Funds transfer companies such as PayPay will be able to participate in the “Zengin System,” which was previously restricted to financial institutions such as banks.

This is something that has been discussed among the people concerned for the past few years, and there is no new information at this time. Opening up the Zengin system is the default route.

What will change in daily life and what will be convenient if this becomes a reality?

In the first place, what does it mean to be “connected to the Zengin system”?

The Zengin System has supported operations such as inter-account remittances at banks and credit unions (the photo is an image).

The Zengin Data Communication System (Zengin System) operated by the Zengin Net is an infrastructure in which almost all financial institutions in Japan participate and connect with each other through a network.

Banks can transfer money to other banks, and banks to credit unions because the Zengin System is in operation.

In 2018, the “More Time System” started operating, making it possible to send and receive money transfers 24 hours a day, 365 days a year.

The Zengin System is a so-called domestic exchange transaction*1It is an infrastructure targeted at financial institutions that conductUntil now, operators of cashless services such as PayPay = fund transfer operators*2was unable to participate.

*2 Funds Transfer Service Provider……Business operators other than banks that conduct exchange transactions must be registered with the country based on the Fund Settlement Act. There are three types: Type 1 with no remittance limit, Type 2 with a remittance amount of 1 million yen or less, and Type 3 with a remittance amount of 50,000 yen or less, but currently only Type 2 is registered. Businesses such as payment services such as PayPay, d payment, au PAY, Merpay, and overseas remittance services are registered.

Materials for the Zengin-Net Experts Meeting (Materials held on January 17, 2022)

However, with the expansion of payment methods by fund transfer service providers and the progress of cashless payments, discussions began on whether to allow fund transfer service providers to connect to the Zengin System. ” and set up the same working group to discuss with related parties.

The Zengin system itself is an expensive system. It forms the core of Japan’s foreign exchange trading, and if this system fails, it will have such an impact that all Japanese foreign exchange trading will stop.

The Zengin System has multiple payment computers installed in Tokyo and Osaka in a redundant configuration, and the cost of stable infrastructure operation is high.

It goes without saying that Mizuho Bank and KDDI are the examples of society’s scrutiny of infrastructure failures, and a certain amount of cost will be necessary.

Advertisements

“Burden” and “Benefits” of Connecting Operators

The cost of maintaining the system is borne by each participating financial institution. In addition, there are fees for individual transactions, and for example, the system cost for FY2021 is estimated to be about 9.2 yen per foreign exchange transaction.

In addition, the operating costs of the domestic exchange system for transactions between banks*3is 62 yen per item. Fees and other charges are incurred in transactions with each financial institution.

These costs don’t simply add up for each transaction, but the more you do, the more it costs.

Nonetheless, in response to requests from the government and reports from the Japan Fair Trade Commission, the newly established domestic exchange system operating costs have reduced interbank transaction fees and reduced costs for fund transfer service providers. (However, depending on the fund transfer service provider, a different network service may be used to connect with the bank, and the timing of the cost fluctuation may differ depending on the contract).

This cost burden is also necessary when depositing from a bank to a payment service such as PayPay. By reducing this, the burden on business operators should gradually decrease.

In order to connect to the Zengin System, it is necessary to have a current account at the Bank of Japan.

For these reasons,Considering the balance between the burden and benefits that will be incurred, it is difficult to imagine that simply connecting a fund transfer service provider to the Zengin System will have a significant effect.

In the first place, in order to connect to the Zengin System, it is necessary to pay a joining fee and share expenses, and it is necessary to have a current account at the Bank of Japan (the Bank of Japan will conduct an examination).

Since the Financial Services Agency and others will be required to continuously monitor and ensure safety, it will be a heavy burden for emerging companies, many of which are fund transfer service providers.

That said, the Zengin System also has a mechanism for indirect connections. Shinkin already does this. Shinkin Central Bank is directly connected to Zengin System, and individual Shinkin Banks are connected to Shinkin Central Bank. In this method, the Shinkin Central Bank acts as an agent for remittance instructions and connects to the Zengin system.

For example, with PayPay, there is PayPay Bank that is directly connected to the Zengin System, so instead of PayPay itself connecting to the Zengin System, it is possible to connect via PayPay Bank.

Although the cost burden is lighter than direct connection, it is not zero. Funds transfer service providers will consider such costs and benefits before deciding to connect.

Small money transfers between individuals are actually handled by Kotora

“Kotora” will be responsible for relatively small remittances (the photo is an image).

In any case, such a costly mechanism is the Zengin system. Users are usually billed in the form of fees. It’s a bit expensive to use for the reason of “repaying 1000 yen for lunch that I borrowed from a friend”.

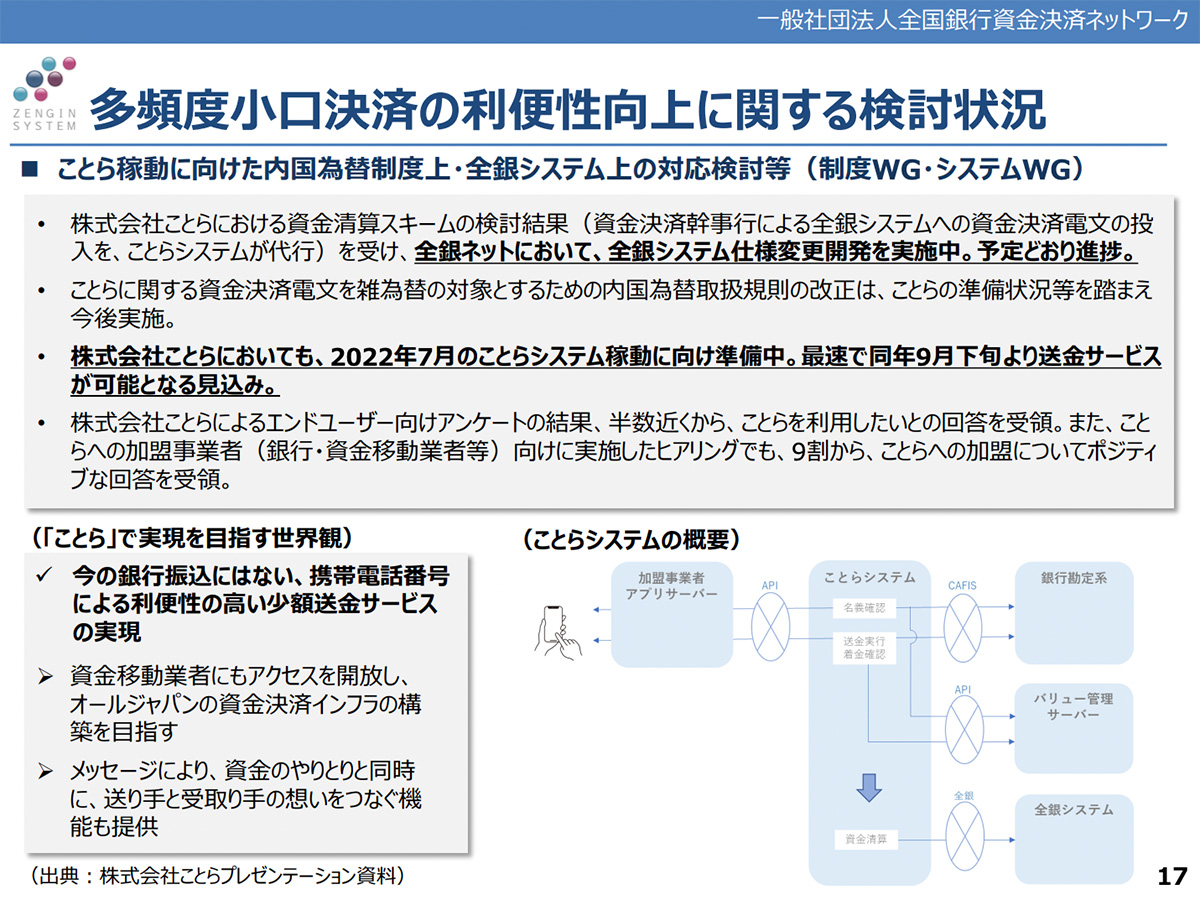

Therefore, the task force considered the flow of operating a separate system for frequent small-value transactions (high-frequency small-lot payments), which will be launched in October 2022 by Koto Co., Ltd. It’s “Kotora Remittance”.

Remittance.

Kotoha is a payment infrastructure built by five megabanks, Mizuho Bank, Mitsubishi UFJ Bank, Sumitomo Mitsui Banking Corporation, Resona Bank, and Saitama Resona Bank, and uses the structure of the existing debit card service “J-Debit”.

J-Debit is a payment infrastructure that connects more than 1,000 financial institutions, and if you connect to the API prepared by Koto, even fund transfer companies will be able to send money to J-Debit member banks.

The cost has not been disclosed at this time, but Hiroshi Kawagoe, president of Kotora, saidTo the extent that the service of “providing free remittances several times a month to their excellent customers” is viable, the fees required from the business side will be low.It says.

Kotara Remittance targets “person-to-person remittances” between fund transfer providers (e.g. PayPay and d payment) and between fund transfer providers and banks (e.g. PayPay and Sumitomo Mitsui Banking Corporation).

Materials about things.

In terms of these matters, there are several voices in the industry that banks are a little too forward-thinking and fund transfer service providers are slow to respond, but in general, there is a high latent need for such person-to-person remittances for fund transfer service providers.

If Kota can be connected to Kota within its own payment app and the service can be provided without impairing the UI and UX of the app, there is a possibility that Kota will be used sufficiently.

In order to realize the remittance mechanism, the Zengin system and Kora are linked, and a connection test has already been conducted.

in short,Even if fund transfer companies will be able to connect to the Zengin system, “the premise is that they will be used for person-to-person remittances.”Use of the Zengin System is not envisionedIt turns out that.

Will connection to the Zengin system change “overseas remittances” and “high-value remittances”?

How money exchange will change (the picture is an image).

What kind of uses are envisioned?

There seems to be one need for overseas remittances, not person-to-person remittances.

When sending large sums of money overseas, it is possible that some business operators will connect directly to the Zengin system to keep costs down. The greater the scale, the greater the advantage of direct connection.

It could also be used for digital payroll.These are intended for person-to-person remittances of 100,000 yen or less, and cannot be used for digital payroll, which transfers hundreds of thousands of yen from corporations to individuals.

However, while salaries and bonuses will be free of operating costs for the domestic exchange system, it has not yet been decided how digital payroll will be handled, so how it will be handled by the Zengin system.

If it is recognized as a salary, it will be possible to deposit money from a corporate account to a settlement service connected to the Zengin System at a lower cost.

For corporations, it is possible to reduce fees by paying salaries using payment providers with low fees.

For users as well, there is a possibility that benefits such as being able to use the money as soon as it is transferred to the payment service and remittance with low fees. However, this is not something that can be realized immediately as the law needs to be amended.

However,When dealing with a large amount of funds, it is difficult for Type 2 Funds Transfer Service Providers with an upper limit of 1 million yen.If it becomes the first type without restrictions, it will be difficult to hold (stay) the balance due to retention regulations, so it is necessary to remit money separately immediately.

In this case, remittances between corporations and services for the wealthy can be built. In cooperation with securities and banks, it will be possible to transfer a large amount of funds to a securities account using the payment application UI. In that respect, connection to the Zengin system may be possible.

When transferring a large amount of funds, there is a concern that the transferred business operator may go bankrupt. Although it does not directly respond to such concerns, since the Bank of Japan will conduct a review when connecting directly to the Zengin system, a certain level of evaluation will be given to the business and management structure.

In addition, in the Zengin system, when transferring 1 million yen from bank A account to bank B account, the current account at bank B on the Bank of Japan is immediately transferred to bank B account, but in reality bank A transfers to bank B. The transfer of funds will be carried out all at once in the evening of that day.

Therefore, theoretically speaking, if Bank A goes bankrupt after instructing the transfer in the morning, there is a possibility that the transfer from Bank A to Bank B will not be carried out.

To avoid jeopardizing the stability of settlements, the Bank of Japan must be collateralized in advance for the amount to be transferred. Conversely, it seems possible to judge that the risk of bankruptcy is low even with digital payroll because the company can provide that much collateral (not a guarantee).

The Financial Services Agency’s monitoring of the opening of the Zengin System to fund transfer service providers is also aimed at maintaining such soundness.

Such a system leads to a sense of security, but I do not feel the need for business operators to bear unreasonable costs. This is a business operator’s decision. Also, since it is a difficult system for start-up companies, it seems that there are not many business operators who feel the effect.

Payment service providers can also expect cost reductions in deposits and withdrawals of member store sales. That said, the operating costs of the domestic exchange system have already brought down costs.

In the example of PayPay, we also offer an “early transfer service (each time)” where payment to the member store is transferred the next day and if PayPay Bank charges a lower fee, this is part of the strategy of enclosing in the economic zone. There will also be

Direct (or indirect) connection to the Zengin System in order to reduce fees charged to other financial institutions is also considered to be somewhat costly for that reason alone.

On the other hand, there are things to do, so it is possible to deposit the sales into PayPay as PayPay money and send it to the store’s own account when the store likes it. It may be possible to make daily sales deposits without going through PayPay bank.

It is possible to provide a service that automatically withdraws a small amount of money from a bank account on a regular basis and transfers it, but the difference in cost burden compared to using direct debit is a problem.

It is difficult to see how effectively the high-cost Zengin system will function.

Connection to the Zengin system will start in late 2023

As a matter of fact, the “opening of the Zengin system” is still in the future.

If the current discussions are concluded, and if Zengin-Net revise its business rules and get approval from the Financial Services Agency, it will pave the way for fund transfer service providers to connect to the Zengin system. This is likely to be scheduled for the fall of 2022 at the earliest.

That doesn’t mean you can connect immediately, and there are other regulations that need to be revised. In the case of direct connection, there is an application and examination for opening a current account with the Bank of Japan, and it is necessary to build an infrastructure to connect to the relay computer (RC) of the Zengin system.

In order to clear all the preparations, the industry says that it will take more than a yearThere is also Therefore, it is expected that the actual connection of operators will start after the end of 2023. If it is an indirect connection, there is a possibility that it will be connected at a slightly earlier stage.

Currently, the Zengin system uses RC connections, but discussions are underway for API gateway connections. The API connection will make it easier to connect to the Zengin System, but this is still under discussion and is being discussed separately from the recent opening of the Zengin System.

Considering the burden of RC connection, funds transfer service providers may choose to wait for the realization of this API connection before considering connection.

However, the API connection is tentatively set to start in January 2024, and there are surveys that indicate that no banks want to participate at this time.

It seems that many banks are waiting for the 8th Zengin System to start operating in 2028, and are expecting to connect to the API.So, until then, it is necessary to build a system that assumes RC connection instead of API.

If we wait until 2028, the provision of services using the Zengin System will be delayed.

For the time being, it is realistic that new services will be provided under the existing framework that does not connect to the Zengin System, and once API connection becomes a realistic stage, some businesses will again consider connecting to the Zengin System. It looks like a direction.

(Written by Yasuhiro Koyama, edited by Yutaro Kobayashi)

Source: BusinessInsider

David Ortiz is an opinionated and well-versed author, known for his thought-provoking and persuasive writing on various matters. He currently works as a writer at 24 news breaker, where he shares his insight and perspective on today’s most pressing issues. David’s unique voice and writing style make his articles a must-read for those seeking a different point of view.