More and more companies are delisting and going private.In 2022, the same 79 companies as in 2008 at the time of the Lehman shockThere was also86 more in 2021, 35 already in 2023has been delisted from the Tokyo Stock Exchange (as of June 27).

On the other hand, the background is different. In 2008, 33 of the delisted companies were due to bankruptcy, but recently”dare”choose to go back to being a private company”Strategic Privatization”is increasing.

team up with a companyTOBIt has a strong presence as an instigator of privatization, such as implementing a public tender offer.PE (Private Equity) Fundis. After restructuring the company through management reforms, the elimination of businesses, the development of new businesses, and sometimes even the change of the company name, the company can be sold to a business company or fund, or relisted to obtain a return.

At Carlyle, which boasts one of the world’s leading investment achievements, we interviewed three people who are responsible for the top positions in each sector in Japan.

Mr. Terasaka (left), Mr. Watanabe (middle), and Mr. Ogura, who are the heads of the PE fund Carlyle.

Yusuke Watanabe (Head of Consumer Goods, Retail & Healthcare Sector)Graduated from Keio University Faculty of Economics, Harvard Business School MBA. After working at Mitsubishi Corporation, he joined Carlyle in 2006. He will also be involved in management in Japan in the future.

Junpei Ogura (Technology, Media and Telecom Sector Head)Graduated from the Faculty of Policy Management, Keio University. After working at the investment banking headquarters of UBS Warburg Securities Co., Ltd. (now UBS Securities Co., Ltd.), he moved to Carlisle in 2006. He will also be involved in management in Japan in the future.

Reiji Terasaka (Manufacturing and General Industry Sector Head)Graduated from the University of Tokyo Faculty of Law. She graduated from Tufts University (Fletcher School of Law and Diplomacy) and Stanford Graduate School of Management. After working for several companies such as the Ministry of Finance (currently the Ministry of Finance), Carlyle, and Japan Display, he returned to Carlyle in 2020.

Reference article:Bean sprouts company in Kyushu invested by Carlyle — “Global expansion” aiming for former managing director of Zensho as president

Tomorrow’s stock price or growth in 5 years?

Toshiba is also moving toward going private, and has announced that it will encourage shareholders to apply for a TOB by Japan Industrial Partners (JIP) and others.

The main battlefield for PE funds is the “cutting out of non-core businesses of conglomerate companies (carve out)” and “Owner-owned companiesbusiness successionIn addition to these, “strategic privatization” has been increasing recently.

Companies that have been delisted and become a hot topic include corporate analysis SaaS and economic media.user basematching app”Omiai”internet marketing,”Hotto Motto” “Yayoi Ken”Plenus, payment serviceMetapsetc. (Metaps is scheduled for June 29).

Bain Capital, a PE fund, has become a buyer of net marketing, and with, which operates the matching app “with,” which is also an investee of Bain, has become a holding company (HD) and is aiming for an IPO.

Reference article:Startup “with” listed “Omiai” as a subsidiary and converted to HD, Bain Capital on the offensive to reorganize the matching industry

Plenus and Metaps are MBOs by management, and the current president will continue to manage them even after going private.

Carlyle will carry out TOB for Uzabase. The purchase price was approximately 58.55 billion yen (Growth Capital estimates).After privatizationSix directors resignThe management system has also been renewed, and currentlyThree outside directors from CarlyleParticipating as

When a listed company receives a takeover bid (MBO) from an investment fund, etc., it wants to implement drastic reforms from a medium- to long-term perspective. It will get worse and the stock price will fall. It is not desirable, so the claim that it should be private is conspicuous.

Terasaka: There is a time span gap between what the market expects in a relatively short period of time and what companies and management want to do from a medium- to long-term perspective.There are quite a few things that occur. If the company remains listed, it will not be possible to make bold decisions, or even if it is possible, it will take time to make a decision.

If we delist and our PE fund becomes the buyer,Investment (holding) period is about 5 years on averageis.short-term profitinstead of aiming for 5 yearsManagement from a medium-term perspectiveI wonder if it’s the advantage of being able to do it.

The number of shareholders is extremely small, and the relationship between shareholders and management is extremely close.As a result, decision making will be much faster.

Watanabe:There are more than a few companies that generate cash flow and profits, but their growth slows down and their stock prices do not rise. and,The dilemma of not being able to incur large upfront costs despite the need for changefall into. In the backgroundThe trend in Japan that favors “stable management”There may also beDo something with the resources you have,and.

By going private and incorporating external capital like ours,Cut off the ties, stop what you stop, do what you do,calledEnabling Bold “Aggressive Management”Become.

Advertisements

It all started with a word from outside the company

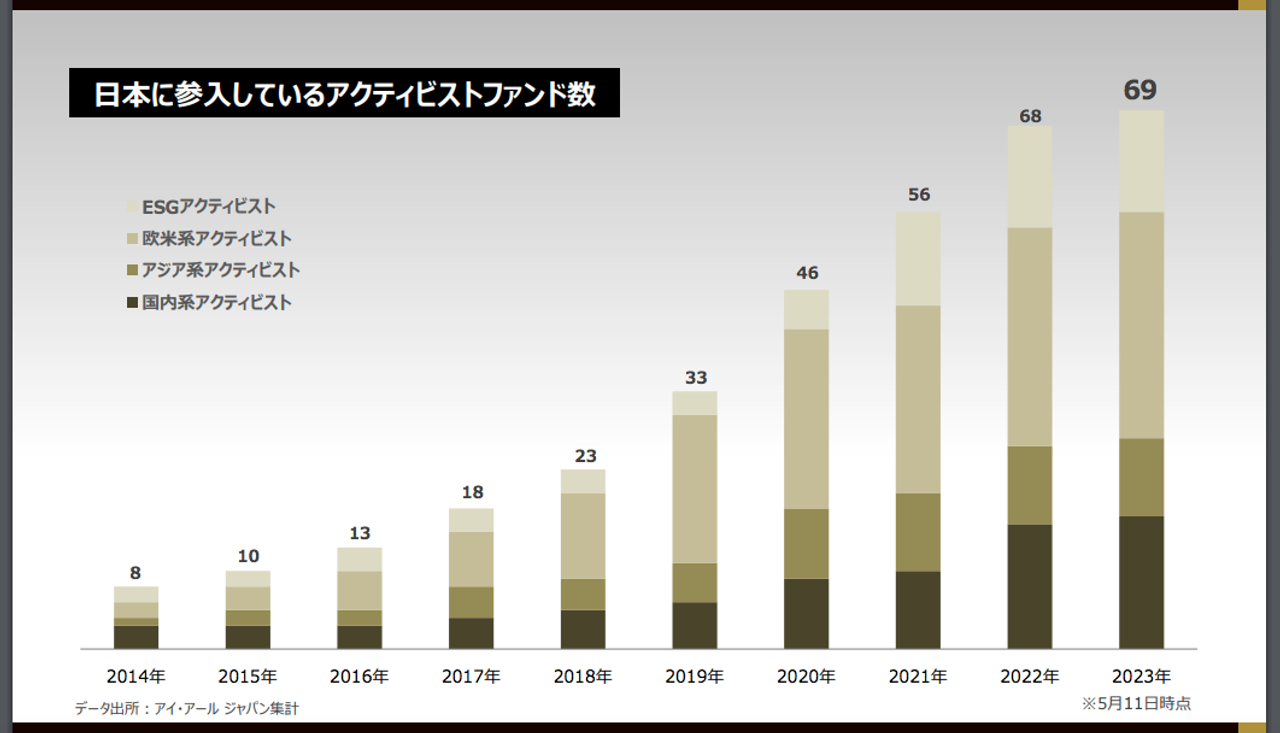

Both the number of activist funds entering the Japanese market and the number of shareholder proposals are increasing.

External factors are also a major reason for the increase in the number of private companies. Along with the market reorganization, the Tokyo Stock Exchange established new listing standards such as the number of shares in circulation.PBR (price book value ratio) less than 1xor,ROE (return on equity) less than 8%It has made it difficult to maintain its listing, partly because it has issued requests for improvement to other companies.

In addition, Mr. Ogura points out thatIncrease in “activists” and “outside directors”is.

Number of active activist funds in Japanis 8 in 2014,In 2019, when discussions on market restructuring intensified, 33,69 in 2023and has increased significantly (as of May 11).

In addition, following the revision of the Corporate Governance Code in 2021,81.6% of prime market listed companies appoint one-third or more independent outside directors(As of April 2022, according to the Financial Services Agency).

Ogura: Discussions at Board of Directors meetings with an awareness of “outside eyes”is a big change. Uzabase, which I am in charge of and currently participates as an executive,A word from a certain outside director started the discussion on privatizationI hear.

Uzabase was founded by three founders, who collectively own about 35% of the company. Management took over quickly, and two of them were no longer involved in day-to-day management.no clear shareholdersIt was the situation.

Due in part to the deterioration of global market conditions, investorsBusiness portfolio is complex and difficult to understandIt seems that outside directors pointed out while there were voices saying that.”I think the time has come to reconsider the shareholder composition and business strategy, including going private using a PE fund.”and.

Carlyle’s example of ‘strategic delisting’

On June 21, 2023, Mr. Takaomi Tomioka was appointed as Co-President of Japan.

Iwasaki Electric:Growth has slowed in the past few years, and although it applied for the prime market in preparation for the reorganization of the Tokyo Stock Exchange, it did not meet the market capitalization criteria (as of June 2021) (according to company estimates in March 2022). . Delisted in June 2023. Implement growth strategies and structural reforms.

User base:After the TOB in December 2022, it will be delisted from the Tokyo Stock Exchange Growth Market in February 2023. Plans to merge with NewsPicks, a wholly-owned subsidiary, in July.

Tokyo special electric wire:A subsidiary of Furukawa Electric, it was listed as a parent company with the company. Delisted from the Tokyo Stock Exchange Standard Market in January 2023. Merged with TTC Holdings and changed the company name to TOTOKU.

AOI TYO HD:Advertisement video production major known for KDDI au’s Santaro series. After delisting in September 2021, we will integrate the consulting business Field Management Co., Ltd., and undertake one-stop from strategy planning to creative.

Money Square:A major player in foreign exchange margin trading (FX). It was delisted in September 2016 and sold to an investment fund of electronics retailer Nojima in December 2022. The amount is just under 20 billion yen (Nikkei Shimbun December 19, 2022).Total assets under custody will grow from 66 billion yen (2016) to over 100 billion yen (2022)became.

Hitachi equipment:A carve-out project from the parent company, Hitachi Metals Group. The TOB transaction amount is approximately 29.3 billion yen (Ministry of Economy, Trade and Industry). The company was delisted in March 2015 and changed its name to Senxia. Achieved both growth and improved profitability as a result of thoroughly reforming the corporate culture from the “stability-oriented” to “profit-oriented” under the umbrella of a large company. When all shares were sold to the US fund Lone Star in March 2022,Average annual sales growth of 7% and EBITDA of 15%.

Kito:Manufacturer of industrial cranes, etc. Delisted in 2003. By strengthening overseas expansion and introducing a compensation system that raises employee motivation,Increased sales by about 50% and operating income by more than four timesand re-listed in 2007. In January 2023, it was taken private again by TOB of PE fund KKR (Kolberg Kravis Roberts) and merged with the American industry.

Concerns about delisting, impact on customers and employees

Shareholder proposals by activists and others continue to grow. Following the 2022 record, the 23rd year also recorded a record high (Nikkei Shimbun June 3, 2023). According to the Financial Services Agency, about half of the prime market and about 60% of the standard market have an ROE of less than 8% and a PBR of less than 1x. There are 269 prime companies, 200 standard companies, and 41 growth companies that have not met the listing maintenance criteria in the new market segment and are subject to transitional measures.

Low interest rates are also a big attraction for foreign funds.

Due to this environment, CarlisleAccelerating delisting of shares in the futureI’m looking at it.

On the other hand, especially in Japan, the brand of “listed companies” is deeply rooted. Are there any disadvantages to delisting, such as social trust and name recognition?

Kokura:Maybe it’s because I’m doing this jobno demeritsI think. Unless the goal is to go public. A domestic company that Carlyle has invested in,No customers or employees left our company just because we were delisted..

Watanabe:There are often people who are worried that they will not be able to hire them.Previously, in the wake of deprivation, the office was so-calledAfter moving from the Pencil Building to a complex facility in a prime location in the center of the city, with a concert hall, museum, and restaurants, the number of applicants for employment increased.something happened. Rather, the place is more important.

Terasaka: “Becoming under the umbrella of a PE fund = something about the company will change.”As a result, people with high motivation who want to take on challenges in companies that are trying to change come to us, and in fact we can recruit better people.

and recentlyPerhaps because the management is getting younger, the negative image of going private has disappeared.You know. People in their 30s and 40s have worked in the midst of calls for the importance of “governance reform.”A sense of crisis that management must be explained to shareholders on a global levelis cultivated from an early age, and I feel that more and more people are willing to accept bold reforms.

Reference article:AIG to sell insurance against activist shareholders.What is the “sound relationship between a company and its shareholders” that is questioned in the rapidly increasing number of shareholder proposals?

There is also a training camp to discuss the company 10 years from now

Then, how will Carlyle proceed with the rebuilding of the company after the share transfer from the TOB? The first thing to do isFormulation of a mission and vision for 10 years from nowis.

Of course, we will have a grasp of it before we invest, but by counting backwards from where we want to be in 10 years’ time, how we will manage the company in the five years under the Carlyle umbrella.How will numbers such as sales and cash flow change?and the ideal organization chart required for the execution of those strategies,Can it be done with existing members, is it necessary to train them, or do we need to bring in human resources from outsideetc. will be considered in detail.

become necessarycapital investmentor other companies in the same industryM&A roll-up (additional acquisition)There is also the issue of whether to reorganize the industry by doing so.

In order to consider these matters, Carlyle members and the management team of the company after the acquisition”Training camp”is said to do We spend one or two nights talking frankly, staying in a hotel in Tokyo, or going all the way to Hayama.

Kokura:AOI TYO Holdings, which was invested and delisted in 2021, is the number one company in Japan for TV commercial production. Of the 1,600 employees in the group, 1,400 of them are creators, which is rare. I spent about a month and a half here setting my purpose.

The decision was made to “make the world brighter with the power of creation.” It contains the desire to remake the world with the power of video, and by setting this goal, we can now look ahead to business development that goes beyond the framework of advertising production.the exit“Impact on the world” instead of “advertising”By settingFurther frontage such as regional branding and movie production of corporate messageshas spread.

Watanabe:One more thing I definitely do”visualization”is.to accomplish the missionWhat KPIs are necessary to measure the progress of management actions and achieve financial targets?decide.ThoseWhile utilizing DX as well as meeting bodies and mechanisms that can be grasped in a timely mannerdesign anddid you really act?,again,results or notmake it visible. That’s how we go through the PDCA cycle.

Five years seemingly long but short. It is necessary to proceed with reforms with a sense of urgency. In the second part, we will go into detail about inviting the president and other management who hold the key to this, merit-based remuneration system that motivates employees, obsession with profits, and support for overseas expansion using a rich global network.

Source: BusinessInsider

Emma Warren is a well-known author and market analyst who writes for 24 news breaker. She is an expert in her field and her articles provide readers with insightful and informative analysis on the latest market trends and developments. With a keen understanding of the economy and a talent for explaining complex issues in an easy-to-understand manner, Emma’s writing is a must-read for anyone interested in staying up-to-date on the latest market news.