On May 26, the Ministry of Finance released the “Japan’s Foreign Assets and Liabilities Balance (as of the end of 2022).” These are the annual statistics that I have been watching continuously.

confirmed through this statistic,Japan’s status as the country with the world’s largest net foreign assets has become the basis for the yen as a safe haven asset.That is certain to some extent.

However, the current situation in which Japanese companies, individuals, and governments hold huge amounts of assets overseas is not necessarily a positive story, as it is proof of the “lack of investment opportunities” in Japan. A closer look reveals the sense of crisis faced by Japanese companies.

Looking at the specific figures, the balance of net foreign assets, which is the balance of assets held overseas by Japanese companies, individuals, and the government minus liabilities, increased by 720.4 billion yen from the previous year to 418.6285 trillion yen. ), marking the fifth consecutive year of increase. It has maintained its status as the country with the world’s largest net foreign assets for 32 consecutive years[Chart 1].

[Chart 1]Transition and breakdown of Japan’s net external assets (orange line).

Despite the record depreciation of the yen in the same year, the balance increased by only about 720 billion yen because the price fluctuations of overseas portfolio investment were extremely large. I don’t think there are many people who immediately get a sense of it, so let’s take a closer look at the breakdown of the balance below.

Looking at the factors behind changes in the balance compared to the end of the previous year (2021) (estimated by the Ministry of Finance),Overseas portfolio investment balance decreased by 48.6 trillion yenare doing.

If we break down the factors into those caused by changes in volume (trading flow) and those caused by changes in price (exchange rate or asset price),Decrease by 22.8 trillion yen due to the volume factor.That much securities assets were soldI’m saying that.

Next, regarding the price factor,¥46.9 trillion increase due to exchange rate fluctuationswhile¥72.7 trillion decrease due to fluctuations in asset prices (categorized as “other adjustments” in statistics)bottom.

Central banks in Europe and the United States have continued to raise interest rates at a rapid pace, and as a result, both the stock and bond markets have fallen sharply, resulting in a decline in the balance of foreign portfolio investment.

However,The record-breaking yen depreciation offset more than 60% of the decline in stock and bond prices, and the decline in the balance of overseas portfolio investment remained at a certain level.It can also be viewed as

In that context, even if the yen depreciates further in the future, it will lead to an increase in the balance of foreign assets. (Again, this is not necessarily a positive story, as it also reflects the lack of domestic investment opportunities.)

“Yen that is sold and never returned”

What is more worrisome than trends in foreign securities investment is the rise in direct investment and its share of the balance of net foreign assets.

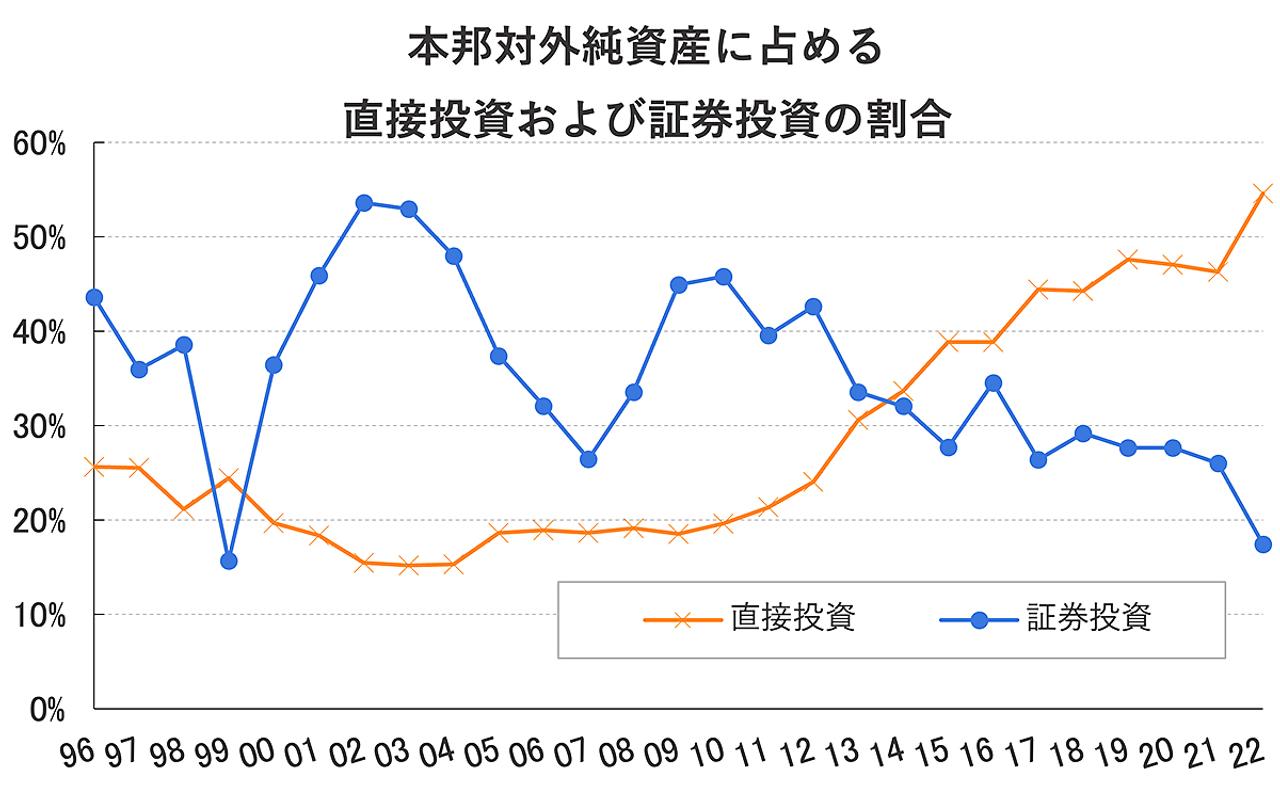

Looking at net foreign assets by the end of 2022, direct investment accounted for 54.6%, the largest item since the start of statistics. Meanwhile, portfolio investment fell to 17.5%, the lowest level since 1999. As a result, the difference between the two was 37.1 percentage points, an unprecedented level of difference[Chart 2].

[Chart 2]Percentage of direct investment (orange line) and portfolio investment (blue line) in Japan’s net foreign assets.

Considering the above changes, it seems that the recent repeated depreciation of the yen can only be understood as a “structural” phenomenon.

The balance of foreign securities investment is expected to repatriate when the risk-averse mood rises, but the balance of foreign direct investment will not be the same.

It is easy to imagine that an investor who sensed a crisis would sell foreign securities in a short-sighted manner and exchange them for yen. need. Repertoire is not easy.

In other words, although Japan’s status as the country with the world’s largest net foreign assets has been maintained for 32 consecutive years, the current situation is that direct investment has greatly exceeded securities investment.The percentage of “yen that has not been returned after being sold” is increasingcan also be rephrased as

and,The author believes that this decline in yen-buying demand is the true cause of the relentless yen depreciation..

Of course, even among the profits generated from direct investment, strictly speaking, dividends and distributed branch profits can be expected as a recurring flow of foreign currency selling and yen buying.

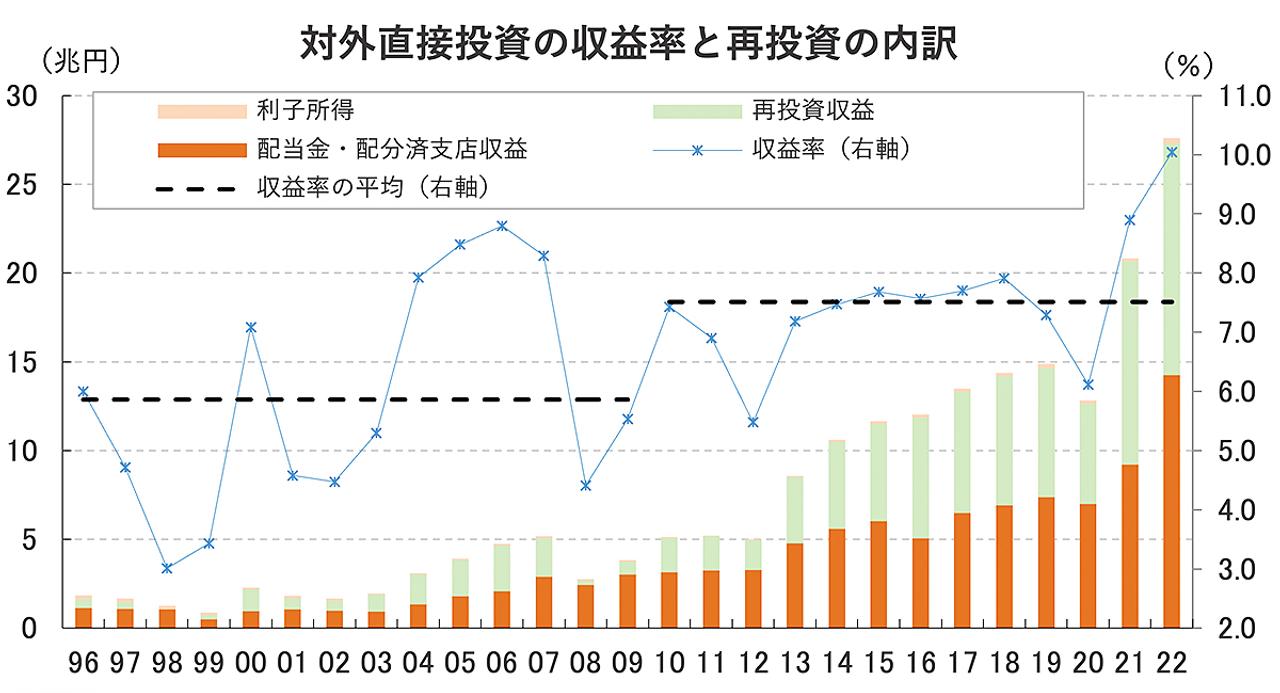

Nevertheless, as the rate of return on direct investment continues to rise over the long term, the breakdown isPercentage of reinvested earnings is steadily increasingThe facts cannot be ignored[Chart 3].

[Chart 3]Return on foreign direct investment (blue line) and breakdown of reinvestment.

Given the fact that the rate of return on direct investment is on the rise, and that foreign countries are achieving higher growth rates than Japan, the tendency for direct investment to be preferred over securities investment will likely continue.

Only if soThe meaning of returning the profits earned through direct investment to Japan (selling foreign currency and buying the yen) fades.If the profits are used to invest in foreign companies (especially in a situation where the yen is depreciating), the cost of converting back to yen will be wasted.Body.

In fact, the ratio of reinvestment to direct investment returns averaged 31.8% over the 14-year period from 1996 to 2009, but rose to an average of 45.9% over the 13-year period from 2010 to 2022 (start of statistics). The average ratio was calculated by dividing the last 27 years into half for convenience).

In fact, the increase in the reinvestment ratio of foreign direct investment is consistent with the feeling that I have heard from business corporations on overseas business trips.

Rather than returning profits to Japan, the dominant behavior is to continue to search for investment opportunities that seem to have high expected returns overseas and apply them there.I feel that.

To recapitulate the gist of this paper, while Japan’s net foreign assets are steadily increasing, the proportion of the yen returning to Japan is declining.

In addition, the recent yen depreciation against the dollar has progressed to the 140 yen level for the first time in about half a year since the fall of 2022 (closing price on May 28).

*Contributions are my personal views and are not affiliated with any organizations.

Advertisements

Source: BusinessInsider

Emma Warren is a well-known author and market analyst who writes for 24 news breaker. She is an expert in her field and her articles provide readers with insightful and informative analysis on the latest market trends and developments. With a keen understanding of the economy and a talent for explaining complex issues in an easy-to-understand manner, Emma’s writing is a must-read for anyone interested in staying up-to-date on the latest market news.