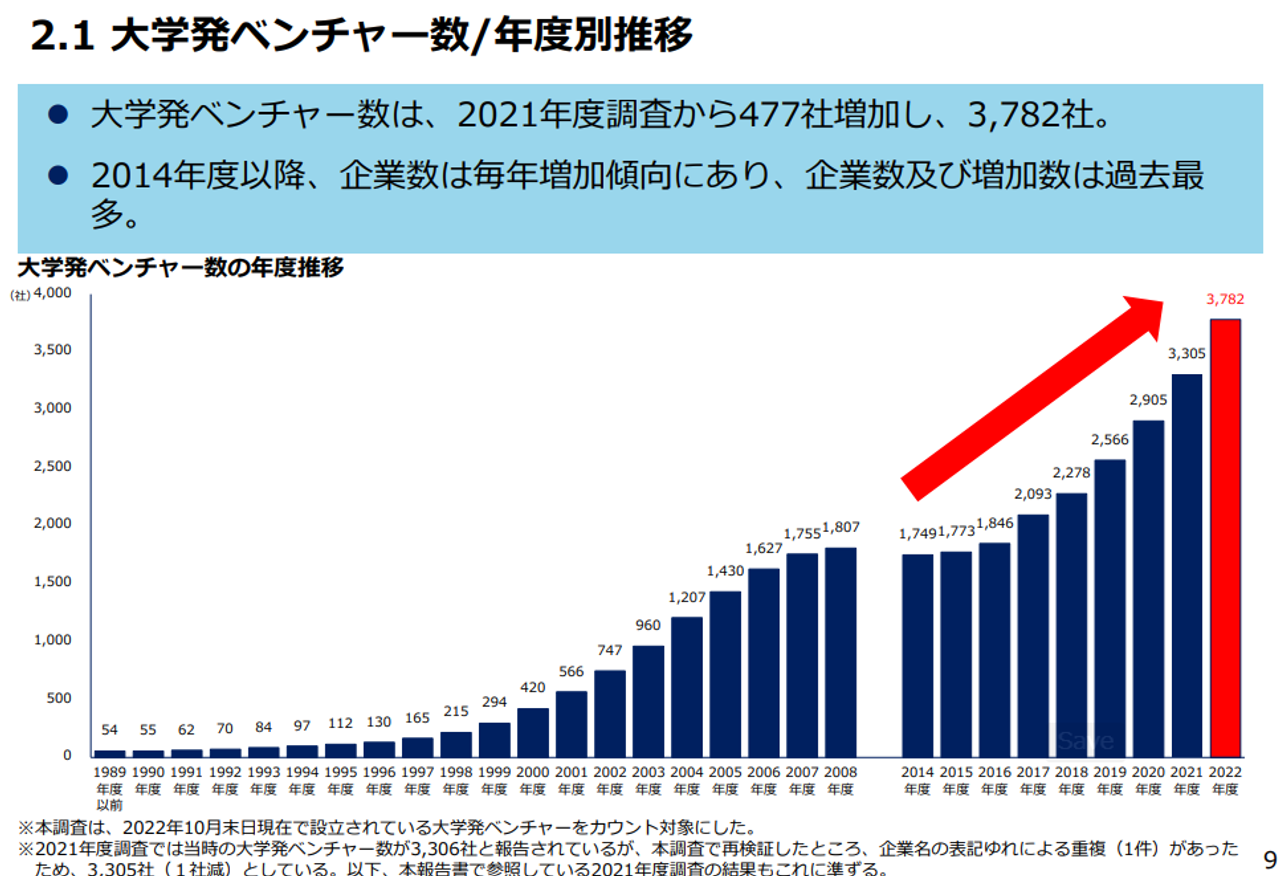

University startups are active. According to a survey compiled by the Ministry of Economy, Trade and Industry, there will be 3,782 university-launched ventures in 2022. The number of companies increased by 477 from the previous year’s survey, and both the number of companies and the number of increases were the highest ever.

Creation of university-originated ventures supported by the government. While the number of companies is steadily increasing across the country, the report also reveals challenges in business growth.

Both the number of university-launched ventures and the number of increases hit record highs.

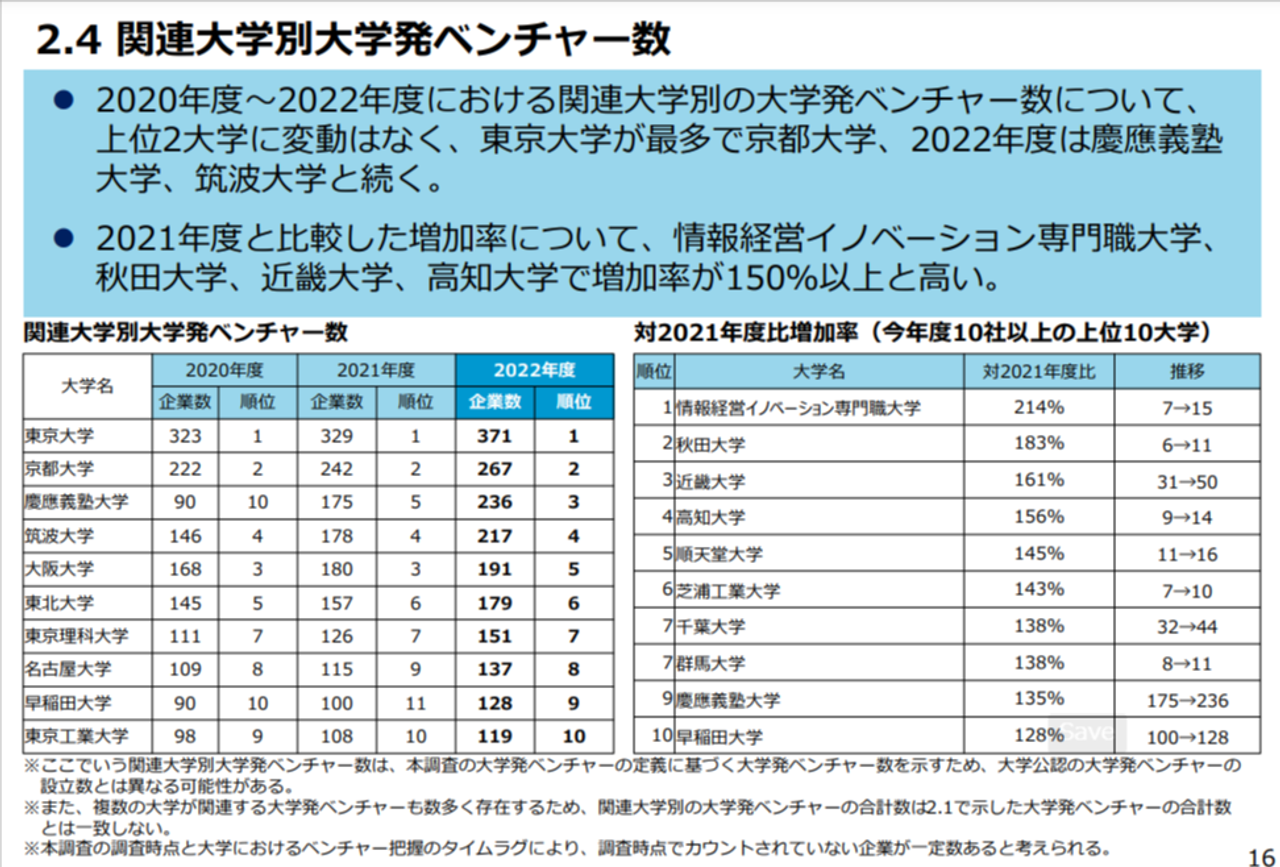

The number of increase is “Keio” exceeds the University of Tokyo

By affiliated university, not only national universities and famous private universities, but also regional universities increased.

The creation of university-launched ventures was preceded by national universities, but the survey shows that private universities and local universities are growing.

In terms of the number of increases by university, Keio University61 more companieswas first in Keio has set a goal of creating 300 university-launched startups by the end of the next three years, and is strengthening its support for securing human resources. In terms of the total number, 236 companies will rise from fifth place in the previous year to third place as of FY2022.topUniversity of Tokyo (371 companies)Although it is still not as good as it is, its presence is increasing.

In terms of the rate of increase, the movements of local universities are also noticeable.Akita University(Increase from 6 companies to 11 companies),Kochi University(9 to 14 companies in the same), it seems that university-launched ventures, which until now were mainly concentrated in universities in the metropolitan area and urban areas, are gradually spreading nationwide.

Majority of industries are IT (applications, software) and bio/healthcare/medical equipment.

Advertisements

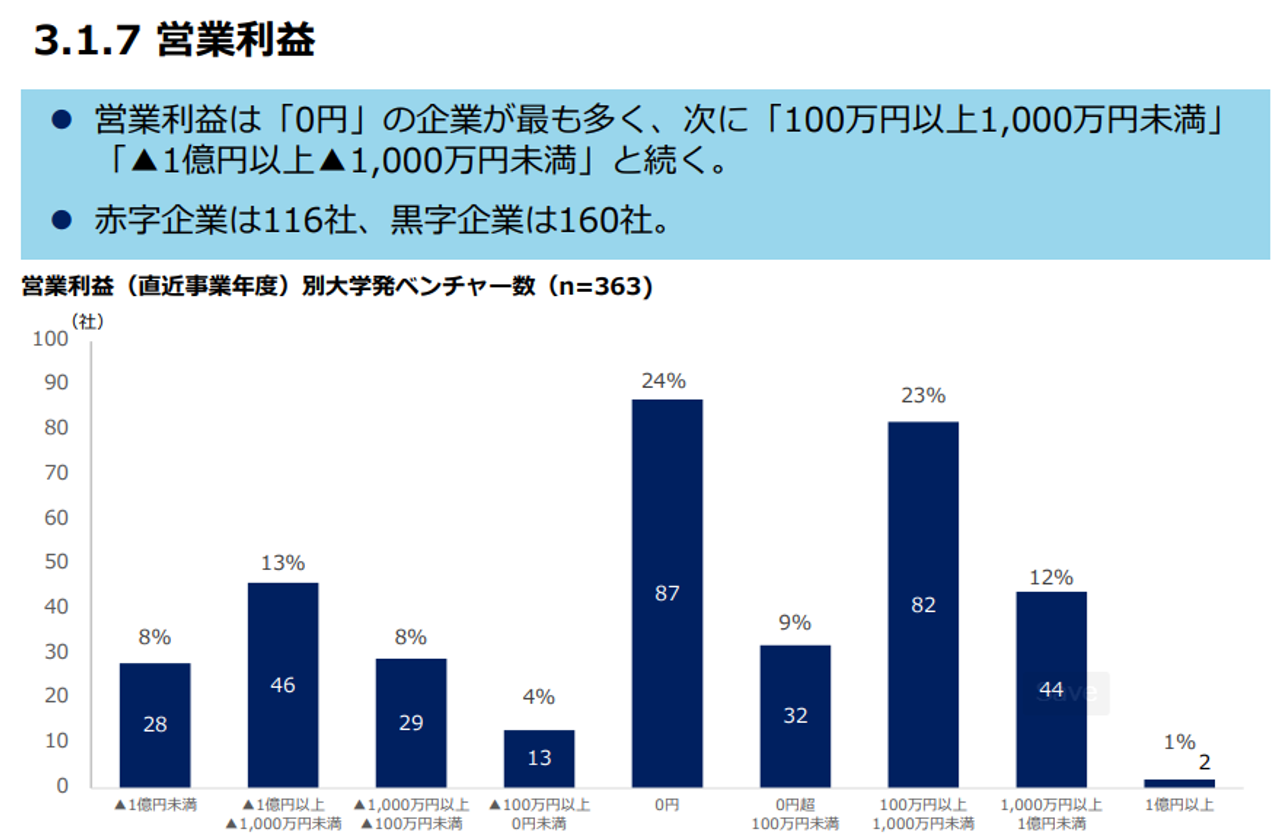

Sales are less than 50 million yen, operating profit is 0 yen most

The most common answer for operating profit was 0 yen. There are 116 companies in the red.

Many of the companies that responded to the Ministry of Economy, Trade and Industry’s survey were young companies, with a total of 78.5% having been established within the past 3 years and within the past 5 years. The number of full-time employees is less than 5, and about half of them are the most common.

Sales are10 million yen or more and less than 50 million yenis the most common, about 30%. This was followed by 19% for 100 million yen or more and less than 1 billion yen, and 18.4% for 0 yen. This ratio is largely unchanged from 20 years ago.

Looking at the operating profit, 24% of the companies reported “0 yen”. On the contrary, only 1% of the companies answered that they would spend more than 100 million yen.

Many university-launched ventures are often established for the purpose of commercializing university research results and founders’ technologies. Including the so-called deep tech area,It takes time for technological development to lead and generate profitsYou can also see the case.

This survey also reveals the points that need to be overcome in order to shorten this period.

Issues of funding and lack of management personnel

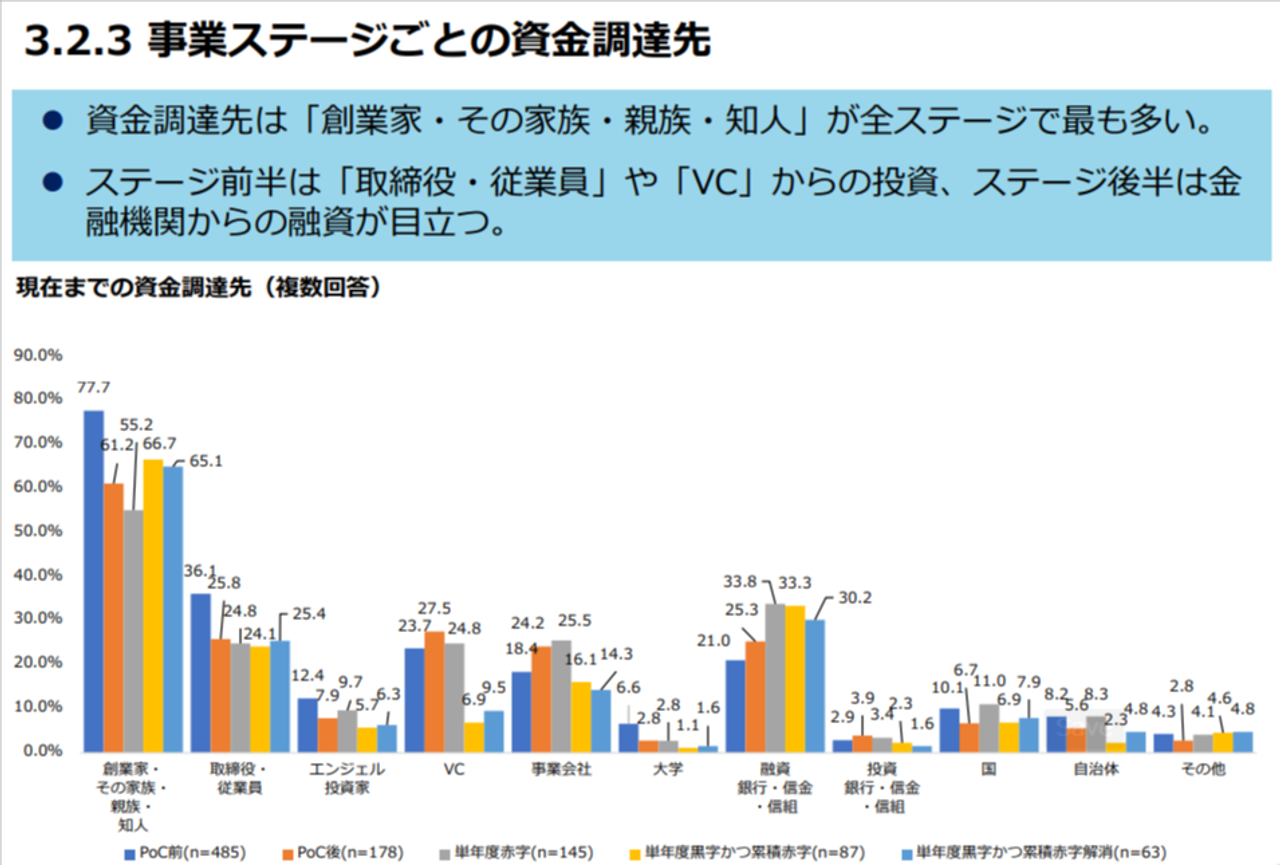

A high percentage of funding is from relatives such as the founding family and relatives.

Let’s take a look at the items that show the challenges faced by university-launched ventures.

Regardless of the stage of the business, the sources of funding are most often relatives of the founding family, their families, relatives, and acquaintances, accounting for 50% to 70%. Financing from VC is less than 30% even before and after PoC.

Regarding the relationship with VCs, while most of the respondents answered that they “never felt any difficulty”, in the interview survey, “Few VCs investing in R&D startupsIn addition, the issue is that the fund size is small.”Not fully understanding what and how to appealI want to know how to do that.”

In terms of human resources, such as management strategy and fund procurement,Difficulties in recruiting positions that play important roles in commercializationIt seems that one of the issues is what I am doing.

Among executive personnel, the highest ratio of “needed but could not be obtained” wasCFOand was 24%. In terms of human resources for managers,Marketing/Sales”and”Strategy/business development” was high, reaching about 30%.

The goal is “one university, one exit”

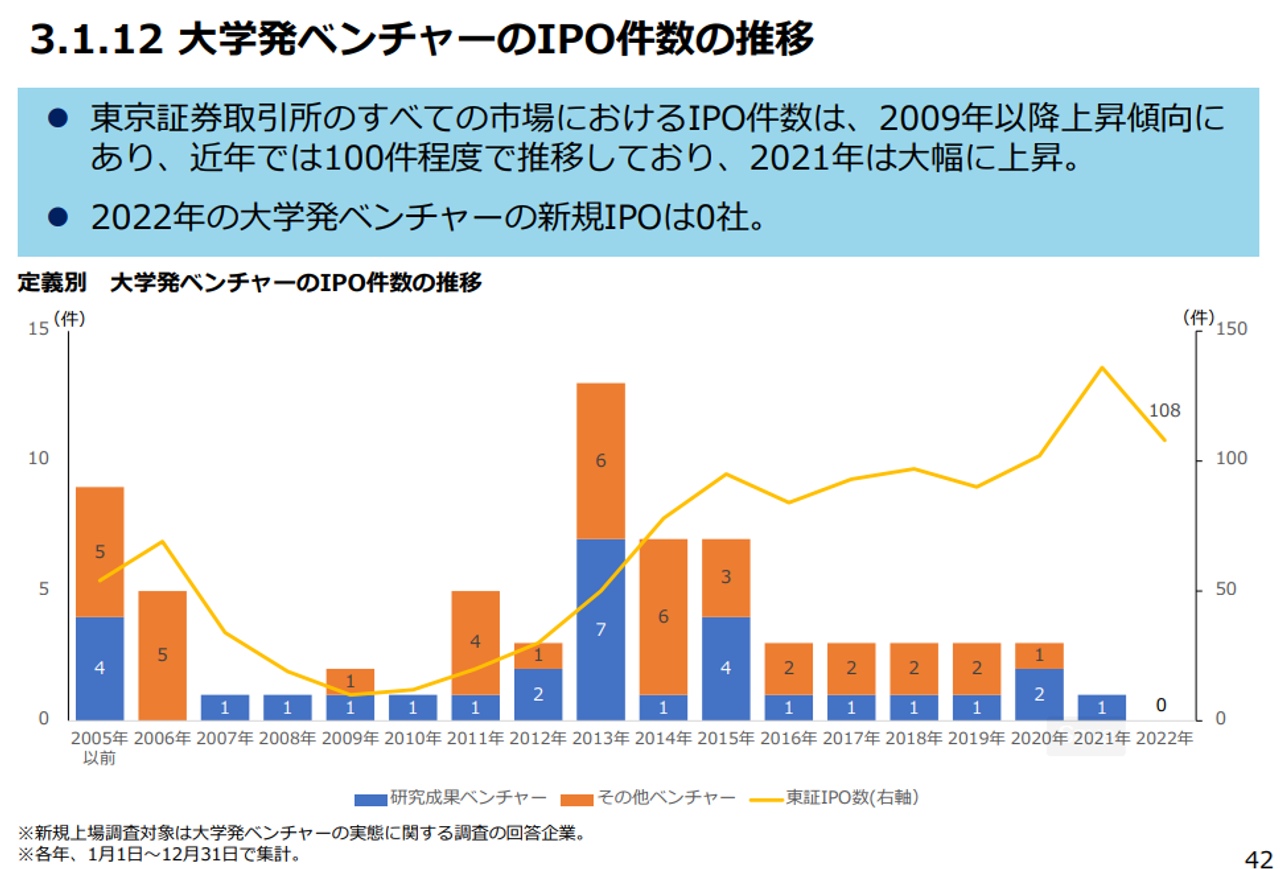

Number of IPOs of university-launched ventures. In 2022, there were 0 cases.

The number of new listings of university-launched ventures has been around 3 since around 2016, but it was 0 in 2022.

According to a survey, there are currently 63 listed university-launched venture companies, including Euglena and Gunosy.

In the “5-year startup development plan” formulated in 2022, the government sees an issue that the proportion of universities working to support the creation of startups is “still low.” By fiscal 202750 startups per research university, 1 company aiming for exit”1 university 1 exit movement” is included in the plan.

The number of university-launched ventures ranked 1st to 167th by related university is as follows.

1st to 58th place.

58th to 112th place.

112th to 167th.

167th place.

Source: BusinessInsider

Emma Warren is a well-known author and market analyst who writes for 24 news breaker. She is an expert in her field and her articles provide readers with insightful and informative analysis on the latest market trends and developments. With a keen understanding of the economy and a talent for explaining complex issues in an easy-to-understand manner, Emma’s writing is a must-read for anyone interested in staying up-to-date on the latest market news.