In the domestic apparel industry, Workman Co., Ltd. (hereafter, Workman) has achieved a profit margin that surpasses Uniqlo and Shimamura and a growth rate of 20%. In Part 1, we saw that one of the success factors is the low labor cost rate, and that it was possible thanks to the franchise model adopted by Workman.

Traditionally, Workman has specialized in the niche market of work wear and built a winning pattern by focusing on management targeting individual customers rather than corporate customers. However, we faced the problem of reaching a ceiling of around 100 billion yen.

We will continue to consider how Workman overcame this situation and the secret of the company’s strength from the perspective of accounting and finance.

Secret strategy to break through market peak

Workman launched a new concept store format in September 2018 when the ceiling of the niche market of work clothes was in sight. It is “WORKMAN Plus”.

The products handled by Workman Plus are basically the same as Workman. The difference is the target customer.While regular Workman stores target professional customers who use work clothes at work, Workman Plus targets general outdoor customers..

Although the outdoor wear market has been growing for the past few years, this market is a red ocean market crowded with famous brands such as Patagonia, Columbia, Montbell and The North Face. In fact, according to Mr. Tetsuo Tsuchiya, Managing Director of Workman, in his book “Workman Style ‘Naisai’ Management”, the following analysis results were obtained in a market survey that the company commissioned a research company in advance.

- Workman cannot enter the outdoor wear market, which is full of brand-name products.

- Not eligible for purchase due to lack of brand power

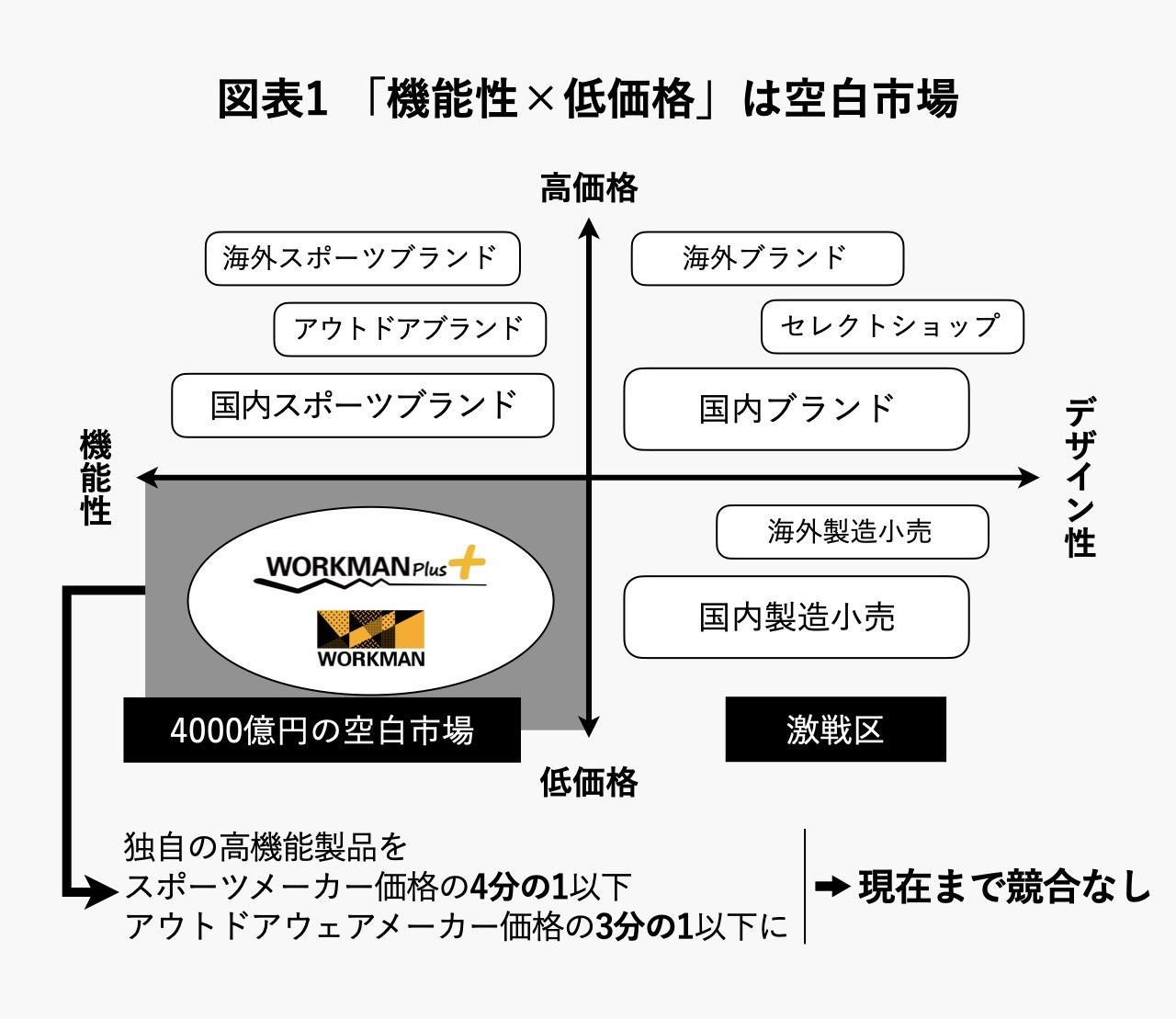

So why did Workman decide to venture into the outdoor clothing market? that is,Senior Managing Director Tsuchiya explained in his book that this was because there was a blank market in the apparel industry’s positioning of “emphasis on functionality” and “low prices.”(Chart 1).

This reading turned out to be a success, and the new business category, Workman Plus, made great strides. Due to the synergistic effect, many general customers also visited existing Workman stores, and in August 2019, existing store sales increased to 154.7% compared to the previous year.

In fact, I own a Workman product, but when I first tried it, I was shocked at how cheap the price was compared to its high functionality.

Due to their high functionality, Workman products have often been used in ways that exceed expectations. A summary of the representative episodes that Managing Director Tsuchiya reveals in his book is roughly as follows.

- waterproof winter suit: Waterproof and cold weather wear made for outdoor workers such as construction workers was selling to motorcycle users.

- shoes for the kitchen: Non-slip shoes developed for those who work in the kitchen.

- wool socks: Highly moisturizing merino wool sold to climbing enthusiasts.

- apron: The “durable water-repellent ripstop apron” developed for store clerks and flower shops is popular with general customers for gardening. Housewives also accepted our flame-retardant, stain-resistant chest apron for restaurants.

This precedent, which speaks to the high quality of Workman’s products, must have supported the company’s decision to enter the outdoor wear market.

Workman women’s breakthrough in the last two years

Following Workman Plus, “#Workman Girls” has recently been featured in the media and is attracting attention.

The term #workman girl first appeared in financial results relatively recently, with the financial results for the first quarter of the fiscal year ending March 31, 2020 (end of June 2019). At this time, it only introduced how to use “#workman girls” on Instagram as part of digital marketing, and there was no specific topic of store development.

The term “#Workman Women” appears again in financial results-related materials in the financial results briefing materials for the first quarter of the fiscal year ending March 31, 2021 (end of June 2020), one year later.

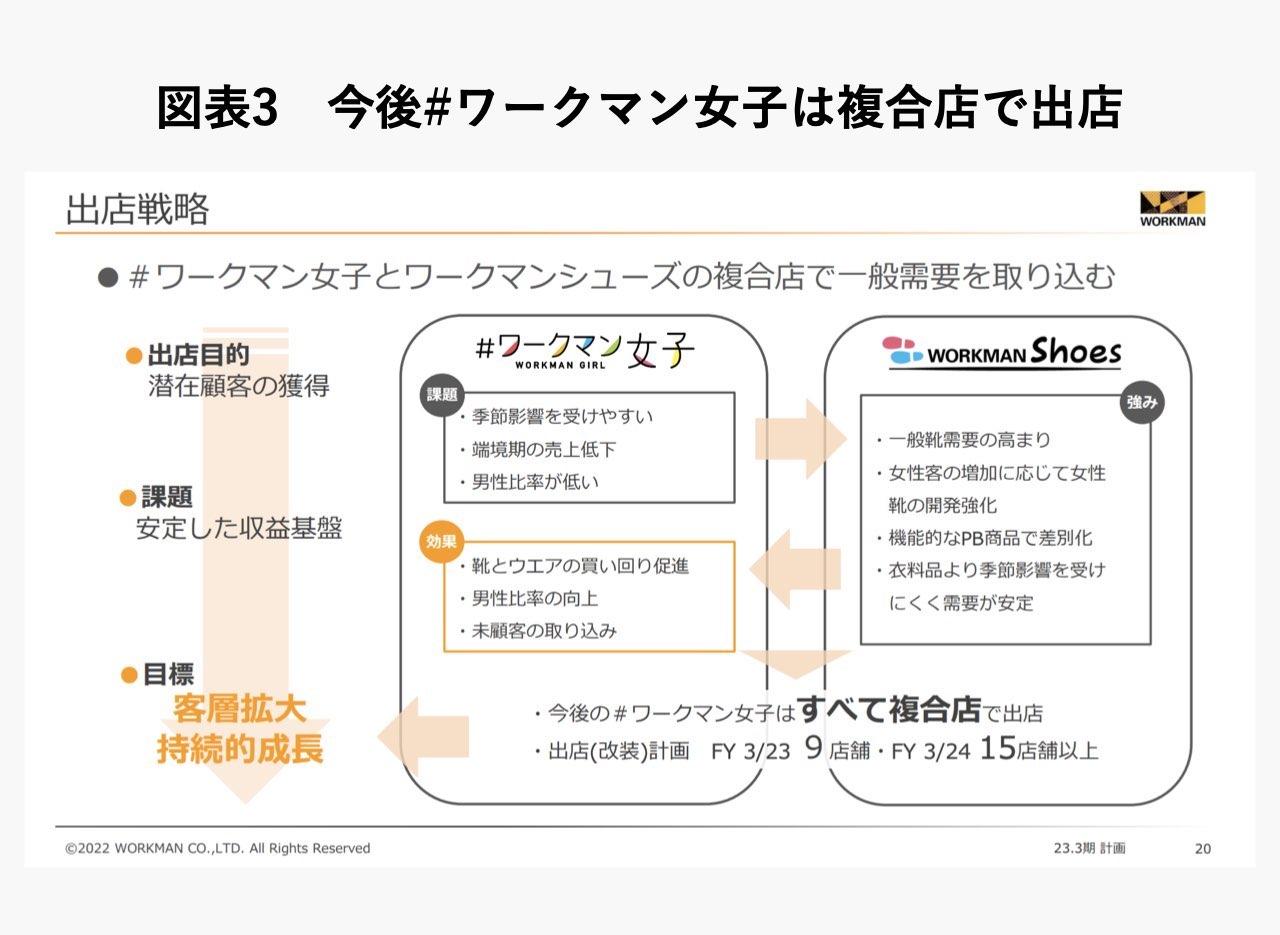

In October of the same year, Workman opened the first #Workman Women’s store in Yokohama City, Kanagawa Prefecture. increasing. In the future, all #Workman girls will aim to further expand the customer base by opening a store in a combined store with Workman shoes.

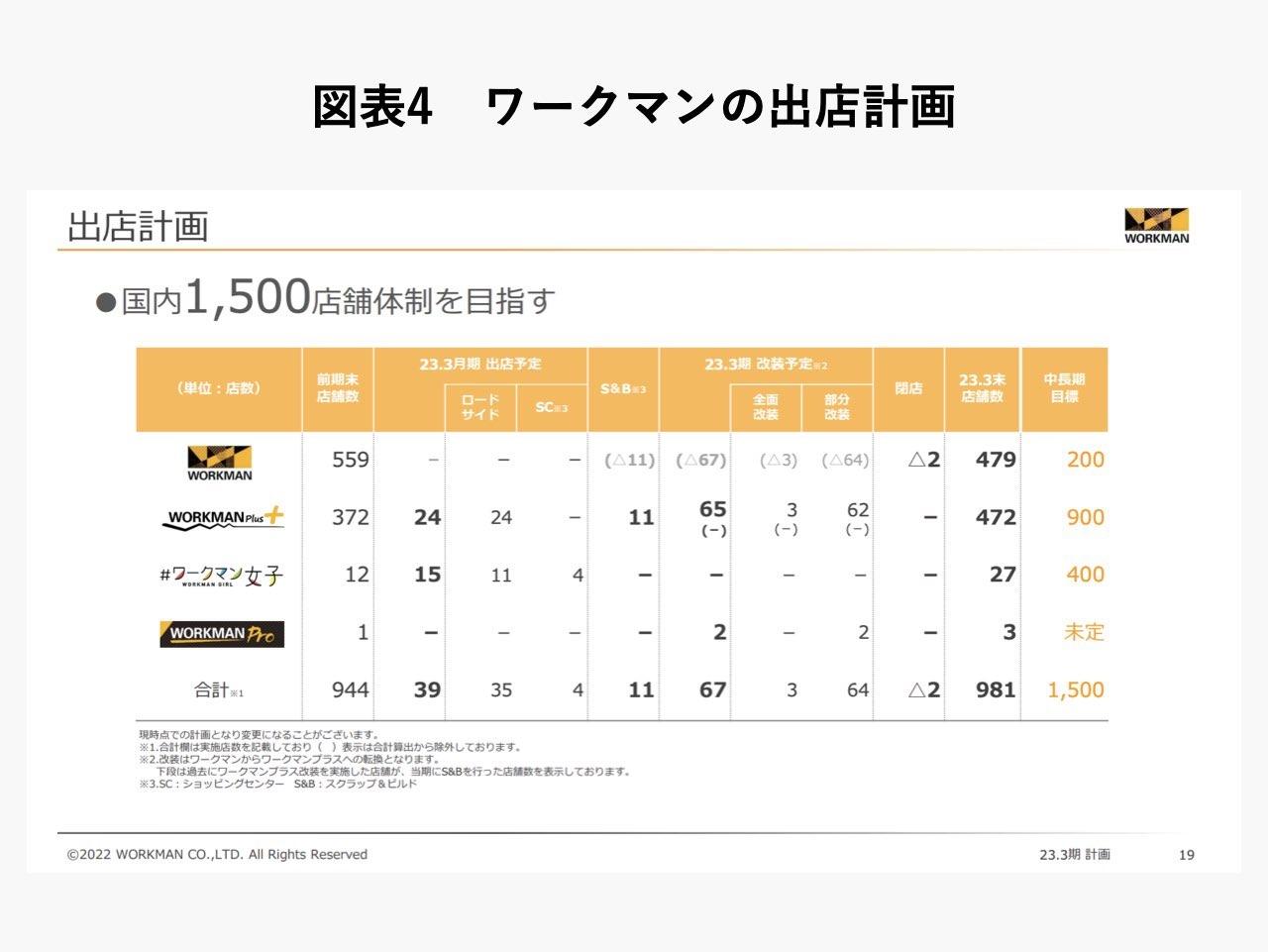

Workman plans to open 1,500 stores in the future, but there are only 200 conventional Workman stores, and the main goal is 900 Workman Plus stores and 400 #Workman Women stores.

From the starting point of the niche market of “work clothes x personal”, we are moving to the outdoor wear market and the women’s market with the new axis of “high functionality x low price”. Workman’s ability to expand into areas while leveraging its strengths to achieve higher profit margins and growth rates than Uniqlo and Shimamura is truly admirable.

Extremely low advertising costs

So far, we have looked at Workman’s growth strategy from the perspective of market development. Especially in the consumer business, it is important to be recognized by a wide range of people.

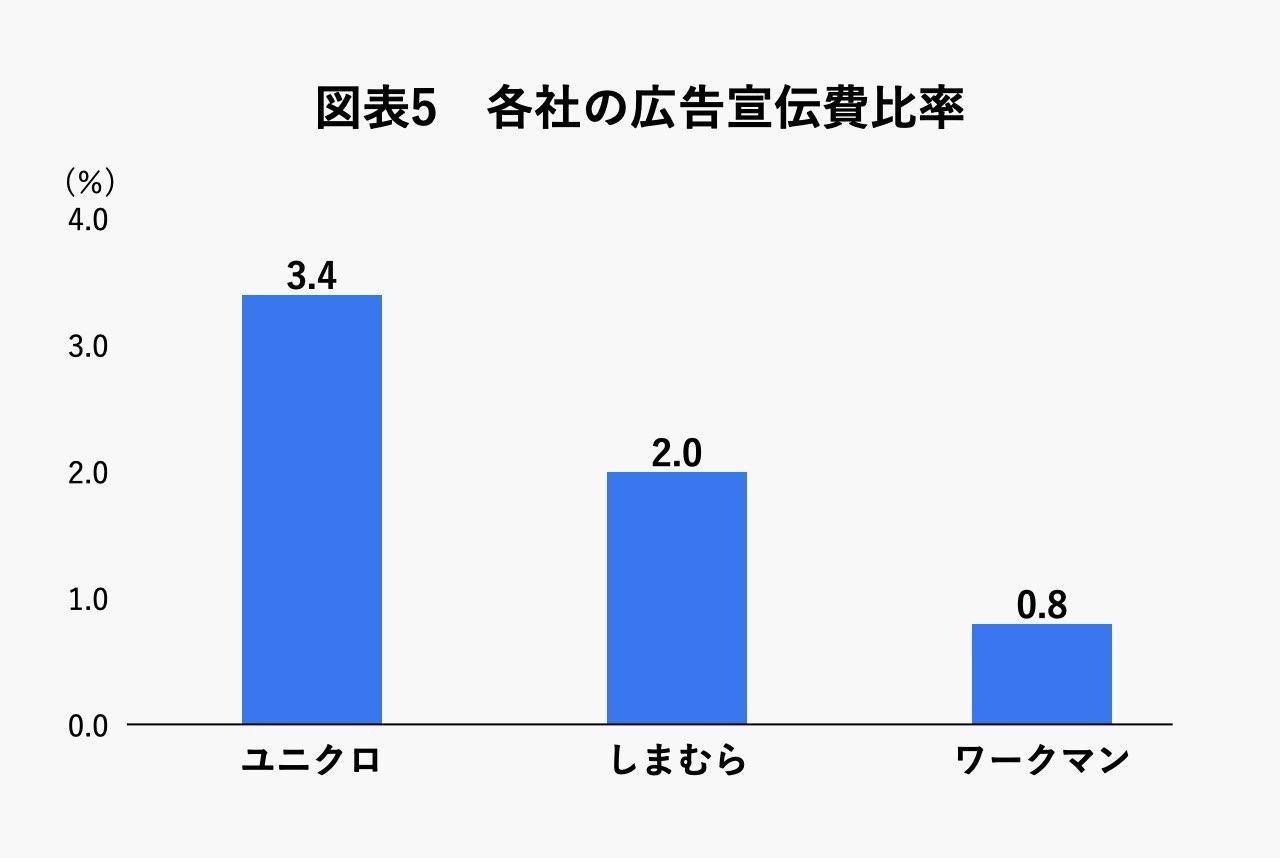

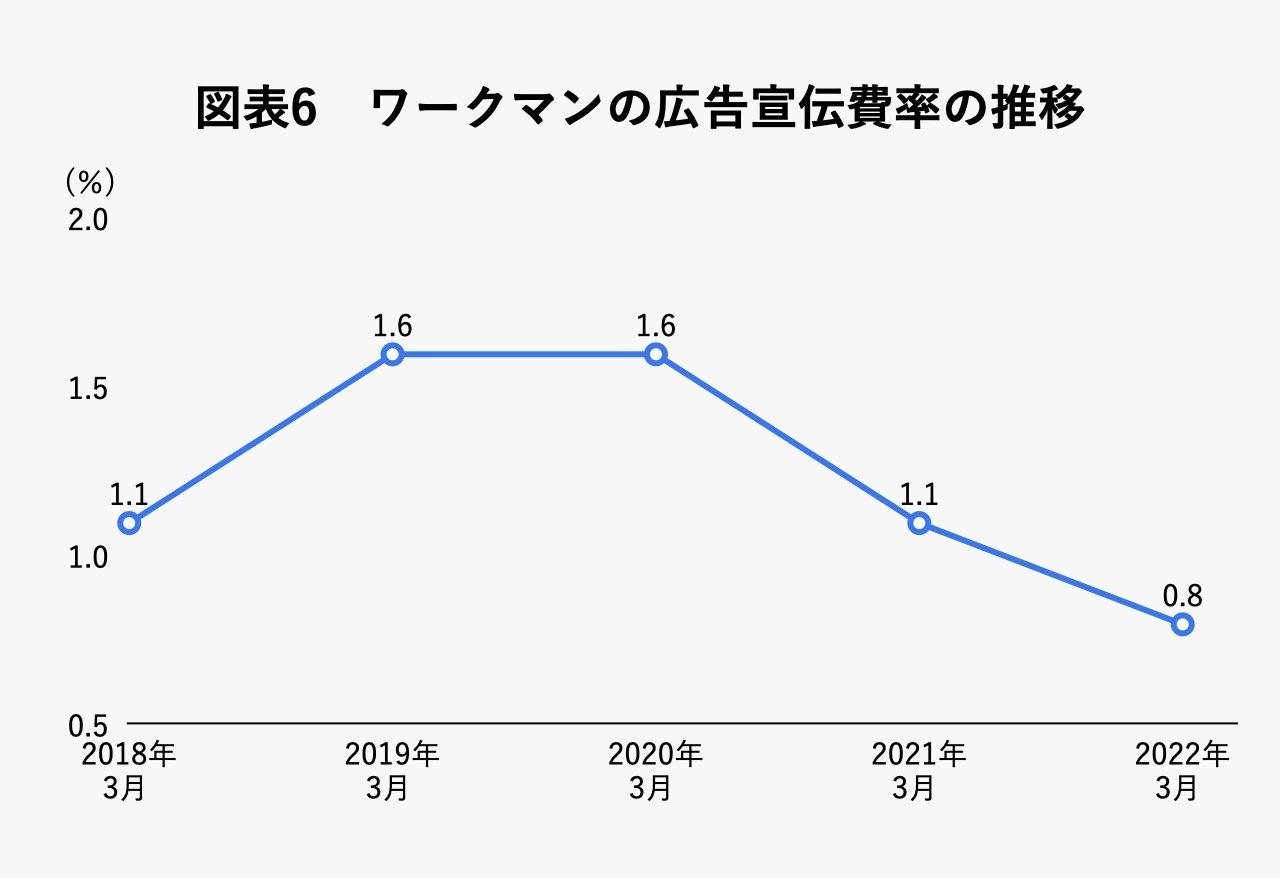

So how much does Workman spend on advertising? Please see Chart 5, which compares the ratio of advertising expenses to sales (gross operating revenue) for UNIQLO, Shimamura, and Workman.

Surprisingly, the ratio of advertising expenses to Workman’s total sales revenue is less than 1%.. That’s a quarter of Uniqlo’s, and less than half of Shimamura’s, which is one of the top domestic apparel brands. As we’ve previously covered in this series, even Snow Peak, which is famous for its loyal fan base and almost no advertising, only spends 1.7% of its sales on advertising. If you think about it that way, you can see how Workman’s advertising costs are low.

Over time, Workman’s advertising expense ratio is consistently low. Normally, we would increase advertising expenses to increase sales, but in the case of Workman, the advertising expenses ratio has actually been on a downward trend over the past few years (Chart 6).

Just because you don’t spend money on advertising doesn’t mean your sales are growing just by word of mouth. Workman has a marketing strategy that increases sales without using advertising. That is the “ambassador marketing”is.

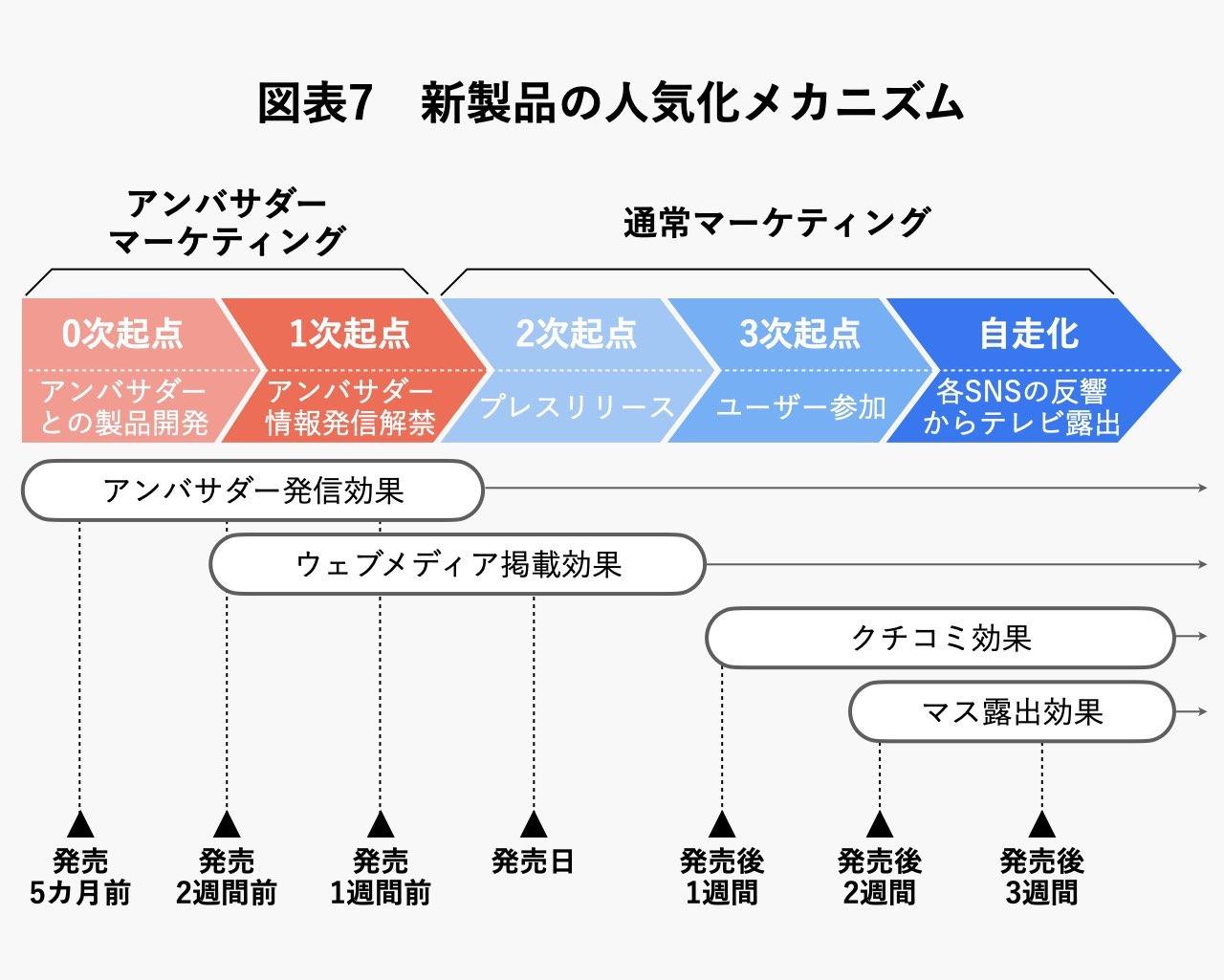

Workman currently has about 50 ambassadors who cooperate with us from product development to dissemination of product information free of charge (*1). Each ambassador has many fans on SNS such as YouTube and Twitter, and sends information to those fans about the products that he was involved in developing.

At the new product exhibition held in the early summer of 2022,Workman claims to have achieved a total of 1.04 billion yen in publicity through ambassador marketing.(*2).

- 10 TV exposures (advertisement effect 730 million yen)

- 10 newspapers/magazines/specialty magazines (6 million yen each)

- Internet-related exposure 524 times (310 million yen)

In this way, ambassadors who advertise their products free of charge are of course appreciated by Workman, but there are also merits for ambassadors. Information on Workman’s new products is so popular that it receives 3 to 10 times the number of hits as normal.

As shown in Figure 7, Workman successfully acquires customers by successfully combining ambassador marketing and regular marketing.

Sales strategy of EC order and store pick-up

On January 27, 2020, Workman ended online shopping on Rakuten (*3). Ambassador marketing using SNS should have a high affinity with the Internet. Instead, Workman introduced a system of “order online and pick up at store” (this is called “Click & Collect”).

The background to this decision, Workman wrote in a release:

- All brick-and-mortar stores are doing well, and opening conditions have been eased, making it possible to open another 400 new stores in the next 10 years.

- Even now, 67% of online shopping customers choose to pick up at stores (guided to pick up at stores)

- In order to compete with Internet-only businesses in terms of delivery costs, we should take advantage of our nationwide store network. If it is a store pick-up of store inventory, it is competitive with major online shopping companies in terms of delivery cost and time.

- Globally, there are an increasing number of examples in which Click & Collect is dominant under certain conditions. In the UK, which has a small land area and many stores, the store pickup ratio of Boots and Marks & Spencer is over 70% (in the UK, the reliability of home delivery is low, but in Japan, the delivery cost is low). Soaring prices are a problem)

In other words, the biggest reason why Workman started “Click & Collect” is to be competitive with Internet-only companies such as Amazon in terms of shipping costs.

When Workman opened a store on Rakuten, the shipping fee was borne by the store owner, Workman. This is unfair to customers who come to the store to buy.

Also, as we saw in the first part, Workman adopts a franchise model, but if Workman strengthens EC, franchisee sales will decrease accordingly. This could lead to cannibalization between franchisees and Workman headquarters.

So if you order online and pick it up at the store,Not only will sales from online orders be credited to the franchisee, but they can also expect further upselling when picking up items in-store.That’s why.

A business model that can grow with little investment

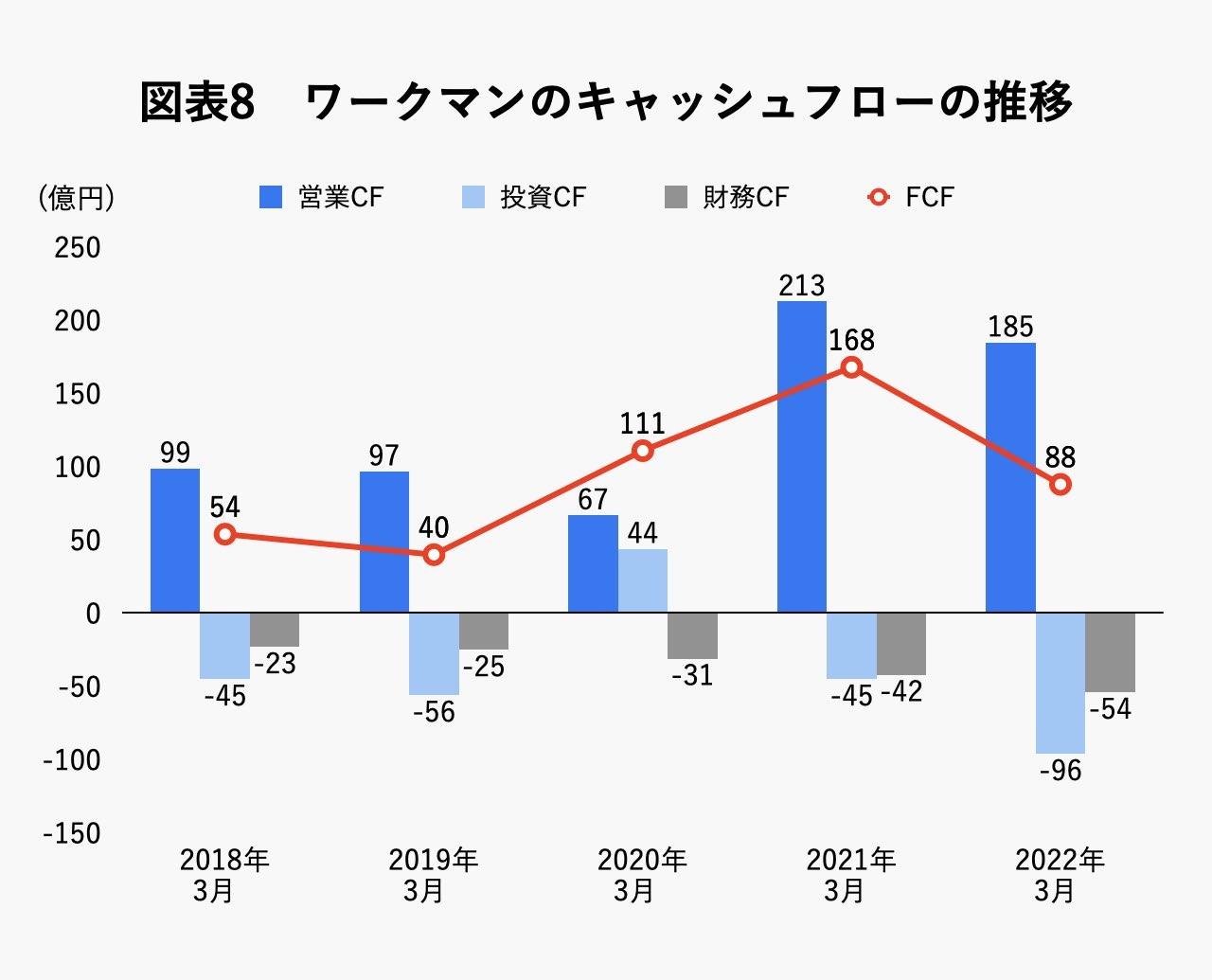

Workman is developing its business with high profit margins and high growth rates, but let’s check the cash situation in the end (Chart 8).

Looking at Workman’s cash flow (CF) statement, free cash flow (FCF), which is the sum of operating CF and investing CF, has been positive for the past five years, with an average of 9.2 billion yen over the past five years and a total of 46.1 billion yen. On the other hand, due to the payment of dividends, financing CF has become negative, with an average negative ¥3.5 billion and negative ¥17.4 billion over the past five years. This is an ideal situation in which the deficit in financial CF is covered within the FCF.

By generating abundant cash flow, cash flow increased from 38.2 billion yen in the fiscal year ended March 31, 2018 to 64.3 billion yen in the fiscal year ending March 31, 2022.

You may be thinking, “If you have this much cash, why not invest more aggressively?”More than 95% of Workman stores are franchises, so there is no need to spend a lot of money on investment CF.. In fact, tangible fixed assets account for only about 19% of total assets.

So, what is the most common asset breakdown is “cash”, which is 51% of the total. While the total amount of cash and deposits is 64.3 billion yen, borrowings are only 1.35 billion yen, and of course we are virtually debt-free. With a capital adequacy ratio of 82.8%, there is no doubt about its financial soundness.

Profit margins and growth rates are high, cash is abundant, and finances are extremely sound. Since the research and development activities column of Workman’s securities report states “no applicable items”, it is unlikely that cash outflows will occur in research and development in the future–that is Workman’s current situation. financial situation.

Companies typically grow through investments in advertising, fixed assets, R&D, and people, but as we’ve seen, with Workman, that “common sense” doesn’t apply.. By using ambassadors, we have been able to keep the advertising expense ratio below 1%, and the investment in fixed assets is fully covered by operating cash flow. Although we do not spend R&D expenses, we are skillfully developing new products by teaming up with ambassadors. We use a franchise model, so apart from training, it doesn’t cost much to invest in people in terms of hiring.

From a financial point of view, the Workman is flawless, but from a financial point of view, it’s not without some concerns.

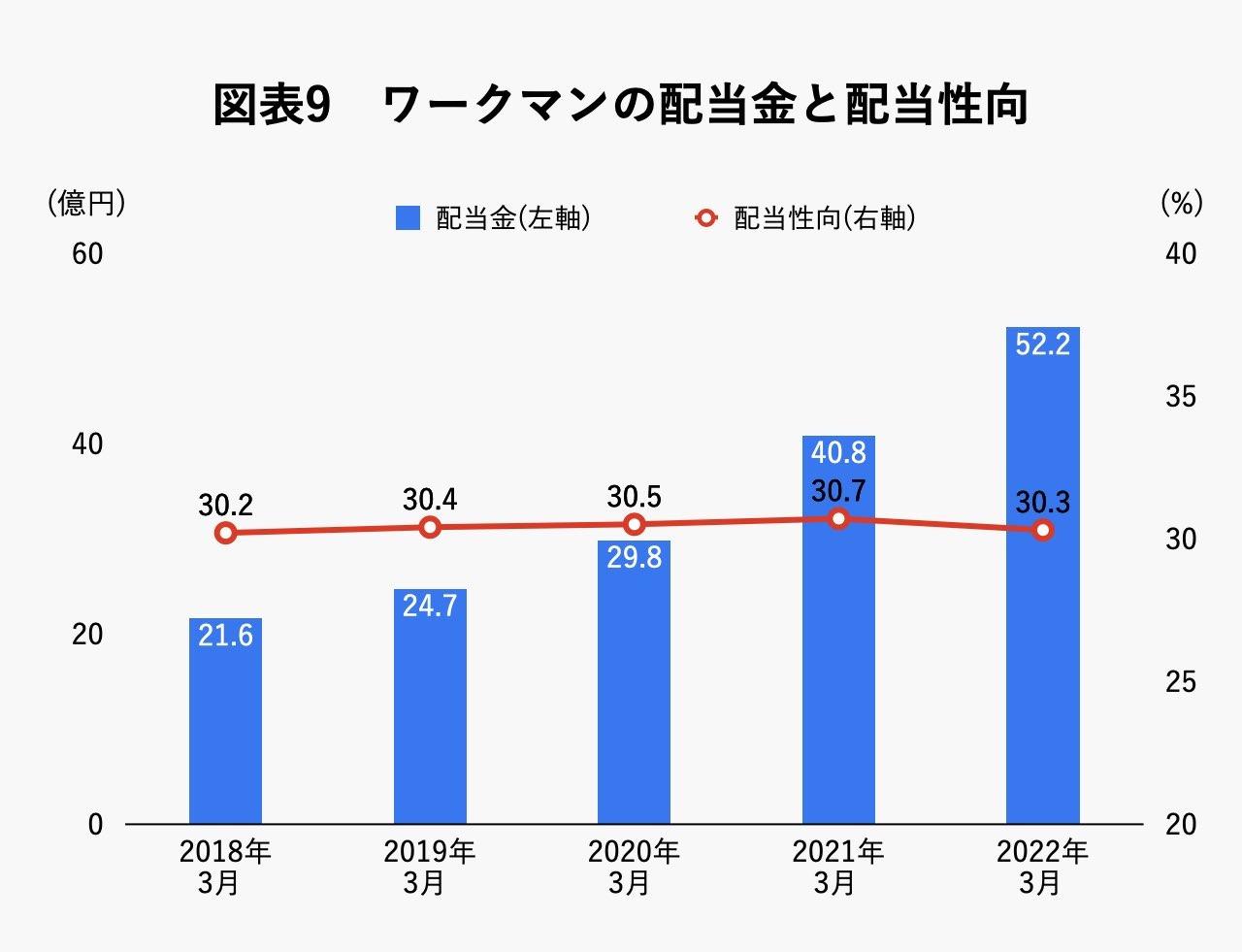

That is, like Apple and Meta (formerly Facebook), which have been featured in this series in the past, if the cash is so good and there are no investment destinations, there is a possibility that the stock market will put pressure on them to return profits to shareholders.

As shown in Figure 9, Workman’s dividend payout ratio has exceeded 30% over the past few years, stably paying out dividends to shareholders.

If Workman continues to grow through the outdoor market and #Workman Girls, it seems that cash will not be used that much at the moment unless there is a very large M&A.

If that happens, the stock market may demand that we increase our dividend payout ratio or increase shareholder returns through share buybacks.

Conversely, except for this shareholder return, Workman’s financial situation can be judged to be an extremely ideal state that can not be further stingy.

From product out to market in

This time, we have analyzed Workman, which has become a hot topic in the marketing context in recent years, from the perspective of accounting and finance. Workman ranks first in the domestic apparel industry in terms of growth rate, profit margin and financial health.

That’s not all. The great thing about Workman’s business is that, despite the fact that it is a “product out” of high quality and low price, Workman Plus and #Workman Girls are able to successfully “market in” existing products by paying close attention to customer behavior. This is the point that leads to the acquisition of customers.

Until now, it has been often pointed out that the products of Japanese companies have a strong product-out concept because of their high quality, and that they are not market-in based on understanding the needs of the market. And this weakness of the market-oriented perspective has been considered one of the weaknesses of Japanese companies.

The example of Workman, which successfully overcame this challenge, could serve as a hint for the pursuit of growth for many Japanese companies whose strength lies in high-quality products and services.

In the world of startups, the acceptance of a product or service in the market is called “PMF (Product Market Fit).” In the sense that work clothes, which had hitherto been a niche market, have been accepted by other apparel markets, it can be said that Workman has truly achieved PMF.

Will Workman continue to produce products that achieve PMF in new markets? We will keep an eye on this trend in the future.

*1 An ambassador is generally a person who is an enthusiastic fan of the company’s products and who promotes other users with their own recommendations for these products. See next article. Insta Lab Editorial Department, “What is the difference between an ambassador and an influencer? Compare marketing,” Insta Lab, November 18, 2021.

*2 See below. “Competitive Strategy to Beat Amazon: Workman Aims to Be a Unique Brand with the Power of Stores and Fans,” Harvard Business Review, December 2022 issue.

*3 Workman release “Workman starts ‘store pickup’ mail order with ‘store inventory'” January 27, 2020.

Shigehisa Murakami: CEO of Fine Deals Co., Ltd., CFO of GOB Incubation Partners Co., Ltd. Visiting professor at iU Information Management Innovation College. After completing the graduate school (master’s course) of the Graduate School of Economics, engaged in securitization, real estate investment, non-performing loan investment, project finance, fund investment business, etc., mainly in structured finance business at a financial institution. Since September 2018, as CFO of GOB Incubation Partners Co., Ltd., he has been developing new businesses and supporting entrepreneurship. In addition, he also provides financial and legal support for several start-up companies. Founded Fine Deals Co., Ltd., which provides financial consulting, etc. in January 2021. In his book “Financial Statement Mystery Training](PHP Institute).

(Writing cooperation: Tatsuya Ito, series logo design: Mio Hoshino, editing: Ayuko Tokiwa)

Source: BusinessInsider

Emma Warren is a well-known author and market analyst who writes for 24 news breaker. She is an expert in her field and her articles provide readers with insightful and informative analysis on the latest market trends and developments. With a keen understanding of the economy and a talent for explaining complex issues in an easy-to-understand manner, Emma’s writing is a must-read for anyone interested in staying up-to-date on the latest market news.