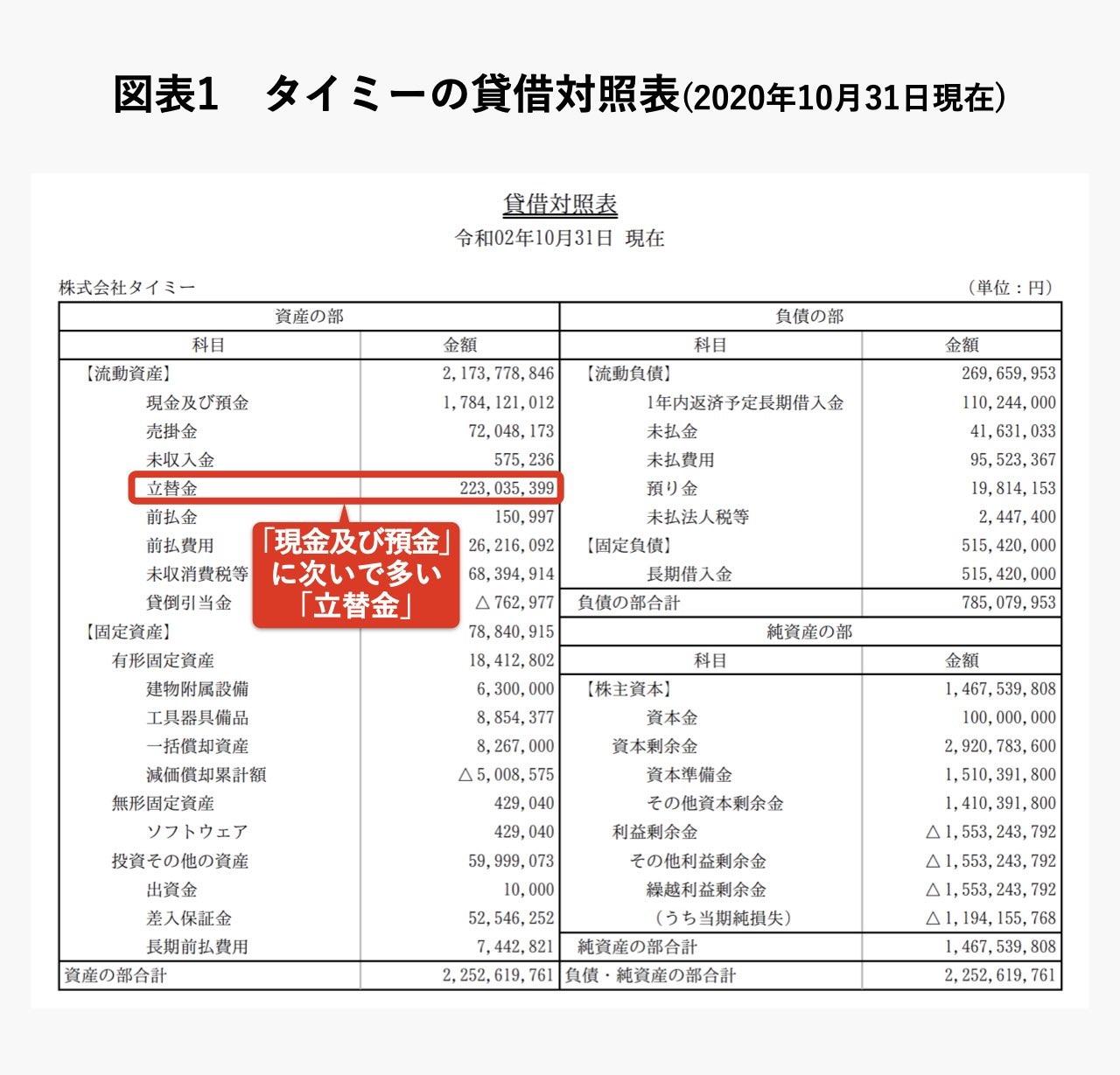

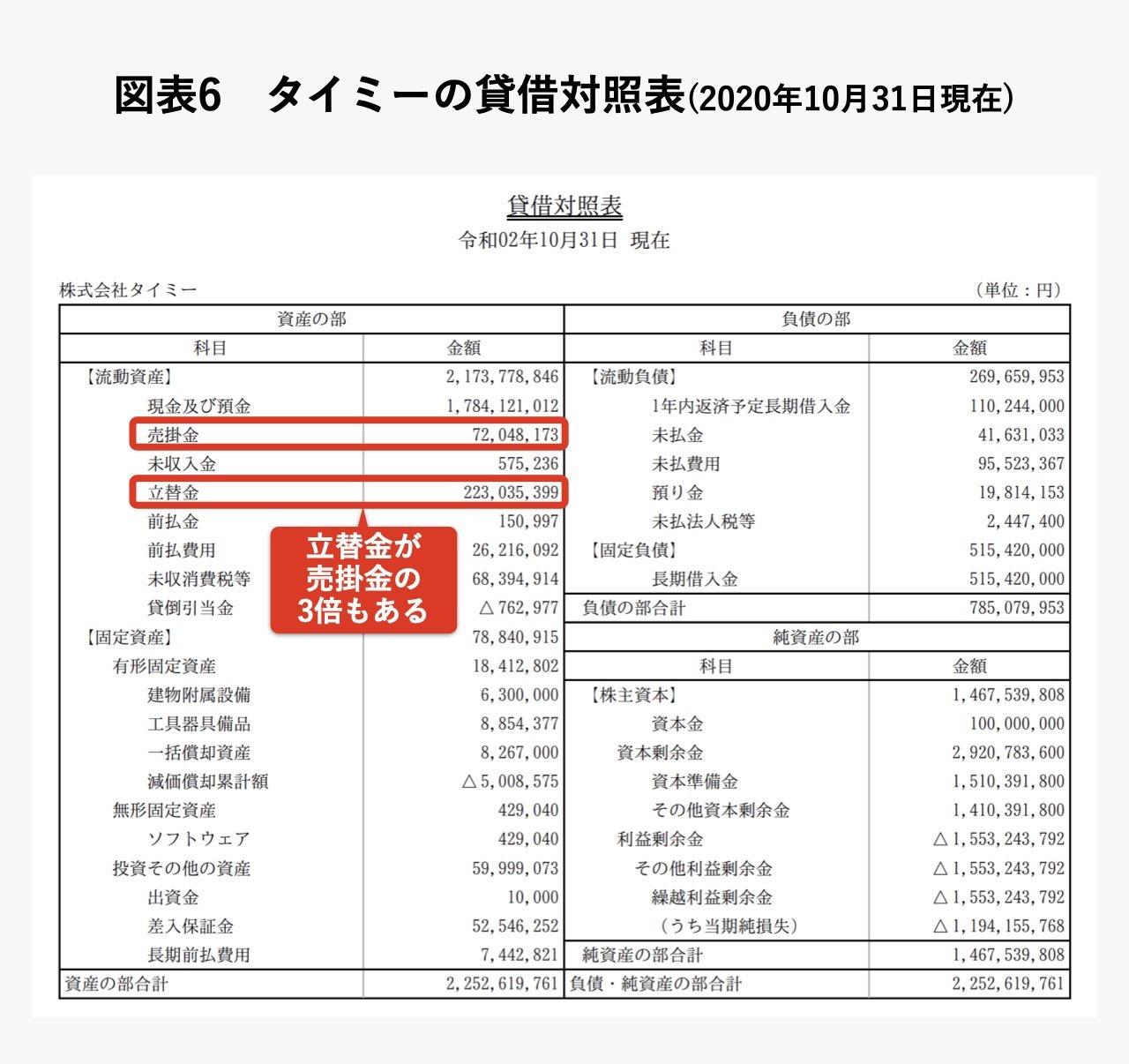

However, Timee pays the compensation on behalf of the recruiting company in order to realize the same day payment for the part-time job. That meansThe more Timey’s services continue to grow and match part-time jobs with companies, the sooner money will come out.It will be. In fact, we can see that there is a considerable amount of “expenses paid” on Timee’s balance sheet (Figure 1).

The only thing I’m worried about is ‘financing’. No matter how good your service is, if you run out of cash, your business will go out of business. How does Timy deal with this challenge? This was the question left over from the first part.

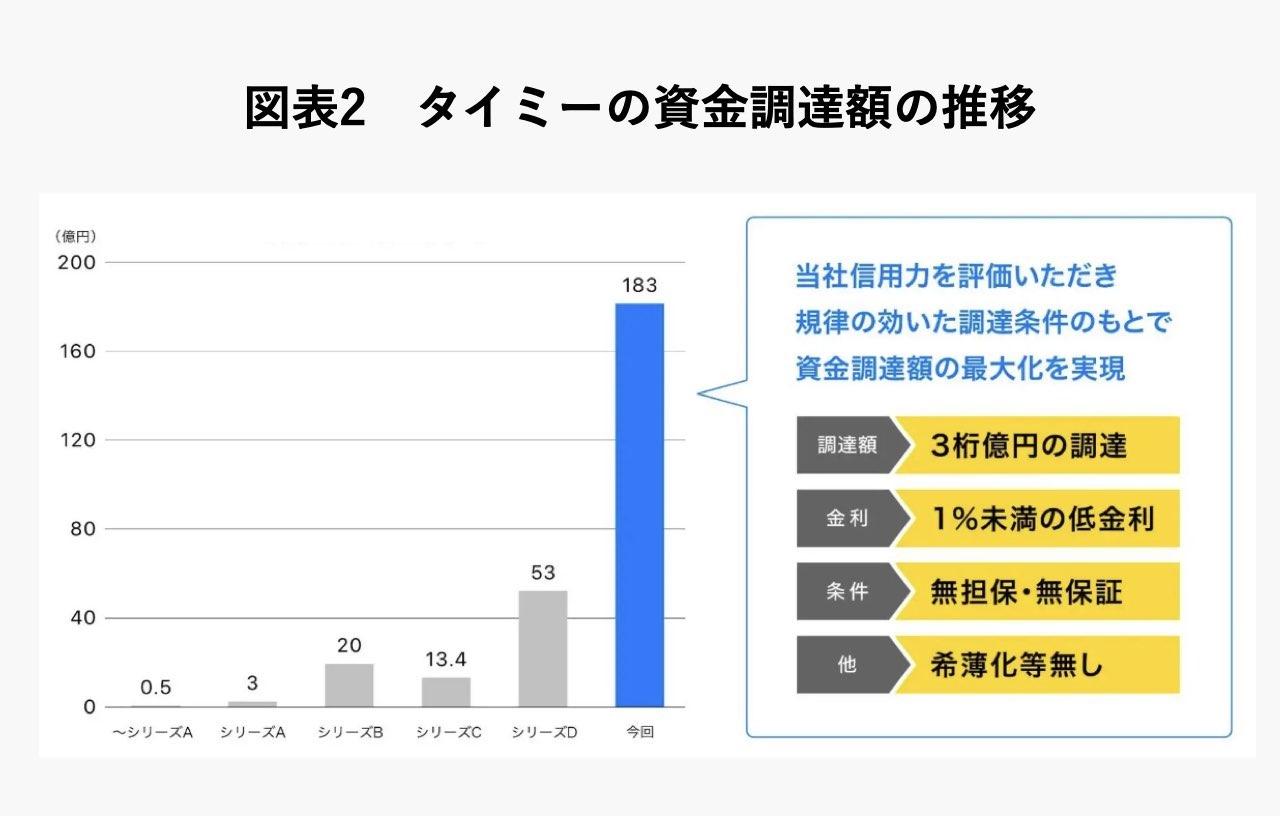

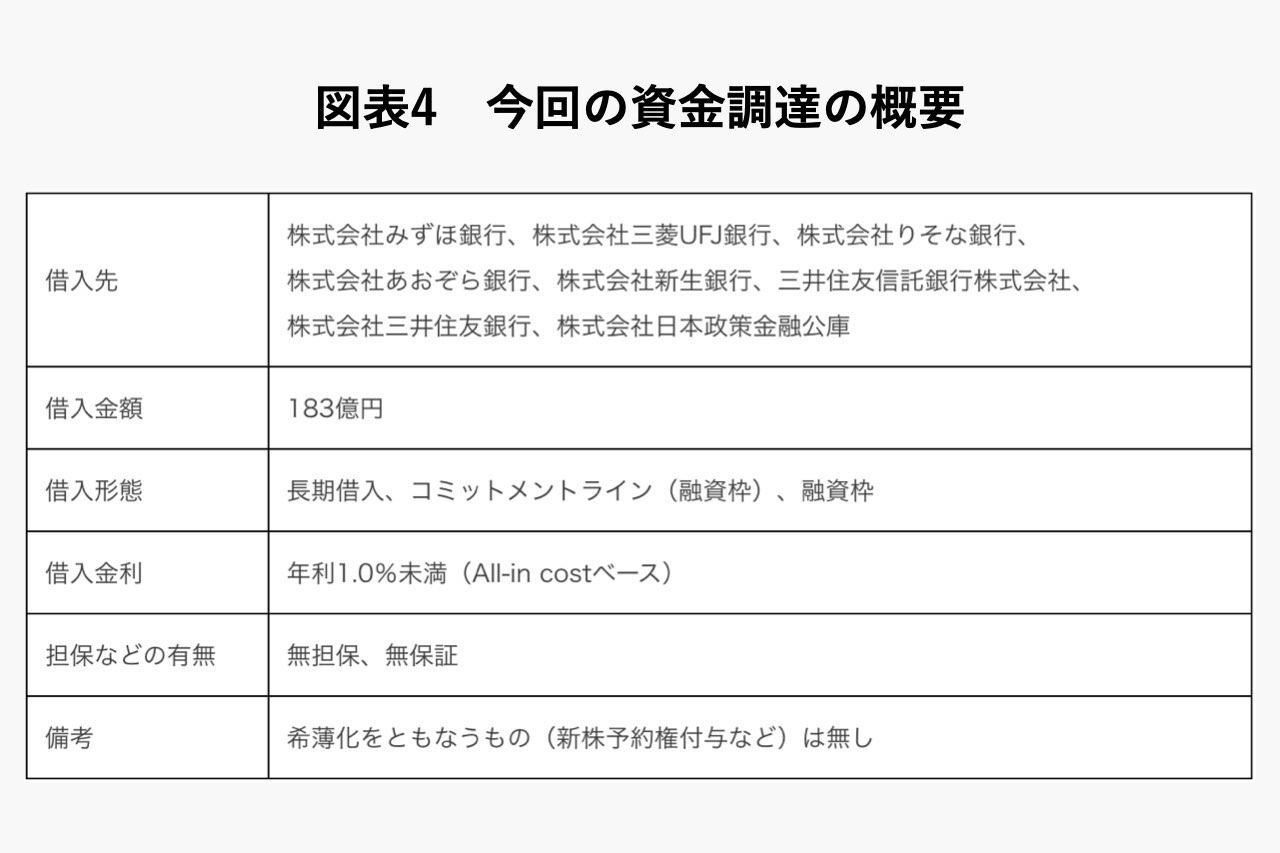

In fact, to address thisIn November 2022, Timee borrowed 18.3 billion yen from banks, including a loan facility.Despite being a fast-growing startup, it was founded in 2017 and is very youngIt is extremely rare for an unlisted company to raise 18.3 billion yen by “borrowing” from a bank.. Why this is the case will be explored in more detail below.

Why was the loan of 18.3 billion yen realized?

Figure 2 shows the history of Timee’s fundraising. In Series D in 2021, Timee has raised 4 billion yen in equity and 1.3 billion yen in debt (*1).

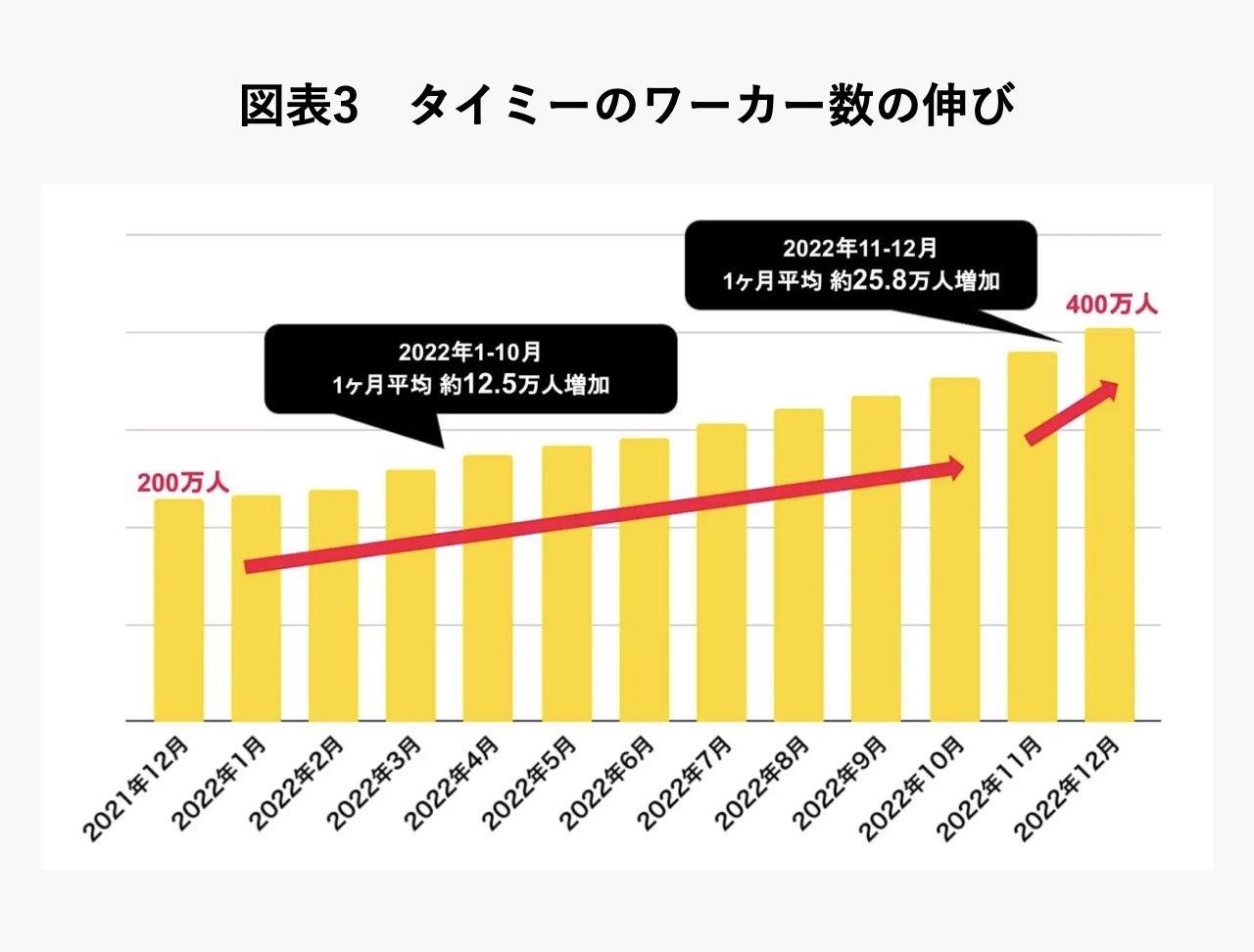

In the year from then until 2022, the cumulative number of workers increased from 2 million to 4 million (Chart 3).

This increase in the number of workers means more same-day payments for Timee, which means cash goes out first.. If so, there will be a corresponding need for funding.

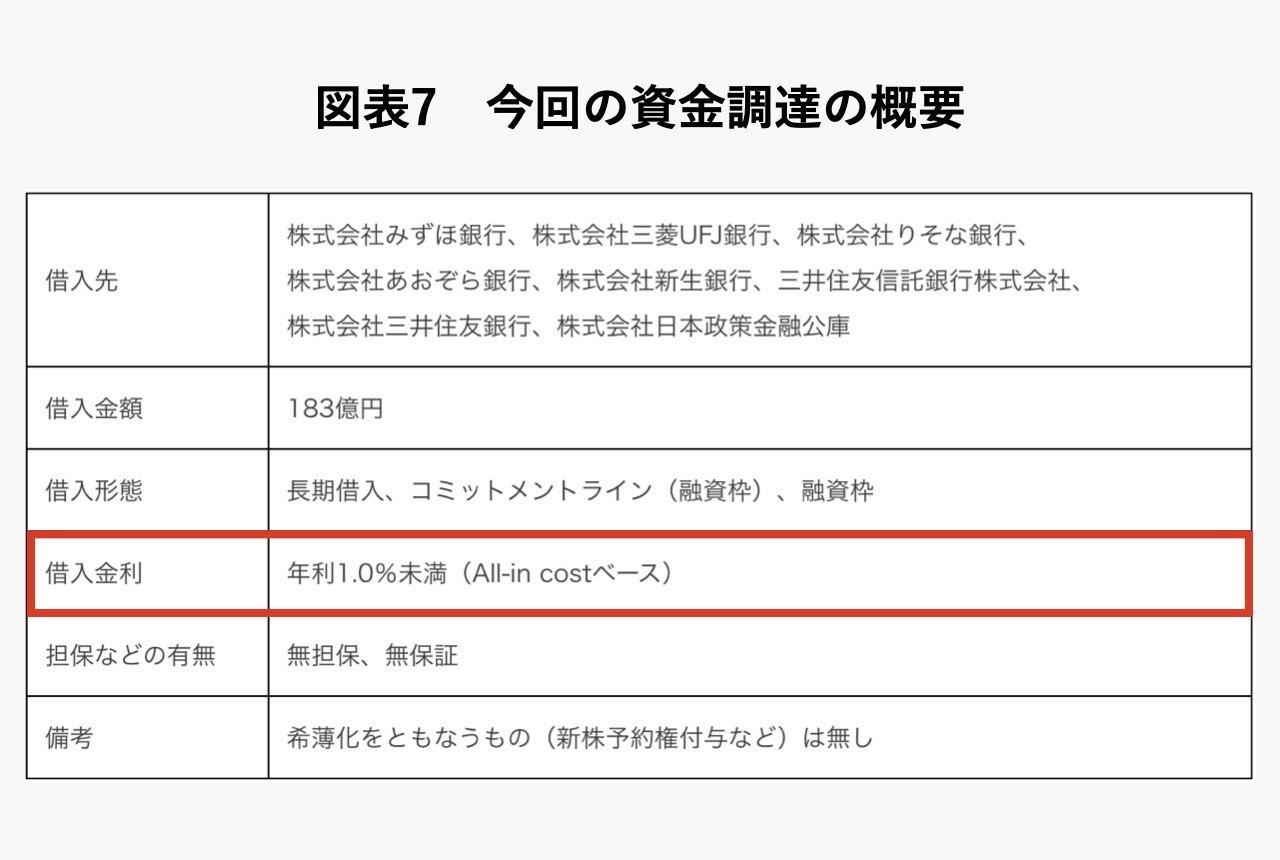

In fact, for this financing, Timee raised 18.3 billion yen in long-term loans and commitment lines (loan facilities) from major Japanese financial institutions such as Mizuho Bank, Mitsubishi UFJ Bank, and Resona Bank (Chart 4). .

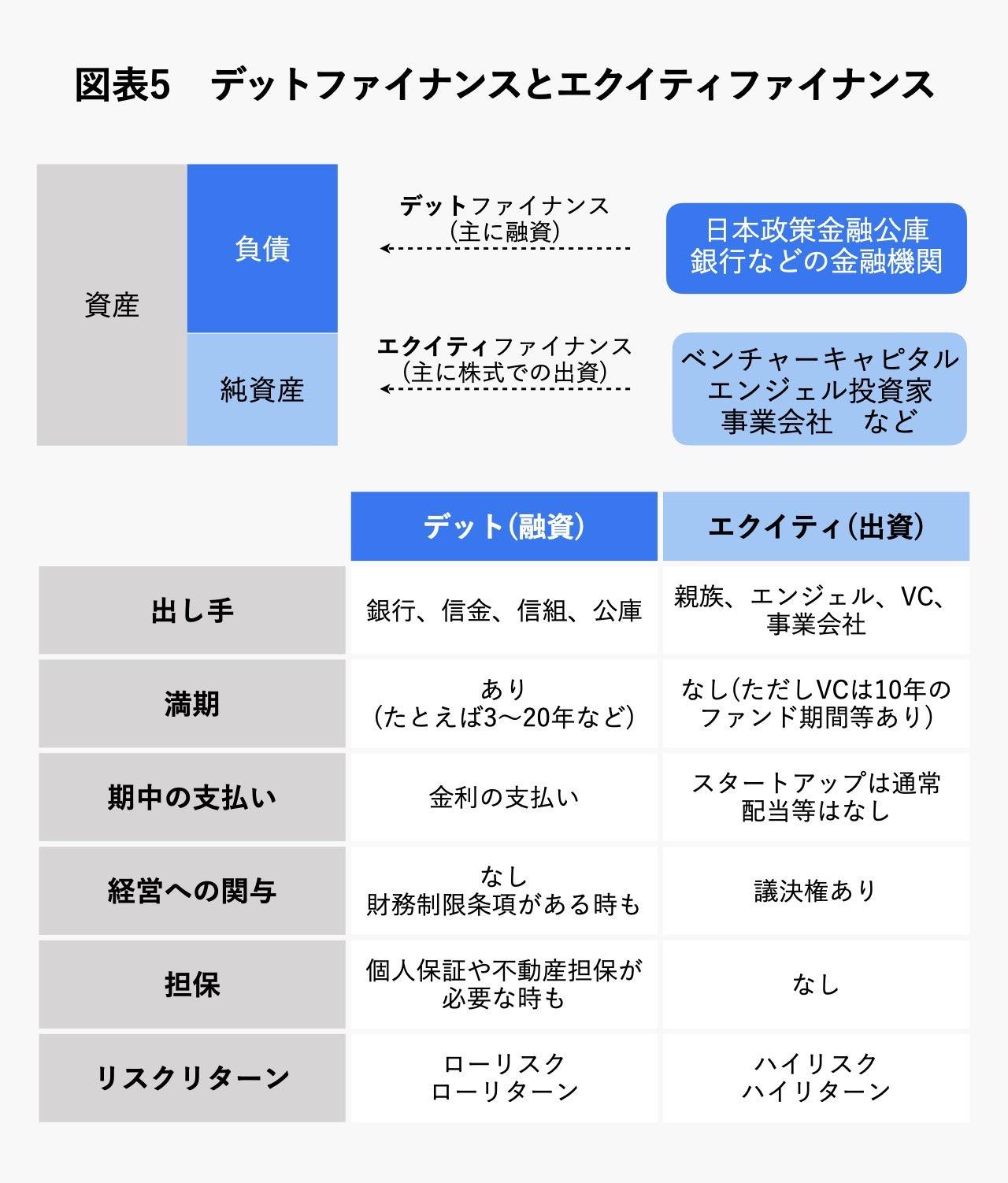

Although growing rapidly, it is difficult for start-ups with high risk to borrow from banks. Therefore, in many cases, it is common to procure equity through the issuance of shares and use debt financing through borrowings after the business has stabilized (see Figure 5).

Despite this, why was Timee able to borrow 18.3 billion yen?

One of the reasons is considered to be the payment.

As we confirmed in Part 1, most of Timee’s current assets are advance payments and accounts receivable (Chart 6).andThese debts are owed by large, high-profile restaurants and retailers, among others..

In other words, much of the advances and receivables in Timee’s liquid assets should be collected from large, highly creditworthy companies. Banks should have made a decision based on the credit status of these companies when lending to Timee.

In other words, it is thought that Timee was able to borrow in the form of “asset-backed borrowing” in a sense by paying advances to major companies and accounts receivable.(This borrowing is unsecured and unguaranteed, so strictly speaking, it is not an asset-backed borrowing, but I assume that this sort of arrangement was actually part of it.)

In addition,The fact that it was not an asset-backed securitization loan is also important.. If you have advance payments and accounts receivable like Timey, it should be possible to implement a scheme of securitization of monetary claims. In fact, if the loan amount is 10 billion yen or more, even if a securitization scheme is set up, it will be worth the cost.

Nevertheless, the fact that the loan was not an asset-backed loan means that the bank evaluated the company’s financial structure and business model as well as the advance payment and accounts receivable assets that the company owns. .

Paradoxically,The fact that this borrowing was not an asset finance using advance money or accounts receivable was evaluated by the bank as corporate finance that borrows from the company’s credit itself.It is considered.

In this way, the fact that Timee was able to borrow a huge amount of money through corporate finance is a big plus as a financial strategy.

First of all, if we raise 18.3 billion yen in stocks, the stocks will be diluted, but if we borrow money, we do not have to worry about that.

Secondly, having secured 18.3 billion yen in funding, Timee will be able to step on the accelerator for growth. With the number of workers doubling in the past year, Timee can expect high growth in the years to come. The biggest bottleneck at this time is the compensation for part-time jobs that are paid on the same day, but if you have 18.3 billion yen at hand, you won’t have to worry about cash flow for a while.

Thirdly, it is also a plus in terms of achievements. This time, we were able to borrow 18.3 billion yen, including the loan facility. If Timee can continue to grow as planned and repay the loan, both the bank and Timee will have a track record of transactions, which will make it easier to continue financing in the future. For Timee, at least based on the current business model, it will be possible to limit equity funding and continue debt funding.

For many startups, going public makes it easier to take advantage of debt, but Timee will be able to take full advantage of debt before going public.about it.

The gimmick of “borrowing interest rate less than 1.0%”

Looking at the terms of Timee’s ¥18.3 billion financing, there are some other interesting points.

For example, what about the fact that the borrowing rate is “less than 1% per annum (all-in-cost basis)” (Chart 7)?

Although Japan has had low interest rates for more than 20 years,Timey’s borrowing rate of less than 1% is quite low. It depends on the company and scheme, so it cannot be said unconditionally, but the level of about 0.5 to 3% is common.

please think about it. From the lender bank’s point of view, no matter how much Timey grows, the interest rate will be less than 1%. On the other hand, if Timee’s business does not go well, it will not be possible to recover its principal and there is a possibility that it will suffer a loss. If the price goes up, the investor will make a profit.)

Why can unlisted Timee borrow 18.3 billion yen at such a low interest rate?

The secret is in the “commitment line” written in the “borrowing form”.

According to Timee’s release, the total borrowing of 18.3 billion yen is in three forms: long-term borrowing, commitment line, and line of credit.

From my practical experience, a line of credit is almost synonymous with a line of credit, so let’s simplify the discussion here and think of it as a “long-term borrowing” and a “commitment line.”

Of these, the commitment line refers to the limit that can be borrowed within the amount agreed between the company and the bank in advance. For example, let’s say a company has signed a commitment line of 1 billion yen with a bank. Then, this company will be able to receive a loan from the bank at any time within the limit of 1 billion yen.

If you don’t want to use the cash right away, but you want to borrow money from the bank just in case, you’ll have to pay the interest rate.ButSince the commitment line is not a borrowing but a “frame of rights that allows you to borrow a loan”, it does not cost as much as the interest rate.. Also, if you don’t actually need the funds, you don’t have to use the commitment line.

However, the commitment line is, of course, not free. If you receive a commitment line of 1 billion yen, you will be charged a “commitment fee” for the unused limit. The commitment fee varies from company to company, but it is generally around 0.1% to 0.3%.

Some people may have come with a pin soon.

As an image, it is the same as the problem we did in junior high school class, “What percentage will be the concentration when mixing salt solutions with different concentrations?” In other words, even if the interest rate for long-term borrowing is around 1.8%, the commitment line fee is as low as around 0.2%.Combining the two yields an interest rate of less than 1.0%That’s what “all-in-cost basis” means.

Timey was not able to borrow at an interest rate of less than 1%, but the commitment line fee was also taken into account.All-in cost would have resulted in an interest rate of less than 1%should be noted.

The implication of being able to withdraw “unsecured, unguaranteed”

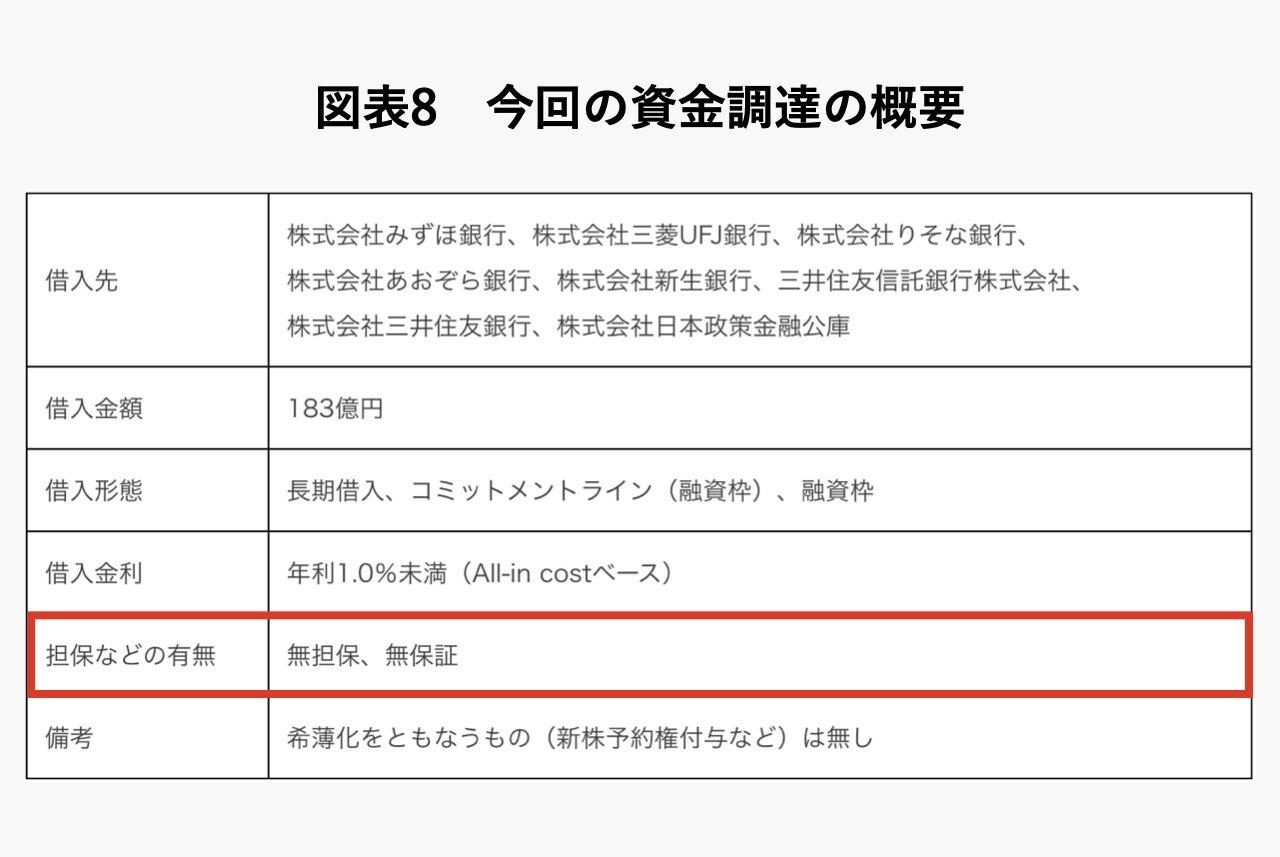

There is one more point that I would like you to pay attention to regarding the terms of Timee’s 18.3 billion yen financing. that is,It means that you were able to withdraw the loan with “unsecured and unguaranteed”.

In general, start-up companies tend to grow rapidly but continue to be in the red. If a bank lends money to such a startup, it will need to set up a bad debt reserve.

Even if the interest rate of the loan is around 1-3%, if the company is classified as a “needs attention” in the self-assessment (*2), the bank will have to set up a reserve of around 5-10%. Hmm. Since the risk does not match the return, banks prepare for the risk of bad debt by requiring guarantors and collateral.

Despite this, the fact that Timee was able to withdraw favorable terms from the bank of “unsecured and unguaranteed” means thatTimey is on the verge of becoming profitable, or it is likely that it has already achieved profitability on a monthly basis.It would be nice to see Also, the sales volume should be reasonable.

Try to estimate the sales of Timey

Now, let’s estimate the current sales scale of Timee based on the available information.

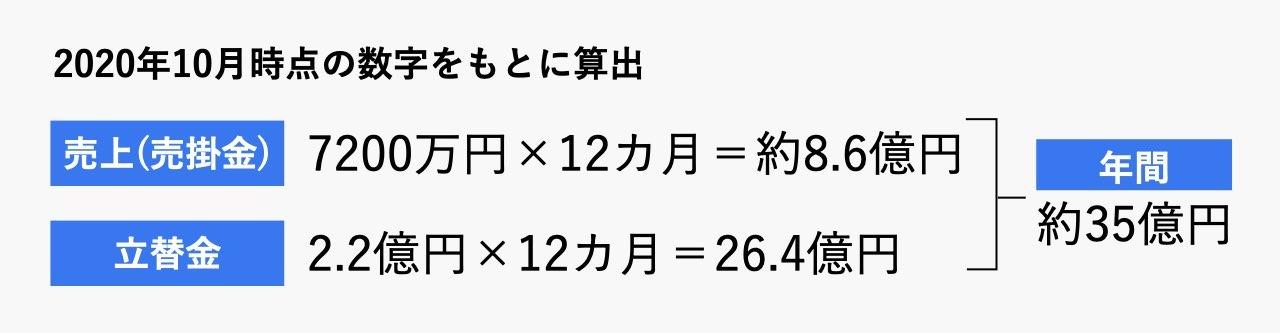

First, as seen in Chart 6, Timee had accounts receivable of 72 million yen and advances of 220 million yen, totaling approximately 300 million yen.

Assuming that these collection sites are for one month, the sales in one year will be 860 million yen by multiplying the accounts receivable of 72 million yen by 12 (*3). increase. The total of accounts receivable and advances paid is about 3.5 billion yen per year.

This figure is as of October 2020, but according to Timey’s release, the cumulative number of workers as of December 2020, which is almost the same time, is 1.6 million. This includes people who have registered with Timee but are not working part-time, so let’s assume that 1 in 5 (20%) of all workers are actually working. In other words, 1.6 million people x 20% = 320,000 people.

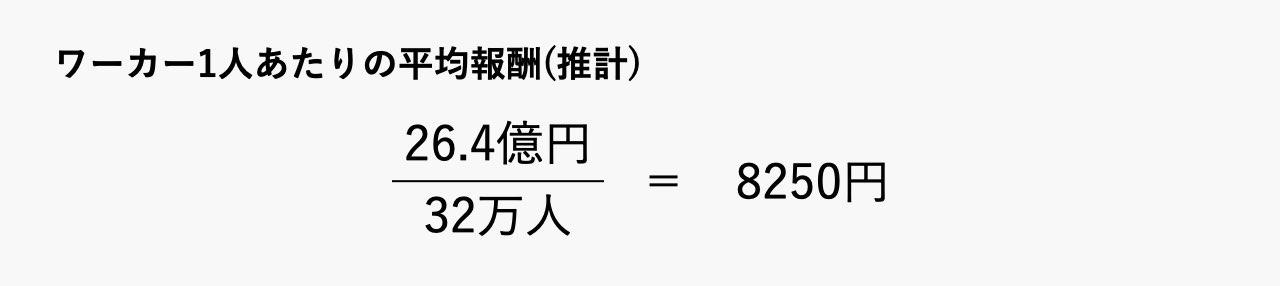

When Timey’s one-year advance payment (≒total amount paid by Timey to a part-time job on the same day) of 2.64 billion yen is divided by 320,000 workers who are actually in operation,

will be Here are the estimates as of the end of 2020.

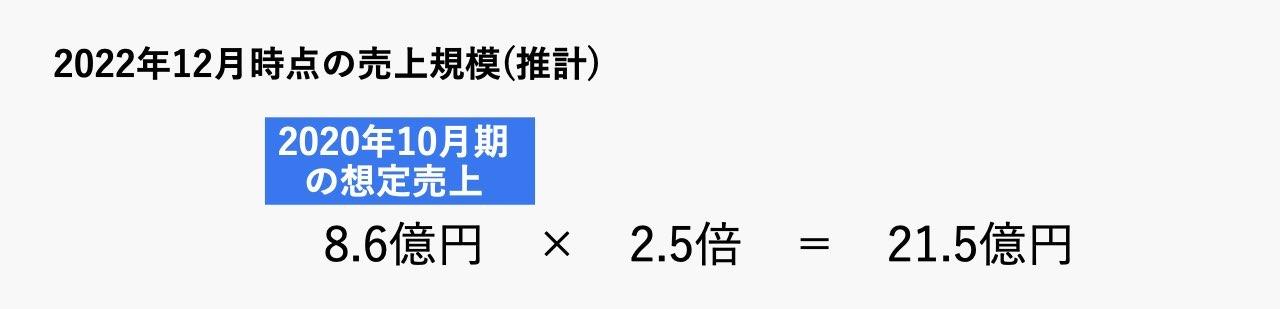

Based on this, let’s estimate the most recent sales scale of Timey.

According to Timey’s release, as of December 2022, the number of workers has exceeded 4 million. It has grown 2.5 times in two years since 1.6 million people.

If the sales estimated from the B/S (balance sheet) as of October 2020 are multiplied by 2.5,

Sales will be 2.15 billion yen.

How big is the sales of 2.15 billion yen? For example, the sales in the period immediately before listing of a human resources matching company that was listed in the past are as follows.

- Wantedly: 840 million yen (Fiscal year ended August 2016, listed September 2017)

- Lancers: 2.52 billion yen (fiscal year ended March 2019, listed in December 2019)

- VisasQ: 610 million yen (FY02/2019, listed in March 2020)

- Coconala: 1.78 billion yen (fiscal year ended August 2020, listed in March 2021)

in short,Based on the estimated sales shown above, Timee is already in the sales phase where it can go public.I understand that.

In addition, gross merchandise value (GMV), which is the sum of accounts receivable and advances, is 3.5 billion yen x 2.5 = 8.75 billion yen, and advances are 2.64 billion yen x 2.5 = 6.6 billion yen.

Reimbursement is the amount for Taimy to pay part-time job remuneration on the same day. This amount will increase as the number of users of Timee increases, but if it runs short, we will be able to cover the total amount of long-term borrowings of 18.3 billion yen and a commitment line.

However, if you compare the 6.6 billion yen in advances and 18.3 billion yen in loans over the course of the year, the ratio of loans is relatively large, so it seems likely that you actually paid more. .

The above considerations can be summarized as follows.

- Since Timee is able to borrow unsecured and unguaranteed loans, it is highly likely that it is at least on track to become profitable or has achieved profitability on a single month basis.

- Timee’s sales are expected to exceed 2 billion yen, which is higher than VisasQ and Coconala’s sales in the period immediately before their listing.

- The annual GMV (gross merchandise value) is estimated to be 6.6 billion yen, but it is smaller than 18.3 billion yen, so the actual gross merchandise value may be even higher. In that case, sales would be higher.

Venture debt supports startup growth

This time, in the first and second parts, we have examined the business model of Timee, an up-and-coming start-up company, and analyzed the background to why it is possible to borrow a large amount.

Speaking of “big startup funding,” there’s an example I’ve seen in the past of this series, like Spiber. Spiber raised 25 billion yen using a special structured finance called “business value securitization”, but Timee simply raises with unsecured and unguaranteed corporate loans.

Until now, when it comes to financial strategies for startups, it has been common to say, “Because it is difficult to borrow from banks, we raise funds through stocks.” However, the fact that Timey was able to borrow from a megabank with a regular loan despite its business model in which cash comes out first may be encouraging for many startups.

Tetsuya Isozaki, the author of Startup Finance, which is considered the bible of startup finance, emphasizes the importance of creating a startup ecosystem.

In other words, in order for many startups to be born and grow in Japan, in addition to entrepreneurs and investors, it is important to establish an ecosystem that includes consultants, tax accountants, and lawyers who support startup companies. That’s it.

Under such circumstances, in the last few years, “venture debt (debt financing system for start-up companies)” has become much more complete than it was 10 years ago. This loan to Timee can be said to be a symbolic effort.

When startups raise a lot of money, they often put out releases. Until now, most of our funding has been through equity (shares), but in the future we may be able to increase debt (borrowing), like Timey. When you focus on startups, be sure to check out their releases as well.

We can’t wait to see what news Timmy will continue to surprise us with.

*1 Timee “Timee raises Series D funding totaling 5.3 billion yen mainly from overseas institutional investors” September 15, 2021.

*2 Roughly speaking, a self-assessment is a process in which a bank examines a borrower based on its business conditions and builds up an allowance for doubtful accounts depending on the situation. 28).

*3 For simplicity, we assume sales to be 12 times accounts receivable at the end of the year. However, if the company is growing rapidly, the accounts receivable will increase steadily during the year. In that case, accounts receivable at the end of the fiscal year will be the largest amount in the year, so if you multiply this by 12, you will be looking at sales a little aggressively. However, for the sake of clarity, we assume that sales are 12 times the accounts receivable. The discussion here also applies to advance payments.

Shigehisa Murakami: CEO of Fine Deals Co., Ltd., CFO of GOB Incubation Partners Co., Ltd. Visiting professor at iU Information Management Innovation College. After completing the graduate school (master’s course) of the Graduate School of Economics, engaged in securitization, real estate investment, bad debt investment, project finance, fund investment business, etc., mainly in structured finance business at a financial institution. Since September 2018, as CFO of GOB Incubation Partners Co., Ltd., he has been developing new businesses and supporting entrepreneurship. In addition, he also provides financial and legal support for several start-up companies. Founded Fine Deals Co., Ltd., which provides financial consulting, etc. in January 2021. His book is “Financial Statement Nazotoki Training” (PHP Institute).

(Writing cooperation: Tatsuya Ito, series logo design: Mio Hoshino, editing: Ayuko Tokiwa)

Source: BusinessInsider

Emma Warren is a well-known author and market analyst who writes for 24 news breaker. She is an expert in her field and her articles provide readers with insightful and informative analysis on the latest market trends and developments. With a keen understanding of the economy and a talent for explaining complex issues in an easy-to-understand manner, Emma’s writing is a must-read for anyone interested in staying up-to-date on the latest market news.