“I believe there are three major issues in achieving sustainable growth.The first is “lack of individuality,” the second is “slow sales growth,” and the third is “deficit structure.””

Tomohiro Wakahara, who has been serving as Euglena’s Representative Executive Officer and Co-CEO since January, expressed Euglena’s current situation as follows while discussing its medium-term policy.

Euglena, which sells health foods and develops and manufactures sustainable aviation fuel (SAF) using used oil (waste cooking oil) and microalgae, announced its full-year financial results for the fiscal year ending December 2023 on February 14th. announcement. A financial results briefing was held on the 16th.

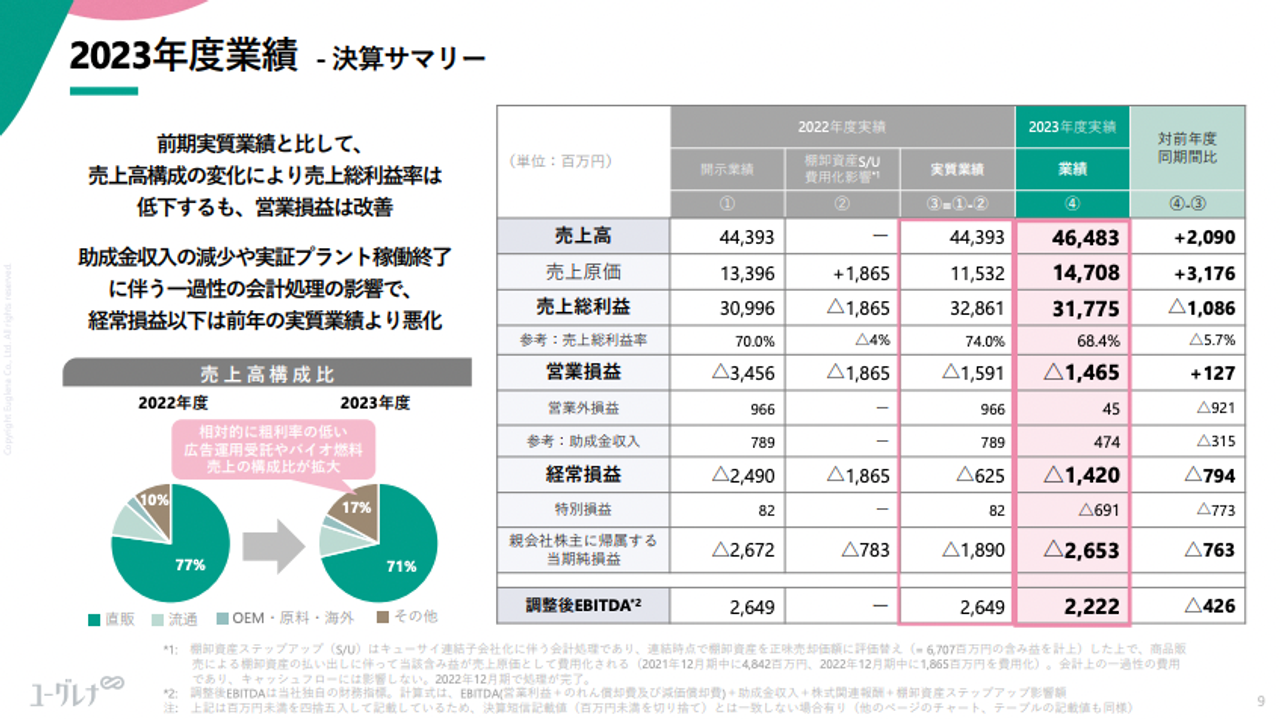

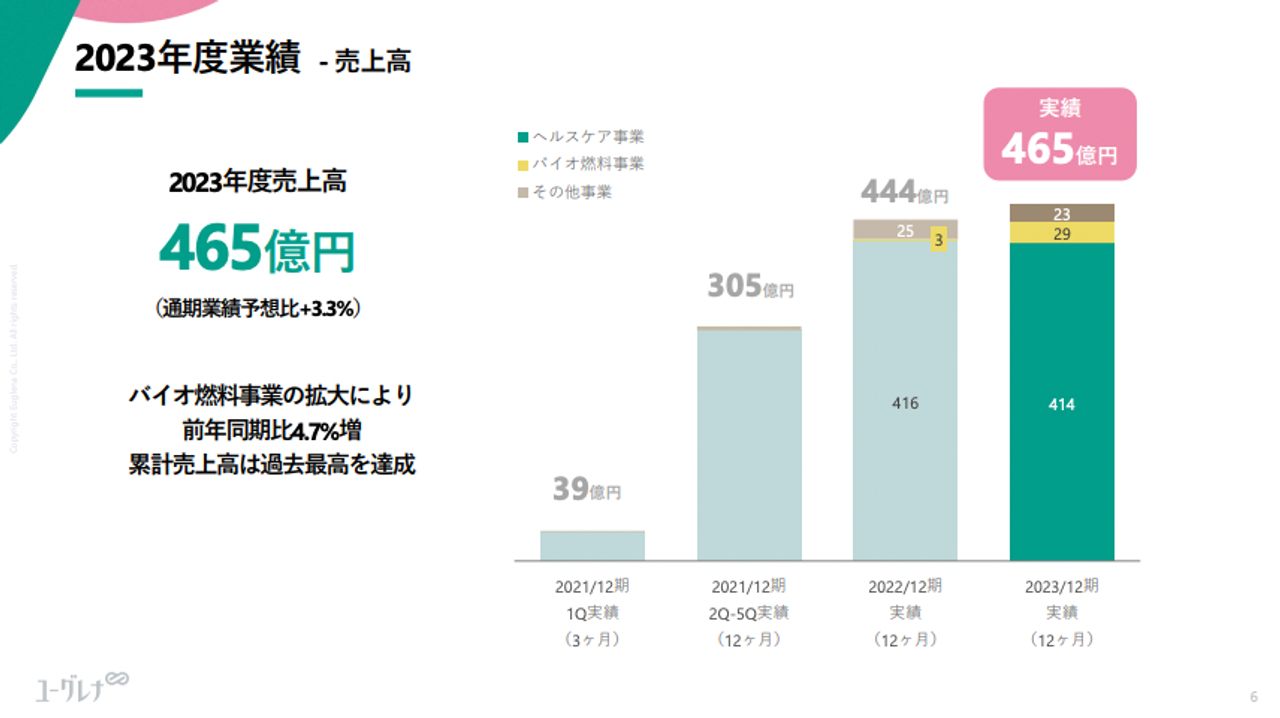

For the fiscal year ending December 2023Sales increased 4.7% year on year to 46,482 million yen.Operating loss was 1,464 million yen.The net loss was a deficit of 2,652 million yen.(All figures are from the financial results report). Sales are almost flat. The net loss was the same as the previous year due to a decrease in subsidy income and the end of operations at a biofuel demonstration plant in Tsurumi Ward, Yokohama City, Kanagawa Prefecture.

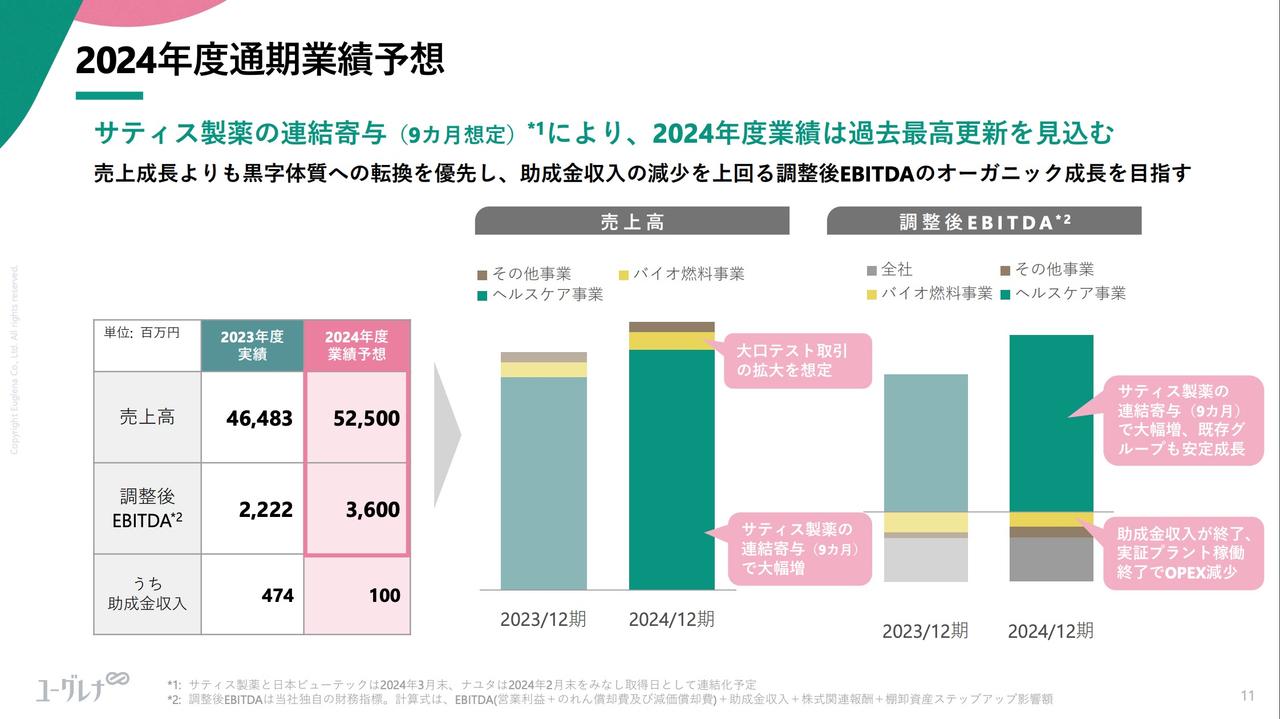

The company’s earnings forecast for the fiscal year ending December 2024 is to aim for sales of 52.5 billion yen and adjusted EBITDA of 3.6 billion yen.

AlsoIt was also announced that the construction plan for a commercial biofuel plant in Malaysia, which had been set to make a final investment decision by the end of 2023, has been pushed back to the goal of making a final investment decision by mid-2024.

Growth in biofuels in 2023 and cosmetics OEM in 2024

In fiscal 2023, the company’s full-year fiscal year, the company’s biofuel business, which sells SAF and other fuels, contributed to sales growth.

Euglena is looking ahead to the commercialization of its biofuel business and is proceeding with test transactions to establish a supply chain. Several large transactions will be realized in 2023,Sales of the biofuel business grew to approximately 2.9 billion yen, approximately 10 times as much as the previous year.. On the other hand, the healthcare business, which sells health foods, etc., recorded a slight decline.

However, the healthcare business will be important in achieving the full-year forecast of “sales of 52.5 billion yen” for the fiscal year ending December 2024.

Euglena’s full-year earnings forecast for FY2024 announced.

On February 1st, Euglena announced that Satis Pharmaceuticals, which is known as an OEM manufacturer of cosmetics, will join the Euglena group. The company plans to make Satis Pharmaceuticals a consolidated subsidiary with a deemed acquisition date of the end of March. Approximately nine months’ worth of sales from Satis Pharmaceuticals will be added to the financial results for the fiscal year ending December 2024. Most of the increase in sales in this fiscal year’s earnings forecast comes from this calculation.

Advertisement

Loss of individuality, slowing sales growth, deficit structure…Three challenges

Co-CEOs Hiroko Uemura (left) and Tomohiro Wakahara (right).

Euglena’s former CEO Akihiko Nagata will step down as CEO at the end of December 2023 due to health reasons*. From this January, the management structure has been changed in which two people, Mr. Wakahara, who was the Chief Financial Officer (CFiO) under the previous system, and Hiroko Uemura, who was the Chief Stakeholder Officer (CSXO), serve as Representative Executive Officer and Co-CEO. .

*Mr. Nagata will remain as a director until the general meeting of shareholders scheduled to be held in March 2024. He is scheduled to retire.

As this was the first financial results conference since Mr. Nagata’s resignation, the new management team spoke about their current situation and future plans. Among them, Co-CEO Wakahara pointed out the following for Euglena’s regrowth:“Lack of individuality” “slow sales growth” “deficit structure”There were three issues.

“Our uniqueness lies in “sustainability,” “commercialization of biofuels and construction of commercial plants,” and “euglena,” which is our starting point. However, various companies have advocated sustainability, and there are also projects to build biofuel plants. We are starting to see the emergence of players who are adopting microalgae.We recognize that it is no longer possible to say that we are unique just by doing these three things.” (Co-CEO Wakahara)

Additionally, Euglena has achieved significant growth as a group through repeated M&A. When Kyusai, known for its green juice, became a consolidated subsidiary in 2021, Euglena’s sales grew significantly. Sales, which were around 10 billion yen, quickly expanded to the current 40 billion yen.

on the other hand,

“We recognize that sales in the healthcare business (which sells health foods, etc.) have not necessarily achieved significant growth.” (Co-CEO Wakahara)

He pointed out that in order to continue to grow over the medium to long term, it is necessary to grow the underlying business itself. He once again returned to the research and development of microalgae and emphasized the importance of reconstructing competitive advantage and uniqueness.

Based on this, the company plans to create second and third pillars of sales, such as the biofuel business, which is close to commercialization, and the agritech business, which is currently in the process of launching.

In addition, Co-CEO Wakahara

“We are still in the red due to upfront investments associated with the launch of new businesses and various M&A expenses.

Even though it is for growth, we need to firmly improve this deficit structure.”

He also mentioned improving the company’s deficit structure.

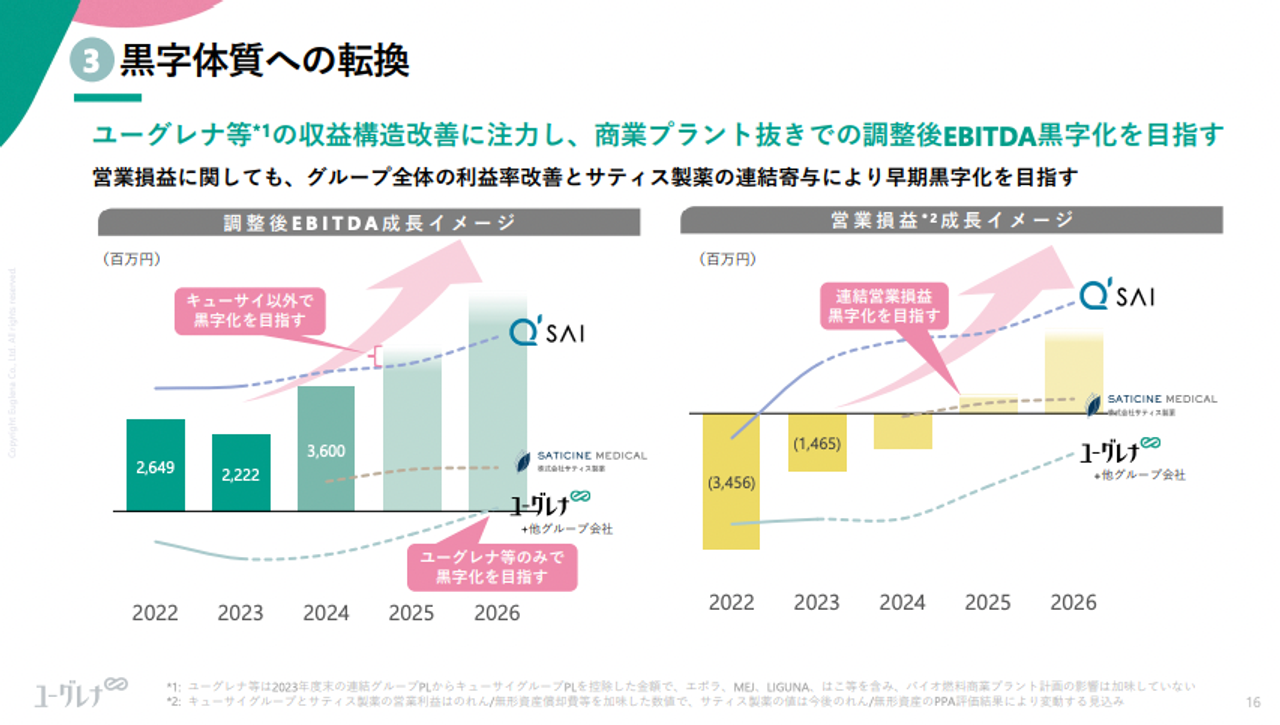

The company aims to achieve consolidated operating profit in 2025.

Originally, it was expected that once the commercial plant for the biofuel business currently in progress became fully operational, it would generate large sales and profits.However, Wakahara Co-CEO

“We will achieve sustainable growth by creating a structure that allows us to turn a profit even without a commercial plant.”

He also said that the company will change its structure even within its existing business framework.

In particular, with the addition of Satis Pharmaceuticals to the Group in February,

“We are now at the stage where the entire group, excluding Q-SAI (which accounts for the majority of sales), can aim for a positive EBITDA. As the group’s profitability has improved, we are now within reach for the entire group to become profitable.”

That’s what it means.

On top of that, the healthcare business will have sales of 50 billion yen by 2026 and 60 billion yen by 2030.

The medium-term goal is to aim for an EBITDA margin of 15% or more.

Biofuel business is slower than expected.I can’t tell you the details

Euglena’s next-generation biodiesel fuel “Susteo”

While medium-term policies under the new management structure have been announced, what is of interest is the trends in Euglena’s biofuel business.

Euglena is working with Malaysian energy giant Petronas and Italian oil giant Eni to build a commercial plant in Malaysia to produce biodiesel fuel and SAF. The company originally aimed to make a final investment decision by the end of 2023, butIt was announced that progress was delayed, saying, “We aim to make a final investment decision in mid-2024.”

When asked about the cause of the delay, Co-CEO Wakahara said:

“The basic design and market analysis have been completed, but we are currently in the process of bidding for construction. We are making steady progress, but it is taking some time due to the tight schedule. However, given the global inflation, if there are more considerations to reduce costs even a little, it will take more time.This is a factor causing delays.”

There was an explanation.

In addition, from the financial results briefing materials, it is clear that the company’s medium- to long-term growth image wasWording regarding the construction schedule for the commercial plant and the market share that Euglena is aiming for has disappeared.. In past financial results briefing materials, Euglena envisions a scale of sales of over 50 billion yen if the commercial plant is completed in 2025 and if the commercial plant is able to secure the targeted 30% market share when it goes into full operation. It was held up.

Based on this, the company announced that it would “grow to 100 billion yen in sales by 2026” from 2022.

Co-CEO Wakahara said that originally the numbers listed in the financial results briefing materials were more of an “image of what we are aiming for” than an official announcement.

“As we cannot provide (details) regarding this schedule and market share, the situation is subject to change.We have decided that re-stating the previous figures (in the financial results materials) is itself misleading.

In that sense,The 2026 target also depends on the timing of commercial plants, so in a sense it has been dropped.We have created a growth image for 2030.”

he said.

Source: BusinessInsider

Emma Warren is a well-known author and market analyst who writes for 24 news breaker. She is an expert in her field and her articles provide readers with insightful and informative analysis on the latest market trends and developments. With a keen understanding of the economy and a talent for explaining complex issues in an easy-to-understand manner, Emma’s writing is a must-read for anyone interested in staying up-to-date on the latest market news.