Japanese stock and real estate prices continue to soar. It seems that behind this is the reality of “cheap Japan.”

Rising prices of Japanese stocks and real estate are attracting attention. Newspapers, television, and other media have been intensively reporting on the rising prices of newly built apartments in the Tokyo metropolitan area, and it may be said that this is one of the hottest topics right now.

The prices of goods and services are also rising, and the consumer price index for April announced by the Ministry of Internal Affairs and Communications was up 3.4% year-on-year on a comprehensive basis, excluding fresh food, which fluctuates greatly, marking the first growth rate in three months. Expanded.

There are various explanations for these developments, but my first point is that not only are asset prices and general prices rising, but also that “The eyes of the Japanese side are loweredI would like to point out that we should also look at the facts.

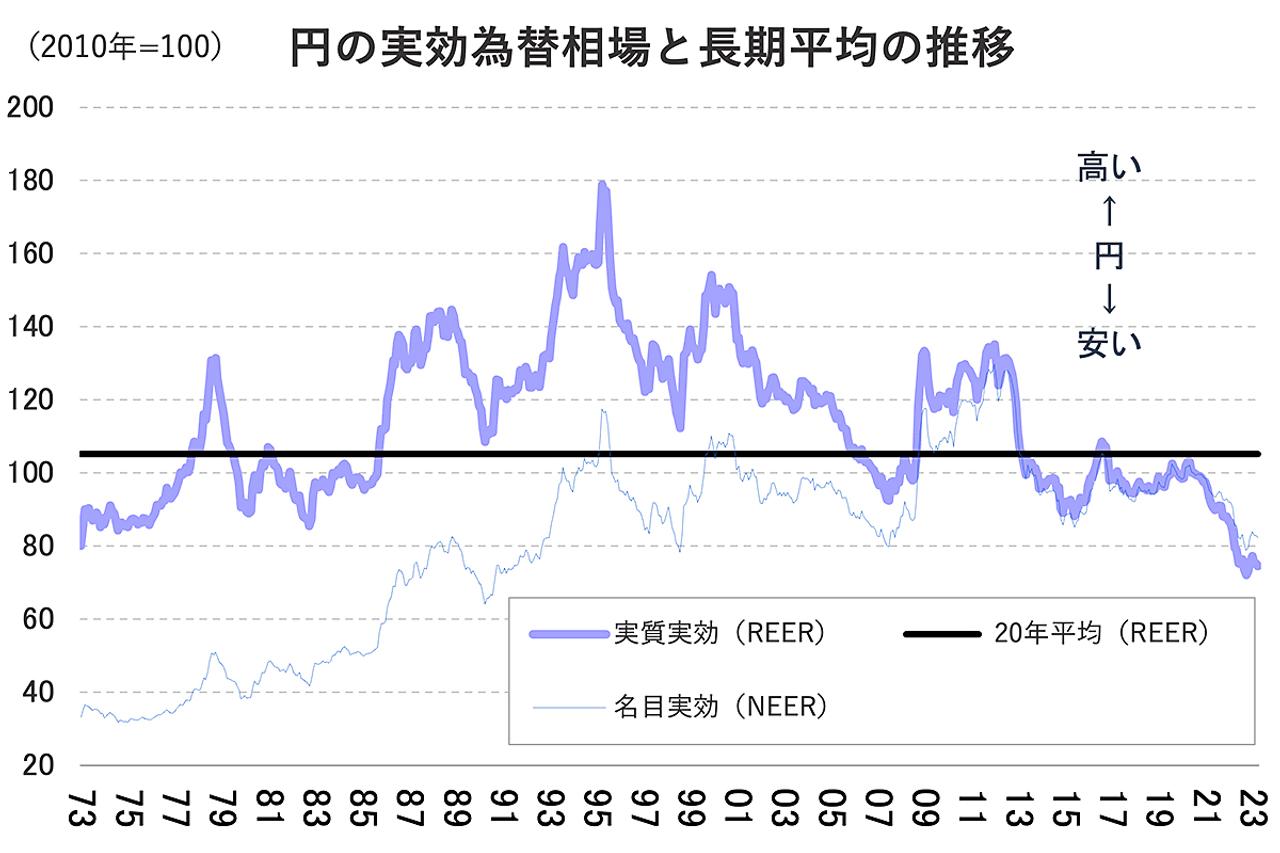

[Chart 1]below shows the circle “Nominal Effective Exchange Rate (NEER)”and”Real Effective Exchange Rate (REER)” for the period after 1964, for which data exist.

[Chart 1]Changes in the yen’s effective exchange rate and its long-term average. The purple line is the Nominal Effective Exchange Rate (REER), and the thin blue line is the Nominal Effective Exchange Rate (NEER).

The effective exchange rate, both nominal and real, is a measure of the “relative” strength of a country’s currency. Here, in order to facilitate the reader’s understanding, I will explain the case where Japan is the main subject.

NEER expresses the value or competitiveness of the Japanese yen against the currencies of major trading partners, and REER is positioned by adding the price difference with each partner country.

As can be seen from[Chart 1]the yen’s effective exchange rate has been on a downward trend in recent years in both nominal and real terms.While NEER is at the same level as around 2007, REER is at the same level as around 1971, more than half a century ago.There is a difference.

Comparing the figures just before the pandemic (December 2019) and April 2023, NEER fell by 16.6% and REER by 24.6%, a gap of about 8 points.

Furthermore, in terms of year-to-date percentage change, the REER fell 1.4% while the NEER rose 0.1%.Recently, the gap between the two has become more pronounced..

To reiterate, REER is NEER plus price differentials. It is considered to be cheap”, and the REER of the yen will fall.

Therefore, the recent sharp decline in the yen’s REER suggests that overseas markets are facing higher inflation than Japan.

Overseas, nominal wages have risen considerably in line with general prices. Wages and prices have been rising in Japan recently, but not as much as in other countries.

Japan’s wage environment, which is inferior to that of other countries, also means that Japan’s purchasing power is declining when purchasing goods from overseas. contributed to the slump.

Advertisements

Prices of “goods and services desired by the world”

Long introduction, but that’s why REER can be used as a measure of international purchasing power.

extreme story,Countries with low REERs will struggle to purchase “the goods and services the world wants”.

Firms set prices corresponding to those goods and services that are in demand in many countries and regions. Of course, there is no reason to lower the price to match Japan, where nominal wages are low, and it is rational to set the price while keeping an eye on the trend in Europe, the United States and other developed countries.

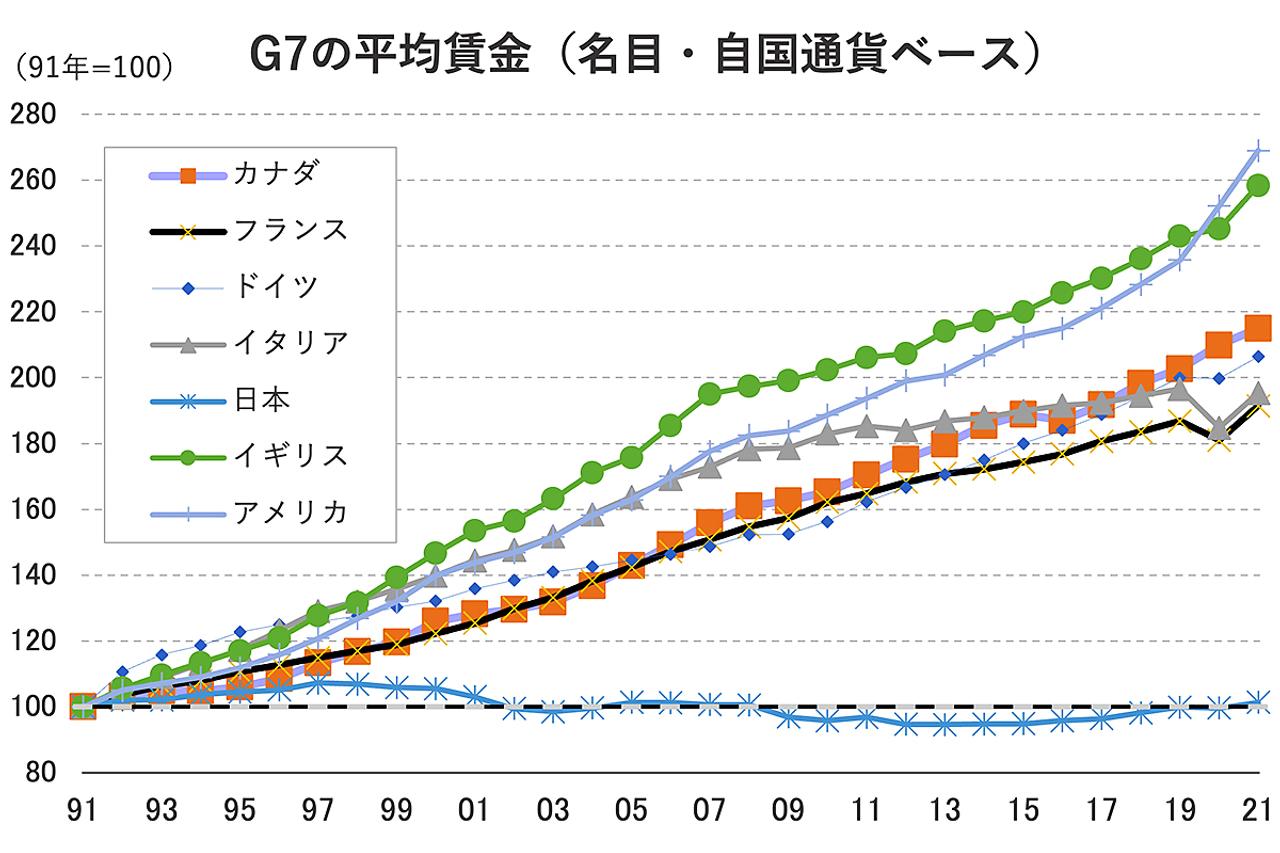

Since nominal wages are rising in countries other than Japan (Chart 2), companies set the prices of goods and services accordingly, and as a result, prices tend to be higher than those in Japan.

[Chart 2]Changes in average wages in seven major countries (G7). Nominal and local currency basis.

Strictly speaking, it is normal for product pricing to vary slightly from country to country, but excessive price differences between countries will induce arbitrage transactions (such as resale) to profit from them, so leave them as they are. not much to do.

A specific example is Apple’s iPhone. In the past, the price for Japan was considered to be strategically low, but in July 2022, the company decided to raise the price by about 10 to 20% against the backdrop of the rapidly depreciating yen.

It should be seen that the price of the iPhone has been adjusted according to international standards as the top of the “goods and services that the world wants”. The depreciation of the yen is just one trigger.

Luxury cars and luxury watches are also “goods and services that the world wants.”

For example, with regard to imported cars, it was reported repeatedly from autumn 2021 to 2022 that major automakers such as Germany’s Volkswagen and Mercedes-Benz and Europe’s Stellantis would raise their prices.

The price hike itself has been carried out in many countries, and it still hurts consumers not only in Japan but around the world.

ButThe degree of damage suffered by consumers due to price hikes is completely different in countries where nominal wages have doubled over the past 30 years and in countries where they have remained almost flat over the same period..

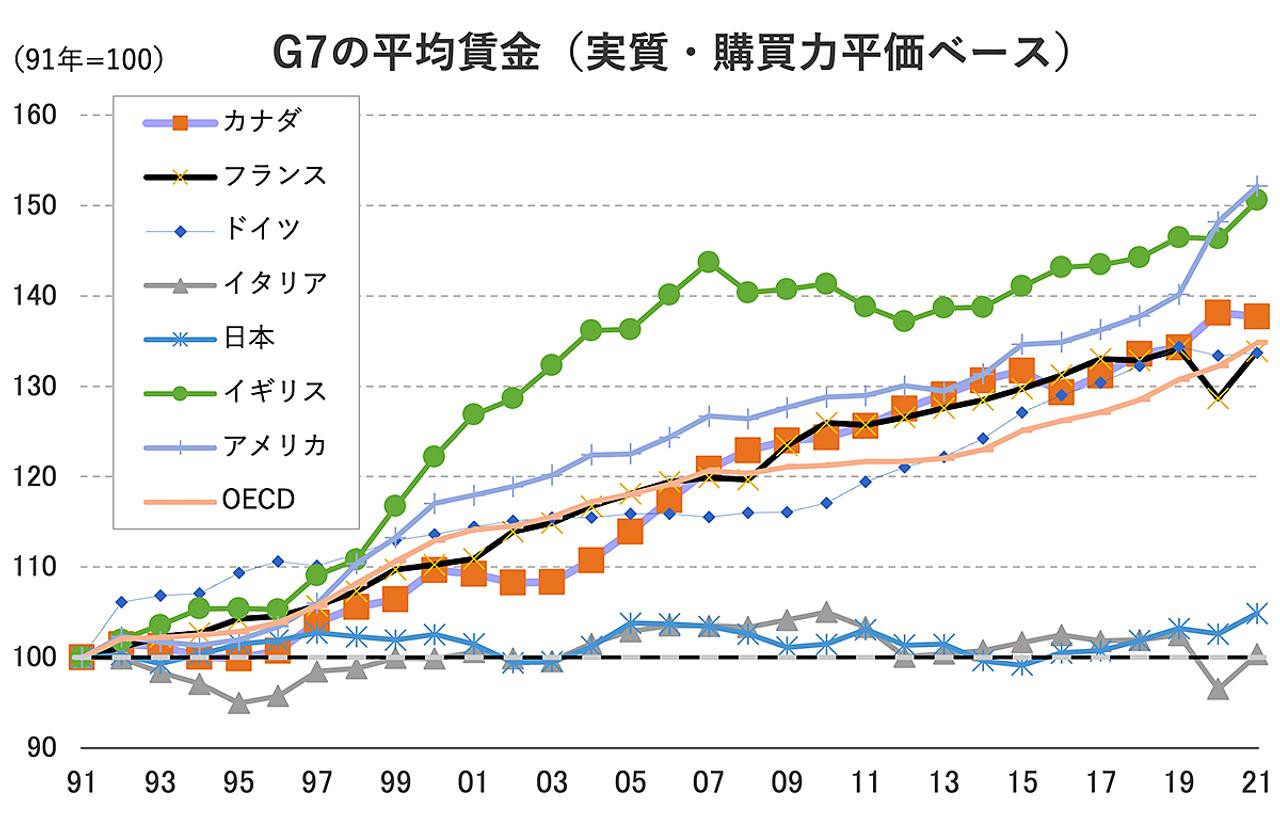

As you can see from[Chart 3]below, in major countries other than Japan and Italy, real wages, which take into account price increases, are also growing, and the damage to consumers is expected to be limited.

[Chart 3]Changes in average wages in seven major countries (G7). Real/purchasing power parity basis.

In comparison, in Japan, where wages have barely risen in real or nominal terms, price hikes have been a considerable blow, and in particular, “goods and services desired by the world” have already become the realm of “lofty flowers.” stepping into.

Why Japanese real estate and Japanese stocks are rising

As long as real estate and stocks can be traded freely, they are included in the “goods and services that the world wants.”

First of all, if we look at real estate, the materials used in housing construction are not so different in any country, so building materials take on the character of “goods and services that the world wants.”

As a background to the recent surge in real estate prices in Japan, it is easy to attract attention to the current situation where the cheapness of the yen is accelerating and concentrating the inflow of capital from overseas investors. It cannot be overlooked that there was a time when construction material prices soared due to restrictions and other factors.

The secondary effect of the depreciation of the yen combined with the rise in the price of building materials, and the cost of Japanese buildings was already high.There is also a side.

In addition, we cannot ignore the fact that more and more foreigners working at construction sites are giving up on Japan due to the impact of the yen’s depreciation. This is because work delays due to labor shortages strengthen supply constraints, which can also be a factor in pushing up real estate prices.

On the other hand, Japanese stocks may now be a kind of “goods and services coveted by the world.”

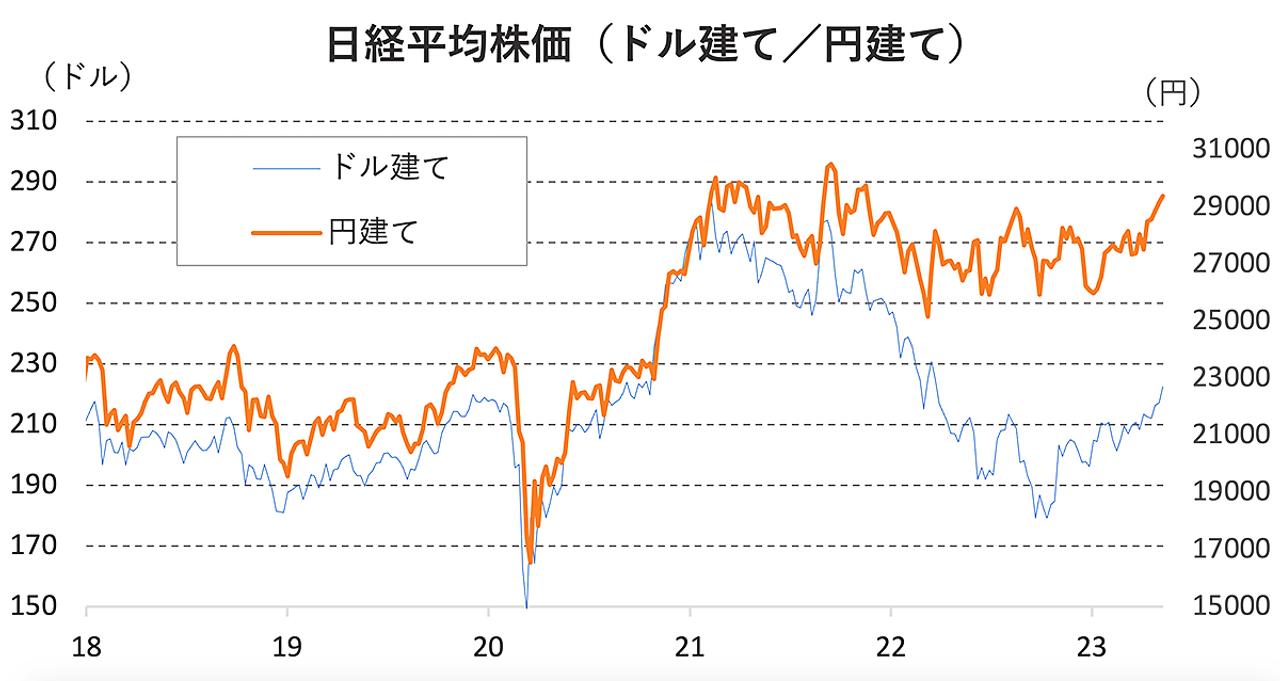

I won’t go into detail about the recent rise in the Nikkei Stock Average, which hit a new high after the bubble burst, butAs the yen’s exchange rate against the US dollar has declined by nearly 30% over the past two years, the presence of Japanese stocks in foreign investors’ portfolios has shrunk more than expected, and it makes sense to buy more Japanese stocks to rebalance this situation. facing a situationThere is a possibility[Chart 4].

[Chart 4]Changes in the Nikkei Stock Average. Dollar denominated (thin blue line) and yen denominated (orange line).

In the end, it can be said that the simple choice of “buying (buying more) because it is cheap” is the driving force behind the “unrivaled high” of Japanese stocks.

To summarize the discussion so far, the rise in asset prices and the prices of goods and services is a global trend, but Japan is in a situation where it is vulnerable to the effects of relatively low wages and low prices. The depreciation of the yen over the past year has spurred this trend.

Ultimately, the author concludes that the problems facing Japan are not only due to rising asset prices and general prices, but also due to the fact that the Japanese people’s perspective is declining.

The figure that condenses such a situation is the REER (real effective exchange rate) of the yen, which continues to be at the lowest level for the first time in half a century.

Japan is “inflationary imports” from overseas

The reason why the price of lodging and food service in Japan is rising is because it is “the goods and services that the world wants”.

“All over the world” simply means foreign visitors to Japan (inbound). Unlike iPhones, luxury cars, stocks, real estate, etc., which have been introduced so far, purchasing accommodation and eating and drinking services in this case is basically Since I am a foreigner, it is only natural that the price will be on a different level for Japanese people.

The Nihon Keizai Shimbun dated May 18, 2018, titled “‘Yokohama Nadaman’ Course for Visitors to Japan Offers Strong Performance Even at Double the Price of Japanese,” and stated that the highest price of a course previously offered to Japanese customers by a famous Japanese restaurant was 32,100 yen. It was reported that a course of 65,000 yen, which is double the price, is being prepared for inbound tourists.

Looking at these situations,One could argue that Japan is in the process of “importing inflation” from overseas via a currency that has effectively depreciated significantly (yen)..

As a development expected from this, the rise of inbound consumption, which is unwavering even for Japanese people in a different dimension of price setting, will be the starting point, and the employment and wage environment in Japan as a whole will be pushed up, resulting in a virtuous cycle of income increase → consumption increase → production increase. There is a flow that goes into

However, if we only look at the total consumption at the destination, which is the “per capita consumption” of foreign tourists visiting Japan multiplied by the “number of travelers,” even at the peak (2019) recorded before the pandemic, the total domestic It is only about 1% (approximately 5 trillion yen) of production (GDP), and even if it were to reach several times that in the future, it seems excessive to expect Japan’s economy to thrive on that alone.

The last thing left is inflation imported from abroad.

If there is inflation, the yen’s REER will rise. Since the relative purchasing power of the Japanese currency will increase, this in itself can be said to be a welcome result. It can also be seen as the process of overcoming Japan’s disinflation (a situation in which the rate of price increases is declining), which has long been a stigma.

However, am I the only one who cannot call such developments a turnaround for the Japanese economy?

*Contributions are my personal views and are not affiliated with any organization.

Source: BusinessInsider

Emma Warren is a well-known author and market analyst who writes for 24 news breaker. She is an expert in her field and her articles provide readers with insightful and informative analysis on the latest market trends and developments. With a keen understanding of the economy and a talent for explaining complex issues in an easy-to-understand manner, Emma’s writing is a must-read for anyone interested in staying up-to-date on the latest market news.