A store opened by Snow Peak in August 2022 in the commercial facility “KITTE Marunouchi” in front of Tokyo Station.

Snow Peak, a major outdoor goods company that was thought to be doing well, announced in February that its net profit had dropped significantly by 99%, and suddenly decided to carry out an MBO (management buyout). Many people were probably surprised.

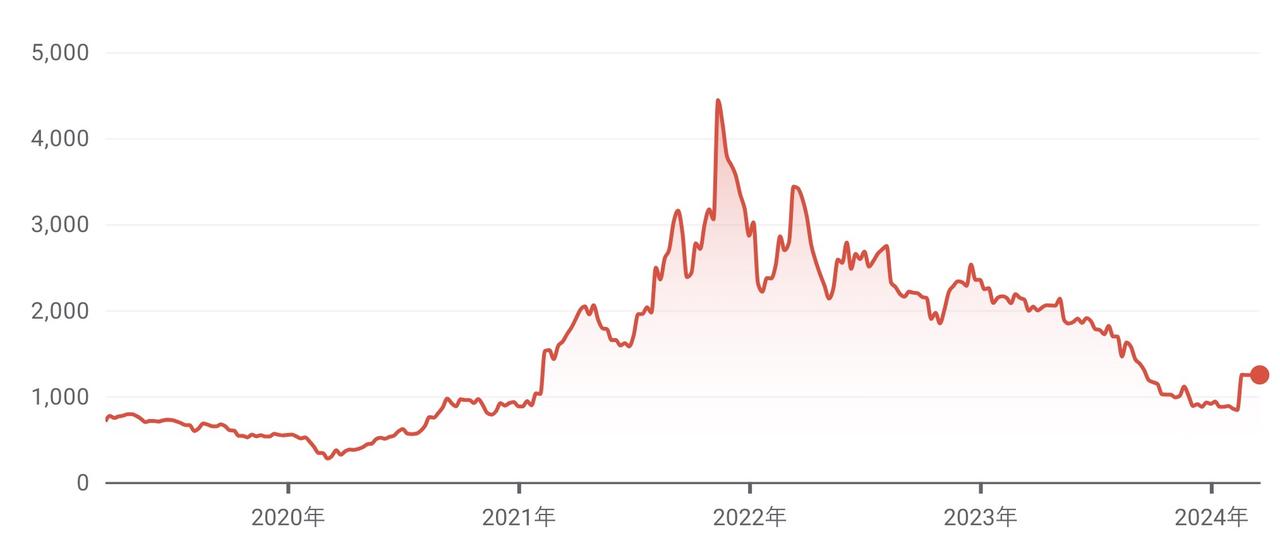

just,When I calmed down and looked at the trends in Snow Peak’s stock price, I found that the stock price had already begun to decline in November 2021, when business performance was still going strong.I understand.

In this article, we will explore what was happening at the foot of the rapidly growing Snow Peak? And how will MBO affect Snow Peak’s management? I would like to think about these points.

Takeshi Miura: Representative director of Japan Intellectual Property Research Institute. After joining Dai-ichi Kangyo Bank (currently Mizuho Bank), he was transferred to NIS (currently R&I). After transferring to Goldman Sachs Securities Tokyo Branch, he became a credit analyst. He worked at Morgan Stanley MUFG Securities and Credit Suisse Securities before transferring to a patent firm in 2018. He is currently disseminating investment information from an intellectual property perspective.

Business performance will suddenly hit a brake in 2023

Snow Peak is a high-quality tent that has received support from users.

Snow Peak announced its financial results for the fiscal year ending December 2023 on February 13, 2024. Sales decreased by 16% compared to the same period last year, operating income, which represents core business profit, decreased by 74% compared to the same period last year, and extraordinary losses related to business restructuring were recorded.Net income was a disastrous result of just 1 million yen, down 99.9% year on year.was.

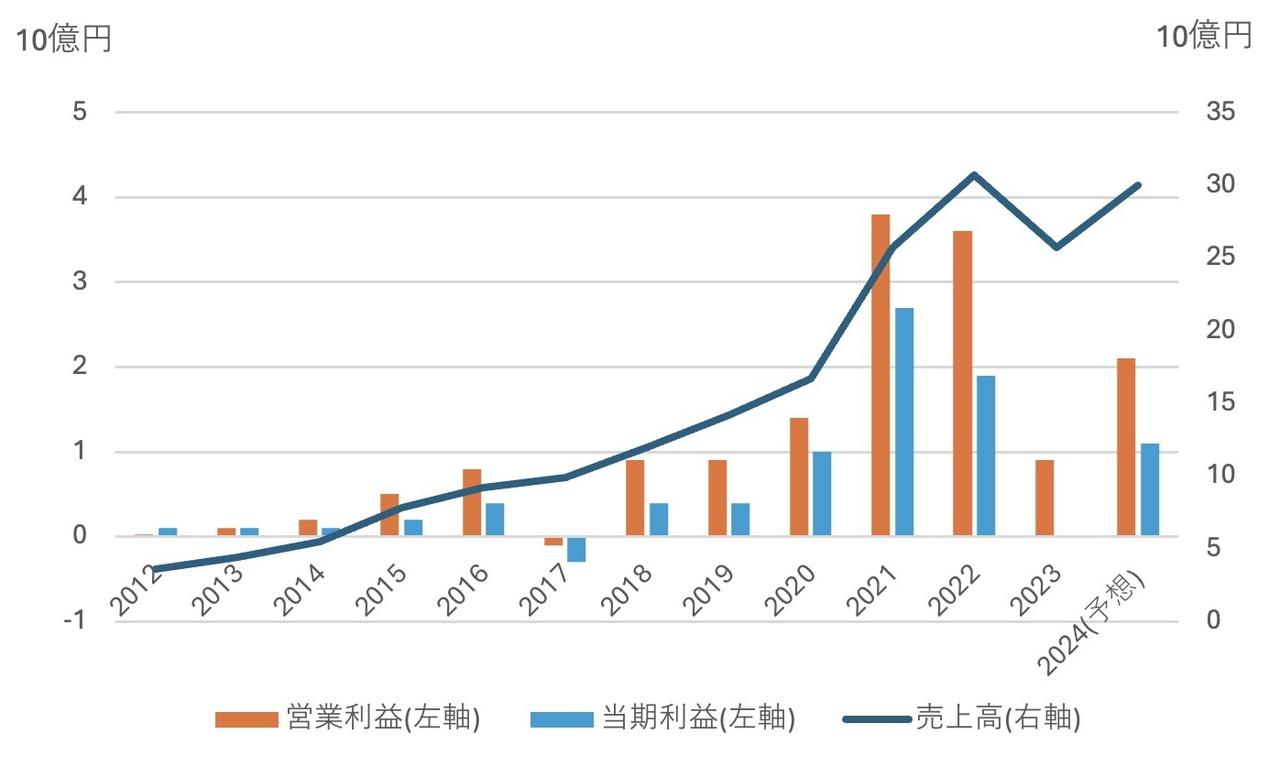

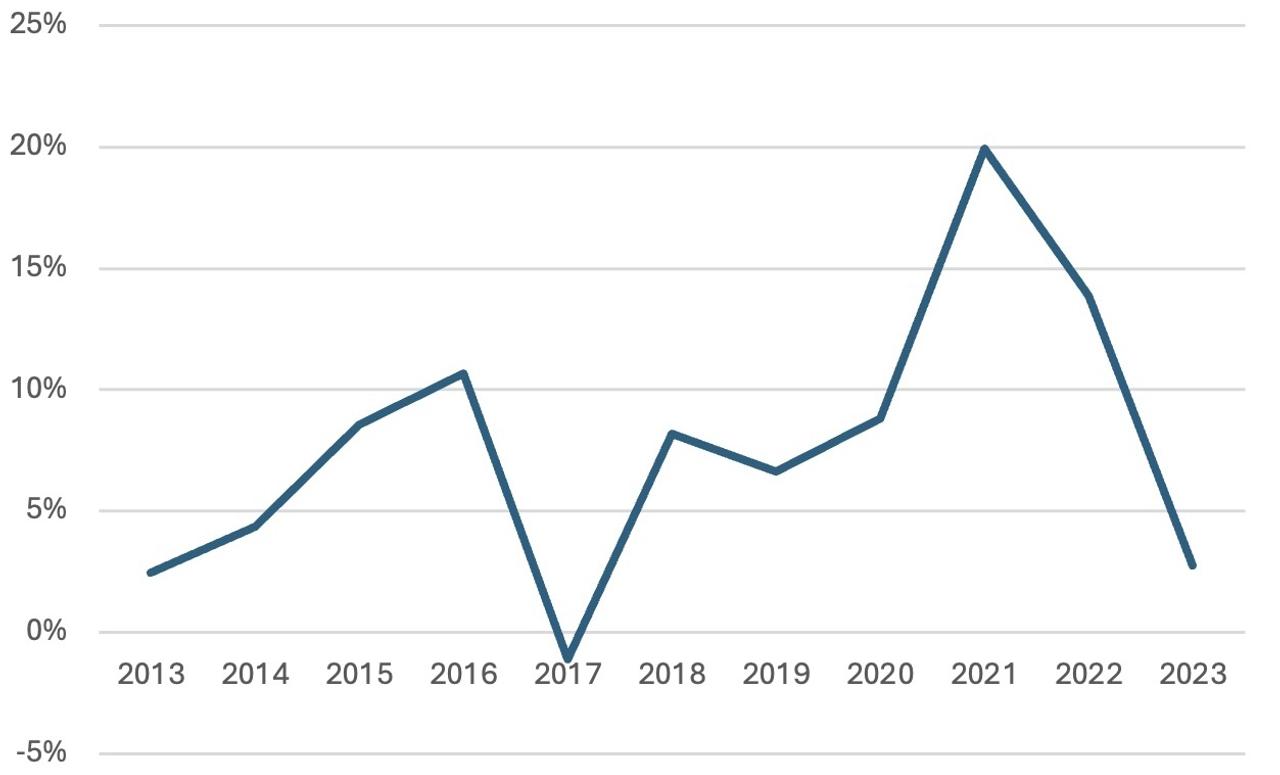

Snow Peak’s business performance appeared to be steadily expanding until the fiscal year ending December 2022. Over the 10-year period from December 2012 to December 2022, as confirmed by listing materials, the compound annual growth rate (CAGR) of sales was 24%, and the operating income growth rate was 61%. ing.

In particular, from the December 2020 fiscal year when the spread of the new coronavirus infection became serious, the camping boom ignited, and sales for the December 2021 fiscal year increased by 53% compared to the same period last year, and operating income increased 2.5 times. Growth has accelerated.

However, things will change completely in the fiscal year ending December 2023. Expenses incurred as a result of opening new stores to capitalize on the camping boom weighed heavily on the company, significantly reducing profits.

Snow Peak’s performance trends.

Snow Peak’s stock price trends over the past five years.Stock prices peaked in November 2021 and began to decline

The stock price began to decline in November 2021, much earlier than the deterioration in business results.

At that time, business performance was still strong, and on November 12, 2021, we announced the full-year business forecast along with the third quarter results for 2021.upward revisionThat’s about as much as I used to. However, perhaps as a reaction to the sudden rise in stock prices, adjustments began after peaking at 4,440 yen (closing price) on November 19, 2021, and in the end, the downward trend could not be stopped.

Following the announcement of the latest financial results for the fiscal year ending December 2023, the stock price fell significantly. The stock price on the day after the financial results announcement closed at 763 yen, down 12%. In the end, the stock price recovered only after the MBO was announced on February 20, 2024.

Advertisement

The fear of “one-legged management”

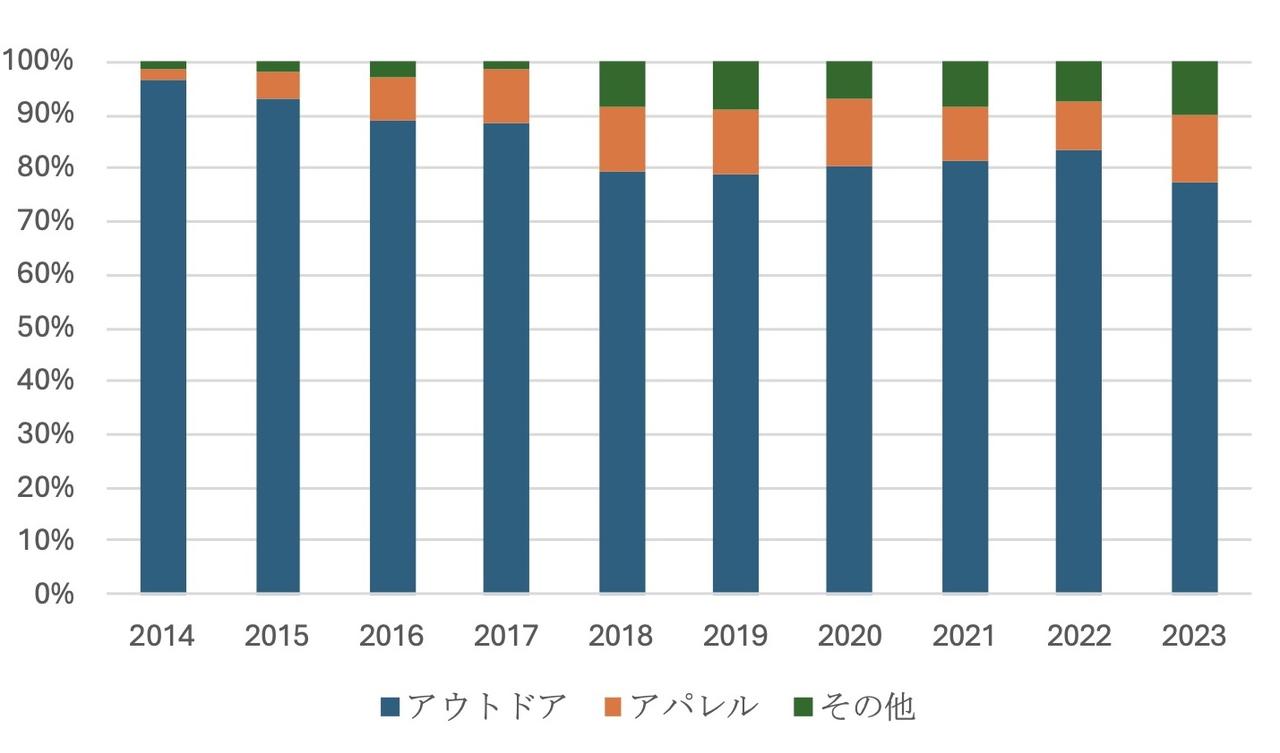

Snow Peak’s sales composition ratio.

These snow peaksPoor performance is due to the fear of one-sided management + rapid growthIt can be taken as

Snow Peak is a manufacturer specializing in outdoor equipment sales. Ironically, as the outdoor goods market that he had developed reached a certain scale, he invited many competing companies, and especially in Japan, as the boom came to an end, competition in the market increased. It intensified. For example, Workman has launched a low-priced tent aimed at camping beginners, and small manufacturers such as Zane Arts are attracting attention for high-priced products, so there is a lot of competition.

As a major domestic company, Snow Peak strengthened its brand strategy and introduced new products, but as a result it was unable to increase sales as expected, and costs remained high.

Of course, Snow Peak was not sitting idle.

Aiming to break away from just being outdoors,In addition to fully entering the apparel business in 2014, we have also started new businesses such as the urban outdoor business.I’ve been putting effort into it. However, sales from new businesses will remain at 20% of the total in the fiscal year ending December 2023. In the end, I was unable to break away from my only outdoor business.

For relatively small companies,Since management resources are limited, it makes sense to concentrate on one business.It goes without saying that steadily increasing sales in that business will lead to expansion of corporate value.

However, when strong competitors appear due to the arrival of a boom, they are forced to compete against them.On the other hand, concentrating on one business, which is called single-legged management,It is necessary to be aware that there is a risk of not being able to rely on profits from other businesses..

“Rapid growth” is also a risk

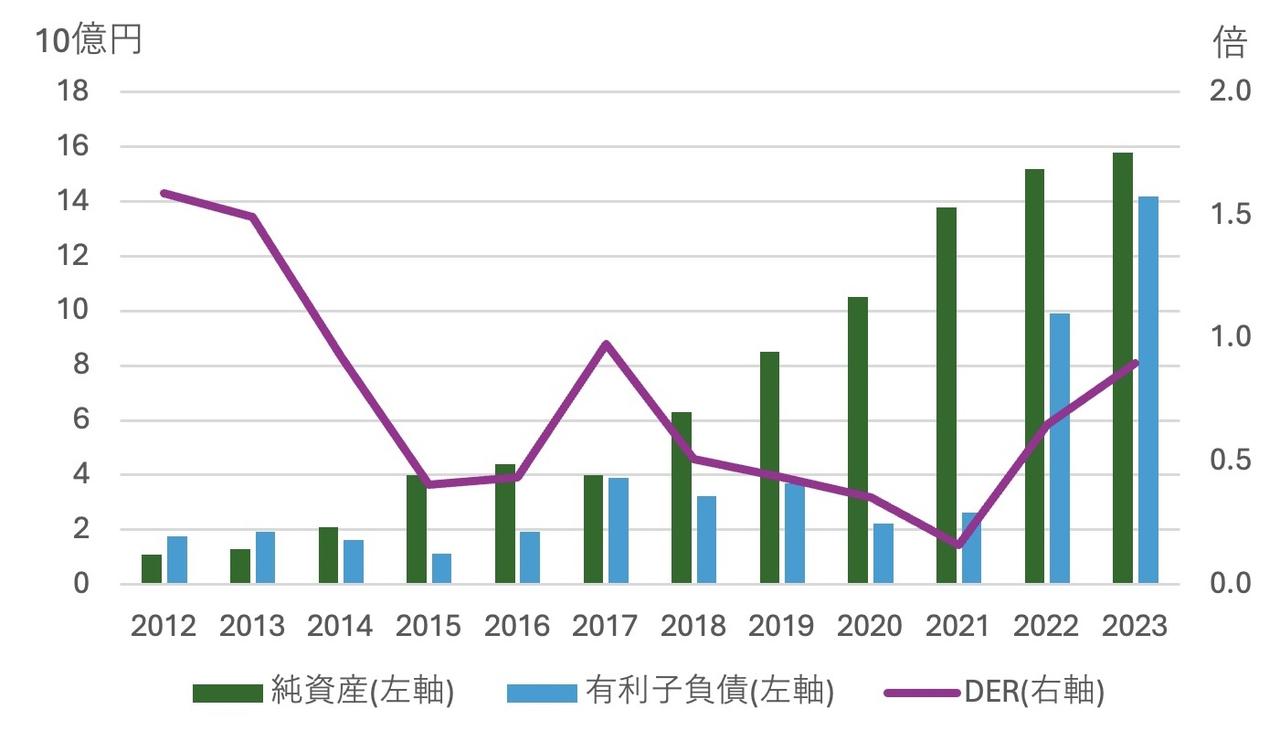

Snow Peak’s leverage transition.

Rapid growth also carries major risks.

In my experience, a company with an annual sales increase of 10% or more is considered a high-growth company.It is no mean feat to continue growing at an annual rate of 20% or more for more than 10 years.. Once investors get used to this high growth,Even if the growth rate declines, the market will react excessively negatively.There are many things.

A further problem is that companies are forced to develop infrastructure based on the assumption of high growth.

Particularly in the retail industry, where the unit price of products is fixed, maintaining growth requires additional investments such as product development, securing human resources, opening new stores, and securing logistics.

In general, in the early stages of a business, employee morale is high, and if a system is in place that can reliably generate sales, the probability of growth is high. However, in the process of rapid growth, profitability inevitably declines.

As a result,Rapid growth is often followed by a sudden brake in performance.. It would be fine if business performance only deteriorated a little, but by that time, many companies have increased debt to expand their business, making it difficult to raise additional funds, and many companies find themselves in a management crisis.

As you can see in the graph above, Snow Peak’s interest-bearing debt is rapidly increasing. It can be said that the difficult financial situation led to the company giving up on rebuilding on its own and leading to MBO.

Click here for leading indicators of “growth slowdown”

However, for investors who have held Snow Peak shares since it went public in 2014, they would have made a large profit if they were able to sell at the stock price’s peak in November 2021.

For investors, theseWhen it comes to growth stocks, people are probably more interested in how long to hold them and when to sell them..

When looking at the sustainability of growth, it is important to first understand sales growth and its guidance. In particular, if sales forecasts have been revised downward, unless the reason is temporary, there is a high possibility that investors will be disappointed. If such an announcement is made, it would be wise to decide whether to sell as soon as possible.

butSince this announcement is made to all investors at the same time, it is impossible to avoid the impact of stock price decline when it occurs..

For investors who want to know about growth slowdowns in advance through financial analysis,We recommend focusing on asset profitability..

In fact, looking at the case of Snow Peak,Return on assets (ROA) will decline after peaking in 2021It can be considered as a leading indicator of corporate growth.

In the first place, it is extremely difficult to maintain an ROA of nearly 20% in the retail industry. If you comprehensively judge industry characteristics and see a track record of extremely high asset profitability, you should suspect that growth will slow down thereafter.

Asset profitability (ROA, operating income/average total assets) trends.

What do you think of MBO in partnership with Bane?

On February 20, 2024, Snow Peak announced that it would partner with Bain Capital, an American investment fund, to conduct an MBO.

Bain Capital will conduct a TOB (tender offer) and purchase shares at 1,250 yen, a 49% premium over the closing price of 838 yen on February 8, 2024. If this TOB is completed, Snow Peak is scheduled to be delisted.

With Bain Capital’s decision to carry out this MBO, investors were able to sell the stock at around 1.5 times the market price at the time.

In the past, there have been many cases in which other companies’ stock prices have fallen steadily, and then increased capital in order to raise funds have caused their stock prices to fall even further.In the case of Snow Peak, investors should think that they were saved by MBO.right.

Will MBO lead to successful management?

President Futoshi Yamai attended a briefing for investors on the financial results for the third quarter of the fiscal year ending December 2023.

Chairman and President Futoshi Yamai, who is the founder’s family and the largest shareholder with 14% of the shares, will continue to invest, and after a series of procedures are completed, he will have 45% of the voting rights together with his family and the company that owns the assets. . Mr. Yamai will continue to manage the company as president even after the MBO.

MBO is when a listed company goes private.By having a small number of shareholders, we will be able to speed up management decisions and take a long-term perspective to implement management reforms such as cost reductions that will lead to a recovery in business performance.It is generally aimed at

However, although investment funds have ample funds, they are merely advisors in managing the business.

Bain plans to utilize its global marketing knowledge to quickly expand overseas, including in the United States and China, but Snow Peak already has a track record of focusing on overseas expansion.It takes a considerable amount of time for business performance to improveThe author thinks that this may be the case.

Recently, there have been many MBOs by foreign PE funds, and I think there is an optimistic opinion that “With Bain’s knowledge, Snow Peak’s management will get back on track.”

Just looking back at history,There are many cases where business has stalled after going through MBO, and if business could improve so easily, Snow Peak could have revived on its own.is.

Once again, Bane is only in the position of an advisor. The question is whether Snow Peak, which was founded by President and Chairman Yamai’s father and has grown as a family-run business, will be able to take advantage of the MBO group. His skill is being questioned.

Source: BusinessInsider

Emma Warren is a well-known author and market analyst who writes for 24 news breaker. She is an expert in her field and her articles provide readers with insightful and informative analysis on the latest market trends and developments. With a keen understanding of the economy and a talent for explaining complex issues in an easy-to-understand manner, Emma’s writing is a must-read for anyone interested in staying up-to-date on the latest market news.