Gardens by the Bay, a popular tourist spot in central Singapore. Due to changes in the price situation, the hurdles for traveling from Japan to the country are rising rapidly.

In early September, I visited Singapore on a business trip. The last time I visited the country was five years ago, but when I compared the price situation with Japan, I felt that the difference had become extremely large.

For example, in Starbucks, which is often used as a price comparison target, the tall size of iced coffee (Cafe Americano) is about 5.8 Singapore dollars, which is 626 yen when converted at the rate at the time of writing (Singapore dollar ≒ 108 yen). The same product is 445 yen in Japan, so it is about 1.4 times more expensive in Singapore.

In addition, mineral water (Evian, 500ml) was about S$3.2 and about JPY346 at Changi International Airport. The recommended retail price that can be confirmed online in Japan (I couldn’t find it at a nearby convenience store) is 170 yen (183 yen including tax), but if you buy it in bulk online, it will be around 140 yen including tax. Singapore is about 2.5 times higher.

As for Evian, there are stores that sell discounts in Singapore, and you can buy them in bulk online at a low price. Also, the author confirmed the price of Evian at the local airport, which is slightly higher than retail stores in the city. Please understand that the comparison results may vary depending on these conditions.

In any case, since such a price difference permeates everyday goods such as coffee and mineral water, travelers, business travelers, and expatriates from Japan to Singapore are likely to suffer pain. You can imagine the actual situation.

Inevitably, the number of travelers from Japan to foreign countries such as Singapore, where there is a gap in price levels, will not increase, and it is highly likely that payments in the travel balance (in other words, imports of services) will decrease in the future. .

Furthermore, demand is expected to concentrate on domestic travel as an alternative to overseas travel, and it is expected that the situation will become even tighter, and that is already happening.

On the other hand, if you come to Japan from overseas, you will have the opposite feeling to what I experienced in Singapore. Given this, it is highly likely that Japan’s travel balance (in other words, service exports) will increase in the future.

On this business trip, I encountered a scene that symbolizes such a situation. That is the long line in front of the security checkpoint when leaving Japan to go abroad.

According to airport staff, it is now common to wait in line for 30 to 40 minutes, at least 20 minutes at security checkpoints at Haneda Airport unless you have registered for facial recognition in advance. It is said that there is

The check-in counter was also extremely crowded. Most of them were foreign tourists (inbound) who enjoyed themselves in Japan and returned home, and it seemed that there were fewer Japanese people.

Both can be said to symbolize the increase in receipts in Japan’s travel balance, in other words, the expansion of the travel balance surplus.

The Reality of “Asia’s Weakest Currency”

Returning to the price difference between Singapore and Singapore, the depreciation of the nominal yen in recent years has had a major impact on the current situation.

Looking at changes in the “nominal effective exchange rate (NEER),” which is an index that measures the relative strength of currencies and does not take into account price differentials, the Japanese yen will be about 15.1% as of the end of August, starting in early 2022. , the Singapore dollar has risen about 9.4%.

When compared by level,The nominal effective exchange rate of the yen is about 40% lower than that of the Singapore dollarThat’s why.

The exchange rate alone creates such a large difference, and the wage gap between the two countries is also added to it, so there is no choice but to accept the large price difference.

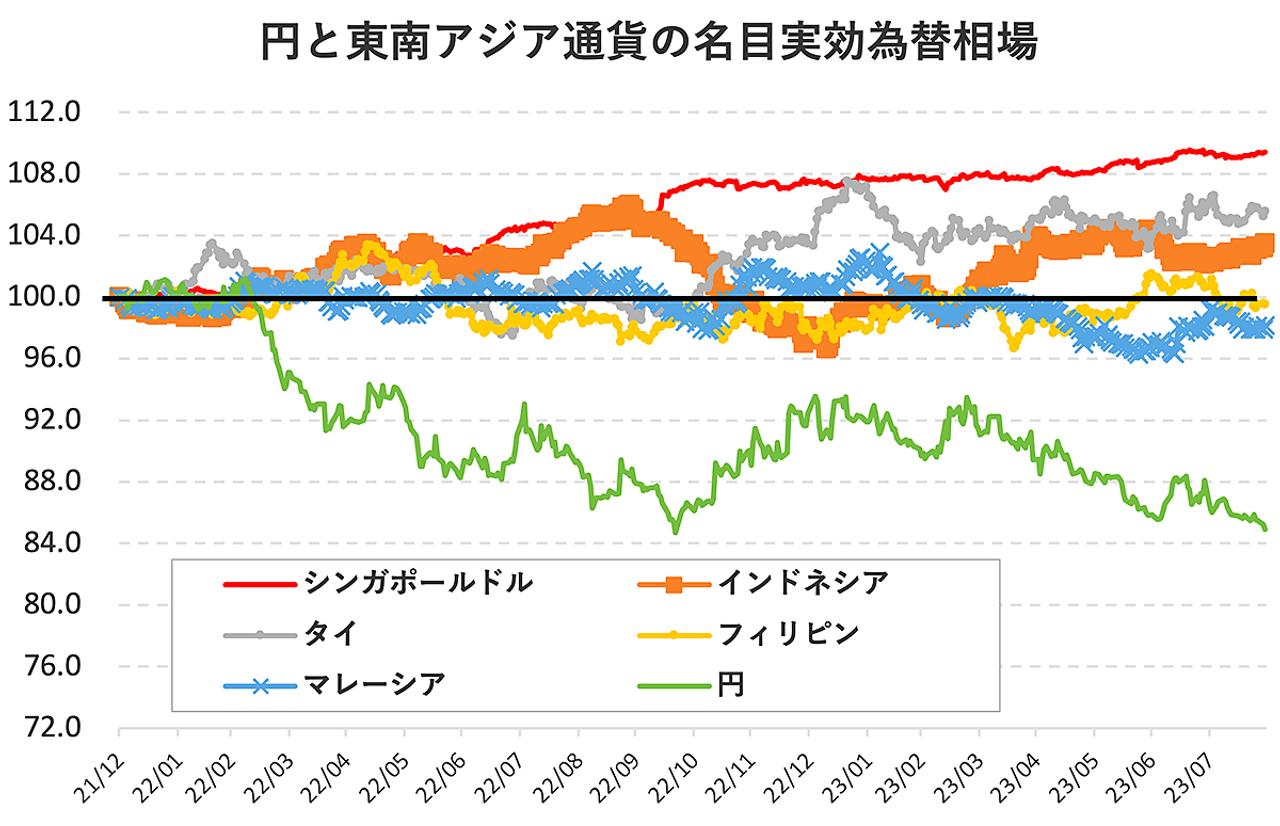

As Singapore is one of the world’s leading financial centers (cities and regions that play a central role in the financial industry), it is prone to rising prices and wages. In fact, even when compared to the currencies of other Southeast Asian countries, the extent of the yen’s depreciation is outstanding[Chart 1].

[Chart 1]Changes in the nominal effective exchange rate (NEER) of the Japanese yen (green line) and the currencies of Southeast Asian countries.

I have repeatedly argued that the recent depreciation of the yen, which seems to have no end in sight, is not a reflection of the strong dollar.

As many pundits have explained, if the global appreciation of the dollar is the real reason for the depreciation of the yen, then there should be a number of other currencies that are suffering from the same major depreciation as the yen..

However, as you can see from the Southeast Asian Nominal Effective Exchange Rates above, no such currency can be found. For example, even in Thailand, which has been under the influence of the military government since the coup d’état in 2014 and has been pointed out to be in economic stagnation, the nominal effective exchange rate is on an upward trend.

Ultimately, the recent depreciation of the yen has caused concerns about the continued huge deficit in the trade balance, the primary income balance in which the surplus earned overseas does not return to Japan, and the future expansion of the deficit mainly in the digital, consulting, and research and development fields. The author believes that structural factors, such as the balance of payments for services, have had a major impact.

In addition, I wrote that the depreciation of the yen on a nominal basis as explained above has a “large impact” as a factor that creates price differences between Japan and overseas, but I believe that this is only secondary. there is

This is immediately apparent when considering the example of Starbucks at the beginning.

For iced coffee in Japan and Singapore to become equivalent, one Singapore dollar would have to fall from the current ¥108 to ¥67. Only then will you be able to buy an iced coffee that costs about S$5.8 for about ¥390.

However, 1 Singapore dollar = 67 yen is the level around 2011-2012.

Japan’s trade balance will become a normalized deficit or become unable to earn a surplus around that time, but at that time there was still no image of Japan falling into a trade deficit country. At that stage, the yen exchange rate was 1 Singapore dollar = 67 yen.

Given that fact, it is unreasonable to think that the price difference between Japan and Singapore was caused mainly by changes in nominal exchange rates (yen depreciation).

Ultimately, unless we pay attention to the depreciation of the yen in real terms, we will not be able to see the actual price gap.

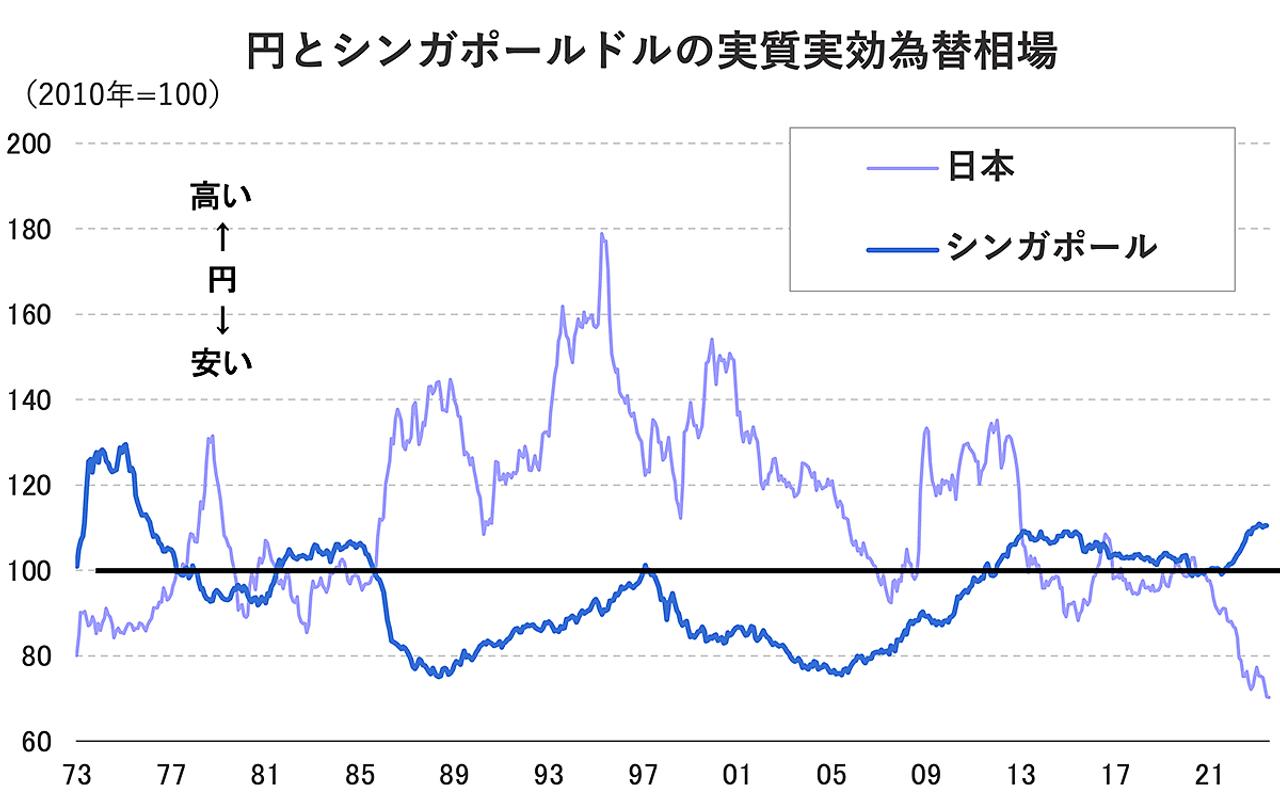

Looking at the rate of change in the real effective exchange rate (REER), which takes into account commodity price differentials, from the beginning of 2000 to July 2023, for example, the yen fell by 53% and the Singapore dollar rose by 31%.is recorded.

When there is such a difference in the real effective exchange rate, which can be read as the “purchasing power” of the currency, the price tag attached to goods and services (even if the quality is exactly the same) naturally changes.

In particular, over the past year or two, the real effective exchange rate between the Singapore dollar and the yen has shown almost opposite movements[Chart 2].

[Chart 2]Changes in the real effective exchange rate (REER) between the Singapore dollar (dark blue line) and the yen (light purple line).

Ultimately, the problem is wages.

When the price gap between Japan and other countries and the necessity of resolving it become a topic of discussion, it is easy to understand intuitively, so it tends to fall into discussions on a nominal basis in the easy context of “side effects of the depreciation of the yen.”

However, even if the exchange rate on a nominal basis is revised slightly, the big picture will not change.

As I pointed out in my previous contribution (dated August 23), the difference in the “price tags” attached to goods and services is caused by wage disparities. It is natural that goods and services provided at higher wage costs than in Japan are sold at higher prices than in Japan.

Therefore, the essence of forecasting the future of commodity price differentials is whether or not the tendency of wage increases to persist and be reflected in the price-setting behavior of companies, which is commonplace in other countries, will take hold in Japan.

With such a chronic labor shortage, it is unthinkable that nominal wages will not rise. For this reason, I feel that the trend of “increase in nominal wages → price hikes” is slowly but surely beginning to emerge in Japan as well.

If prices rise in this way, there is a possibility that the purchasing power of the real effective exchange rate, which continues to decline unilaterally, or the Japanese yen, will rise.

*Contributions are my personal views and are not affiliated with any organizations.

Advertisements

Source: BusinessInsider

Emma Warren is a well-known author and market analyst who writes for 24 news breaker. She is an expert in her field and her articles provide readers with insightful and informative analysis on the latest market trends and developments. With a keen understanding of the economy and a talent for explaining complex issues in an easy-to-understand manner, Emma’s writing is a must-read for anyone interested in staying up-to-date on the latest market news.